- Ripple has officially been delisted from Coinbase, thus reducing the buying pressure behind the token.

- XRP risks freefall to $0.25 if support at the 50 SMA and the 100 SMA fails to hold.

Ripple’s potential uptrend to $0.4 a recently discussed, was sabotaged after Coinbase, one of the leading cryptocurrency exchanges, officially delisted it from its trading platforms. The purge from the United States leading digital exchange comes barely a month after the Security and Exchange Commission (SEC) filed a lawsuit against Ripple Labs Inc. and its top executives.

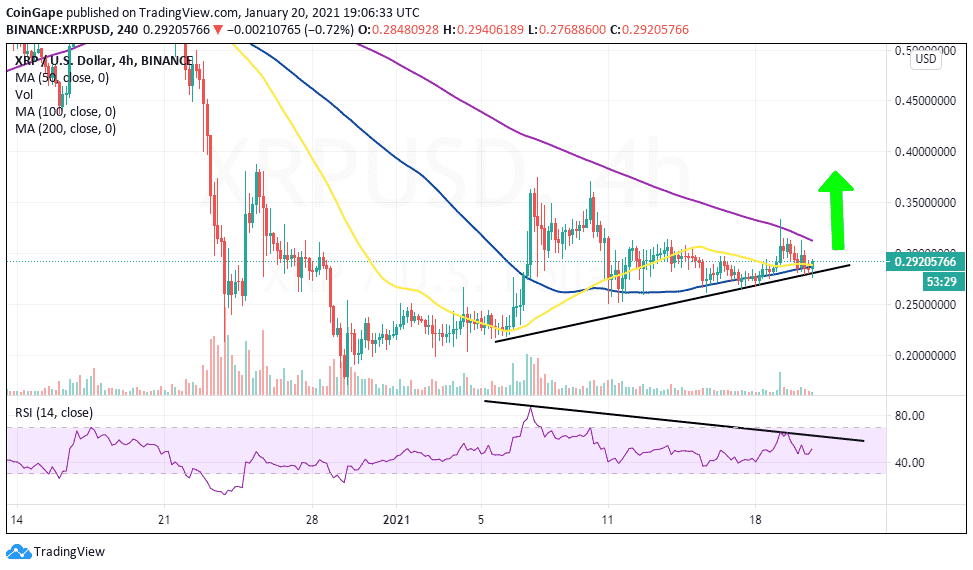

At the time of writing, XRP is dancing at $0.289 after losing some ground from its weekly high at $0.33. It appears that the failure to break the hurdle at the 200 Simple Moving Average must have armored the bears, who are still eager to push the price back to the drawing board at $0.25 and $0.2, respectively.

Meanwhile, the bulls are working tooth and nail to hold the confluence support provided by the 50 SMA and the 100 SMA on the 4-hour chart. To sustain the uptrend and, more importantly, to avert potential declines, Ripple must hold at this crucial level.

XRP/USD 4-hour chart

On the downside, support at $0.25 may be tested, and if it gives in, the cross border token is most likely to extend the bearish leg to $0.2. It is worth noting that the pessimistic outlook seems to have been validated by the Relative Strength Index bearish divergence.

The 4-hour chart shows the RSI breaking away from the price, suggesting that buying pressure and volume decrease. In other words, bears are preparing to regain control even as buyers struggle to hold onto the uptrend.

On the flip side, bulls will avoid declines if they ensure that the confluence support is protected. The anchor will allow buyers to focus on the price action beyond $0.3, while gains above the 200 SMA may validate the spike to $0.4.

Ripple intraday levels

Spot rate: $0.289

Relative change: -0.002

Percentage change: -0.7%

Trend: bearish

Volatility: Low

To keep track of DeFi updates in real time, check out our DeFi news feed Here.

Share on Facebook

Share on Twitter

Share on Linkedin

Share on Telegram