- Litecoin holds above crucial support as bulls-eye liftoff to $200.

- Support at $145 remains key to the uptrend; otherwise, if broken, LTC may retreat to $120.

Litecoin has been grinding higher since the recent breakdown to $110. Recovery was very consistent, but Litecoin failed to hold above $160, let alone clear the resistance at $170. If its current critical support at $145 remains intact, Litecoin might spike toward $200.

Litecoin is on the verge of a breakout to $200

LTC/USD price action is holding within an ascending parallel channel, as seen on the 4-hour chart. The cryptoasset currently sits on a critical support at $145, reinforced by the channel’s lower edge.

Additionally, the 50 Simple Moving Average is in line to offer anchorage and perhaps act as Launchpad for takeoff. A rebound is anticipated to clear the middle boundary hurdle, paving the way for gains toward $200.

LTC/USD 4-hour chart

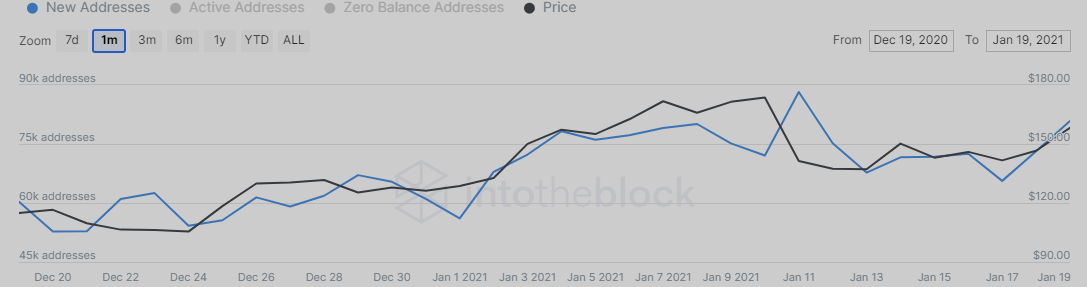

IntoTheBlock’s “Daily Active Addresses” model shows that the number of new addresses created on the LTC network topped-out on January 11 at a high of nearly 88,000 addresses per day, calculated one-month trailing average before falling to about 66,000 on January 17.

Since then, Litecoin’s network growth has recovered by new active addresses per day. At press time, roughly 81,000 new addresses were created based on this trailing average, which can be considered a prominent bullish sign for Litecoin.

Litecoin newly-created addresses

On the flip side, slicing through the $145 support on the 4-hour support credence to Michaël van de Poppe, a renowned technical analyst’s bearish outlook toward $120.

#Litecoin chart from a few weeks back and the levels are still valid.

The range at $120 got a test, and $135 flipped since.

However, does look like a weak bounce from the lows here in which further consolidation seems likely.

Buyer at $120. pic.twitter.com/XoRl78Qsvy

— Michaël van de Poppe (@CryptoMichNL) January 20, 2021

The support at $140 may try to come in handy but might not have the power to flip Litecoin bullish, hence the possibility of losses extending to $120 (a potential buy zone).