Ethereum Ushers In A New Age Of Fintech

The rise of cryptocurrency prices has also brought a rise in volatility. What is up double or even triple digits today may be up more, or down a comparable amount, the next. And Ethereum (ETH) is not immune to this phenomenon but that doesn’t mean you shouldn’t own it. Cryptocurrency and Ethereum are ushering in a new age of fintech that will only grow in the coming years. While it may seem like Ethereum is down for the count don’t count it out. The pullback in price action from recent highs is more to do with the miners liquidating their hoard of coins than it does with a market reversal.

ETH 2.0 Is Here

Ethereum is a decentralized blockchain network intended to run smart contracts. The original format of POW mining (proof of work) left much to be desired which is why the ETH 2.0 has been and is in the works. The project has been in progress since late in 2017 and only now begun to come to fruition. Early upgrades to the network were minor and helped prepare Ethereum for the launch of the Beacon Chain. The Beacon Chain is the root contract that will eventually oversee all the shards and side chains that will form when the full ETH 2.0 upgrade is complete.

What does ETH 2.0 really mean? The core of it is a switch to POS mining (proof of stake) versus POW mining. With POW mining the network has to burn a vast amount of computing power and electricity to validate the chain. With POS mining the network will switch from spending money (and wasting electricity) to make money to using money to make money. With POS mining each miner or node in the network deposits a secured stake that collateralizes transactions made with that node. Think of it like a network of small neighborhood banks that are all part of a larger operation.

If you’ve got money invested in the stock market, but are confused as to what to do next…This is the can’t-miss interview of 2021…

What this means for investors is a chance to stake on the network and earn fees for validating transactions. At last tally, there was nearly $2.4 billion in value staked on the network and the value is growing. Not only is the value of ETH on the rise but the number of stakers is growing as well. In fact, there are more would-be stakers than are spots available ensuring future growth will continue at the same pace. Beaconchain.in shows over 60,000 current stakeholders with 16,270 pending stakeholders waiting for a spot to open up. The network allows 32 slots per epoch with each validator staking 32 ETH worth roughly $30,000 with ETH/USD trading at $1,190.

Ethereum Staking Is The Tip Of The Defi Iceberg

Stakeholders on the ETH 2.0 Beacon Chain are making about $10.37 per day or about 12.5% of their $30,000 stake on an annualized basis. And that is just the tip of the defi (decentralized finance) iceberg. While ETH is the highest-profile defi application on the market it is really intended to facilitate other forms of defi and it is not the only cryptocurrency in the defi market. Defipulse.com shows upwards of $22.5 billion in value locked into the defi market and this number is growing. The amount of money locked into defi has risen about 35% since the start of the year aided by ETH 2.0 but not because of it. ETH 2.0 is worth about 9% of the total defi market which in turn is worth roughly $22.5 billion. To put this in perspective, the defi market is, by market cap, the 4th largest cryptocurrency application by market cap after Bitcoin, Ethereum, and Tether dollars.

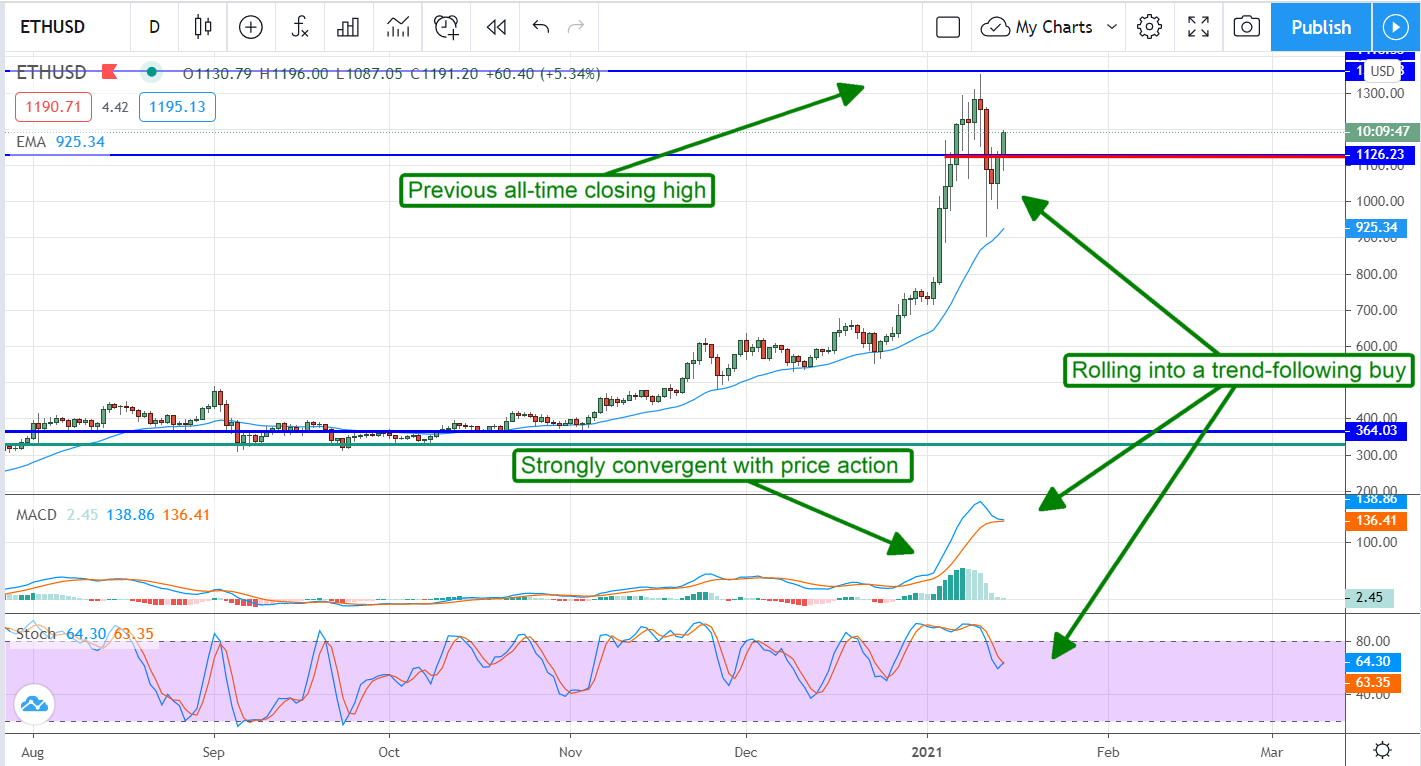

The Technical Outlook: ETH Pulls Back, Buying Opportunity Follows

It was shocking to see the price of ETH pullback as it did over the weekend but that is what you get sometimes with crypto. What investors need to remember is that the cryptocurrency markets are incredibly technical and technical targets were never in danger. The pullback came down to almost touching the short-term 30-day EMA where support is clearly evident. Price action has since bounced higher and begun to show early bullish trend-following crossovers in the indicators. Add to this an extreme peak in MACD that is convergent with the recent test of all-time high levels and another retest becomes the least to expect. If the price action breaks above the $1300/$1350 level the price of ETH/USD could easily double from there, just like Bitcoin did.

15 Energy Stocks Analysts Love the Most

There are more than 450 energy companies traded on public markets. Given the sheer number of pipeline companies, power plant operators, oil and gas production companies, and other energy stocks, it can be hard to identify which energy companies will outperform the market.

Fortunately, Wall Street’s brightest minds have already done this for us. Every year, analysts issue approximately 8,000 distinct recommendations for energy companies. Analysts don’t always get their “buy” ratings right, but it’s worth taking a hard look when several analysts from different brokerages and research firms are giving “strong-buy” and “buy” ratings to the same energy stock.

This slide show lists the 15 energy companies with the highest average analyst recommendations from Wall Street’s equities research analysts over the last 12 months.