Bitcoin resuming the downside following fresh parabolic highs

In a parabolic move, the price of the world’s most popular cryptocurrency on its 12th birthday has traded as high as $34,800 on Sunday with almost all other markets closed over the first weekend in 2021.

Bitcoin surged by more than 300% in 2020 and has now added more than 50% since crossing $20,000 just two weeks ago, gaining over 20% over the past week.

As typical of the crypto asset, it has plunged to as almost as low as $30K amid profit-taking but bulls have stepped back to the plate on a classic buying of the dip, resulting in fresh highs to start the new week in Asia.

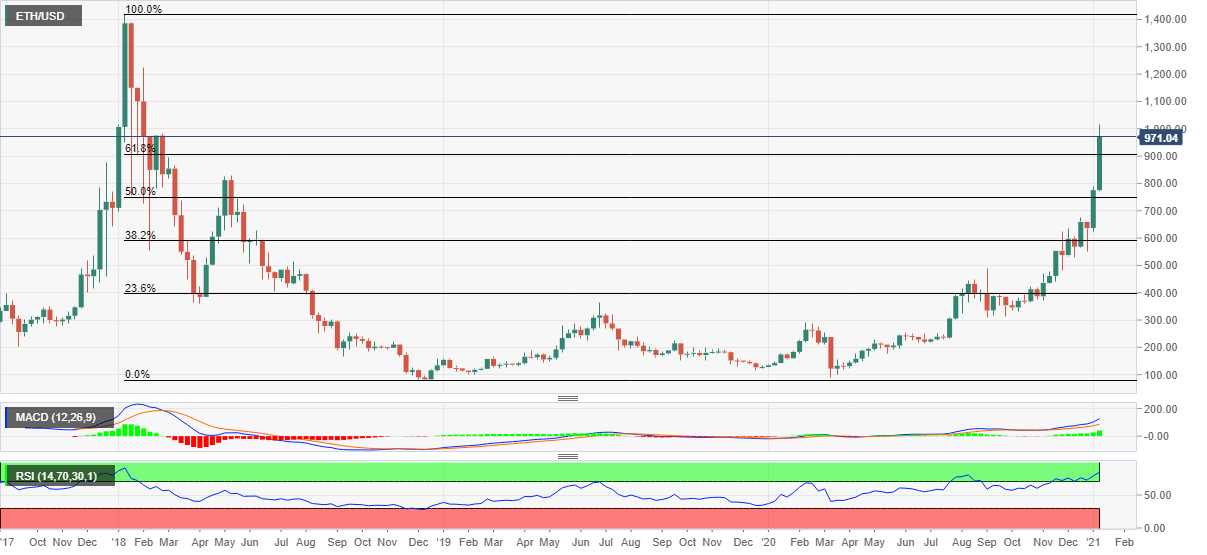

Ethereum Price Analysis: ETH bulls catch a breather around February 2018 top

Having jumped to the highest in 35 months, ETH/USD recedes to $955.35 during early Monday’s trading. Although overbought RSI conditions suggest further consolidation of prices, 61.8% Fibonacci retracement of the year 2018 downturn becomes the key level to watch for bears.

The downside break of the key Fibonacci retracement, at $906.30, needs to get validation from the $900 round-figure before challenging May 2018 top surrounding $830.

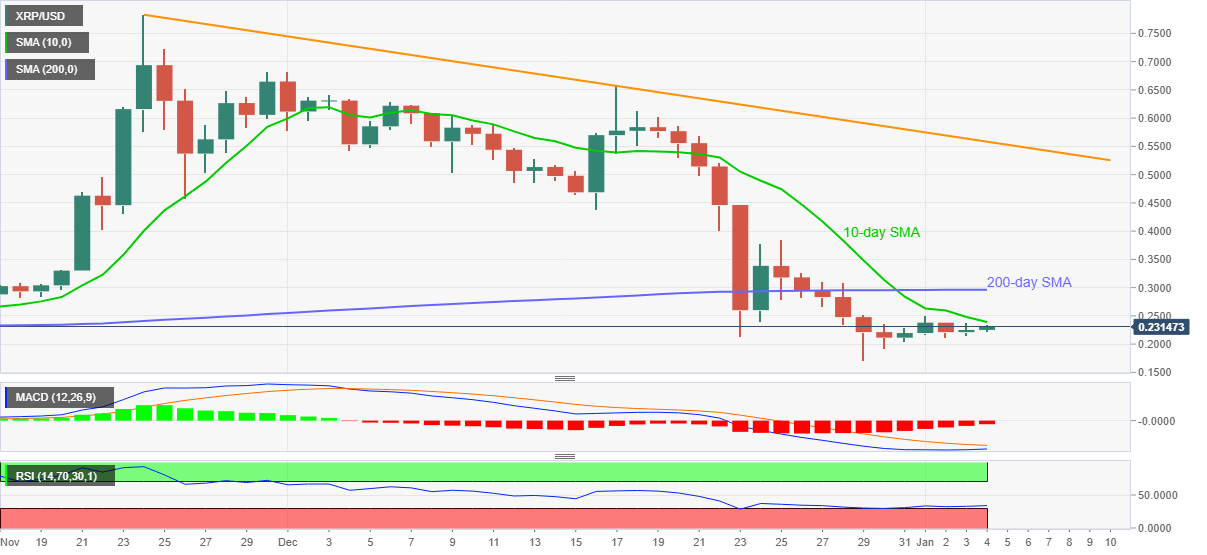

Ripple Price Analysis: XRP bulls battle with 10-day SMA, bumpy road ahead

XRP/USD picks up bids near 0.2300, currently up 2.73% near 0.2310, during early Monday. In doing so, the ripple buyers attack 10-day SMA while stretching corrective pullback from December lows, also the lowest since June 2020.

Not only the 10-day SMA level of 0.2393 but the 0.2400 round-figure and bearish MACD also challenge XRP/USD bulls.

Even if the quote manages to cross the 0.2400 threshold, it needs to surpass the 200-day SMA level of 0.2964 and the 0.3000 psychological magnet to renew short-term buying interest.