Bitcoin prices and a number of other digital assets have grown significantly in value during the last decade. Some people have made millions and even billions throwing down everything they have during the cryptocurrency’s earliest days of price discovery. However, there’s another method of investing called dollar-cost averaging or DCA, a scheme that’s considered far less risky and can still bring a cryptocurrency investor decent profits over the long term.

Ever since bitcoin jumped over the crypto asset’s all-time high (ATH) recorded in 2017, the digital currency has continued to gather a higher value after surpassing the $20k zone. Then bitcoin (BTC) tapped a new ATH ten days ago, after the crypto asset jumped over the $42k range. Additionally, a number of alternative digital assets are nearing their 2017 ATHs and some newer coins like Polkadot and Chainlink also touched price highs.

Now there are many people who were able to invest in bitcoin, ethereum, bitcoin cash, and many other coins early, and this has produced significant gains for these risk-takers. But there is another method of investment that people have been leveraging for a very long time called dollar-cost averaging or DCA.

The most important #Bitcoin advice you’ll ever get. pic.twitter.com/hFU7t3gYPJ

— Documenting Bitcoin ? (@DocumentBitcoin) January 14, 2021

Essentially, the DCA method of purchasing involves buying a set sum of cryptocurrency at regularly scheduled intervals. This contrast is quite different than throwing all the funds down at once and waiting for profits. An example of DCA buying would be to purchase $10 in bitcoin per week, for a three year or longer period of time.

Buying in this manner is considered less of a strain on emotions and far less risky as well. The scheduled intervals of buying take place no matter what the cost of bitcoin (BTC) or the other cryptocurrency costs at that moment in time. Then if you aggregate the number of purchases per week, and standard price from the purchases over the three-year period, the investment cost will be measured in a mean average.

Moreover, depending on the crypto asset’s market performance a DCA investor can do extremely well for themselves in a much slower and less risky manner.

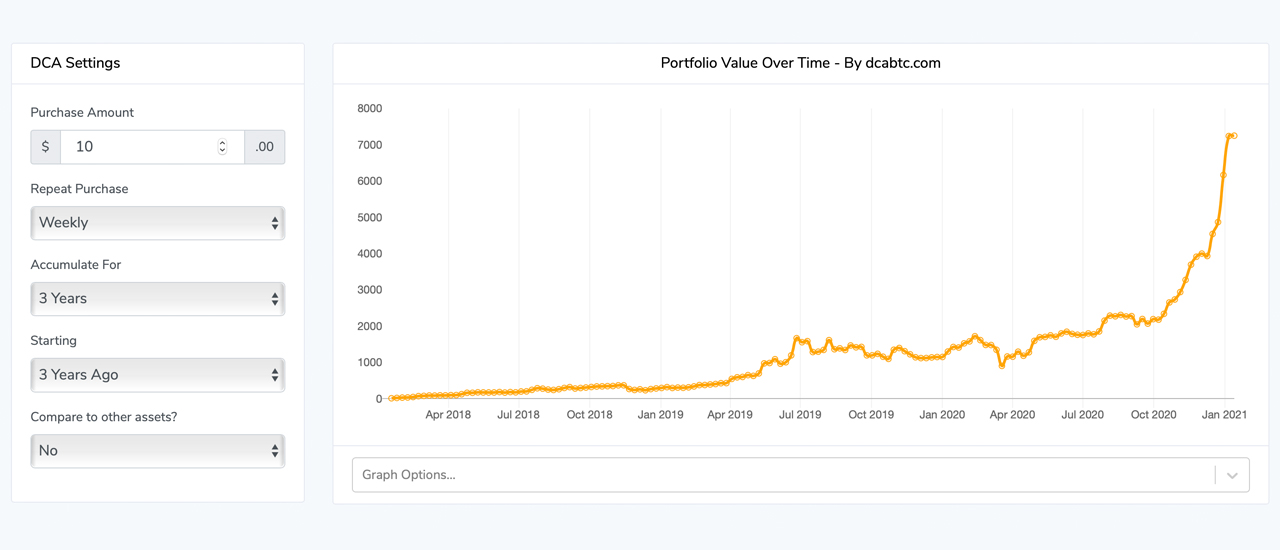

There’s also a website that can help you estimate the interval of purchases over time and the mean average over the course of the time period. The web portal dcabtc.com offers a calculator in order to figure out your DCA metrics over time, and if you’ve already been leveraging DCA investment you can check the profits of your current BTC investment.

Here’s a great example of DCA purchasing over time with an investment of $1 per week into BTC during the last nine years. Dcabtc.com explains that purchasing $1 of BTC since January 2012, every week for nine years starting nine years ago, would have turned $470 into $289,295 using today’s exchange rates. That’s a whopping 61,452% gain in value over the course of a nine-year span.

Now if the person started three years ago, and invested $10 per week into BTC every week for the last three years would have seen a 361% increase. That method of DCA purchasing would have made $1,570 turn into $7,249 during the three-year timeframe. Of course, the period when you start investing does make a difference for both DCA and just throwing down all the funds at once.

Timing is key and sometimes earlier doesn’t make a difference either, because of bitcoin’s price fluctuations. A good example of this is if someone invested one large sum into BTC on March 12, 2020, at a low of $3,800 per unit. Using today’s BTC exchange rate shows that investment would produce a whopping 821% over the course of time up until January 17, 2021.

Dollar-cost averaging is still far less stressful, because a person can invest without putting much emotional energy into playing the lows and highs like the aforementioned lump-sum investment. DCA investors don’t have to put a lot of time and effort into studying market charts, keeping an eye on breaking crypto-related news stories, and keeping tabs with industry heavyweights. The funds are simply invested without many time-consuming activities, and the investment can be calculated over extended periods of time without much worry.

The crypto investor who calculates with a DCA approach doesn’t care that the market is not predictable and the stress relieved from trying to time crypto markets is insurmountable. Throwing it all down at once and trading cryptocurrencies successfully takes time and research, things that some people just don’t have the time to apply.

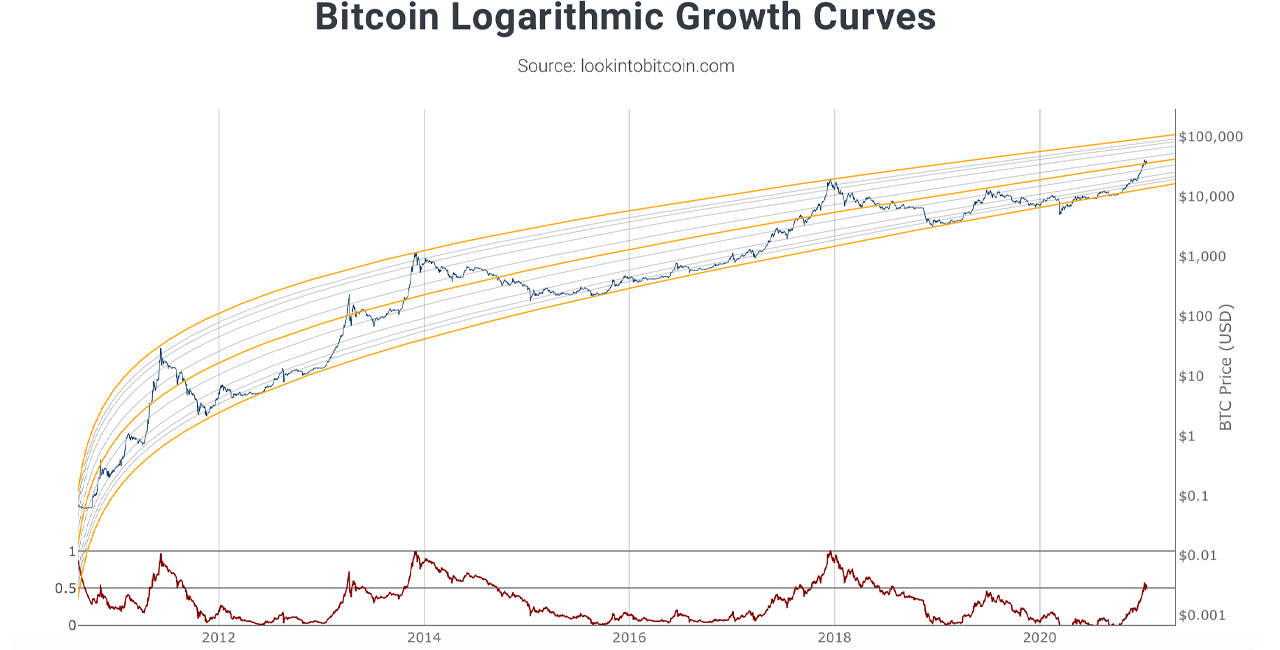

A DCA investor understands that the price of bitcoin changes very often, and catching highs and lows can be difficult. But long term perspectives, logarithmic growth curves, and overall rising interest shows holding digital assets for a long period of time has so far, been an extremely profitable means of investing.

What do you think about dollar-cost averaging? Do you use this method of investment or do you day trade highs and lows? Let us know what you think in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, lookintobitcoin.com/charts, Twitter, dcabtc.com,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.