The total crypto market cap added $111.7 billion to its value for the last seven-days and now stands at $942.7 billion. The top 10 currencies were mostly in green for the same time period with Cardano (ADA) and Ripple’s XRP adding 32.1 and 28.3 percent to their values respectively while Polkadot (DOT) erased 19.8 percent. By the time of writing bitcoin (BTC) is trading at $34,137, ether (ETH) is at $1067. XRP is hovering around $0.282.

BTC/USD

Bitcoin closed the trading day on Sunday, January 3 at $33,121 after trading as high as $34,820 during intraday. The coin added 12.8 percent for the weekend, jumping up from the sub-$30k area on Saturday. It ended the week 26 percent higher.

On Monday, the BTC/USD pair experienced a flash crash. The so-called CME gap was filled all the way down to $27,710, but the leading cryptocurrency managed to recover in the evening part of the session, still closing with a short red candle to $31,973.

According to some analysts, the futures funding rate for BTC was way too high already so the long squeeze event, which liquidated billions-worth of positions, was meant to actually restore the funding rate equilibrium. A lower funding rate is in general better for the long-term uptrend stability.

Additionally, bitcoin is in an uptrend corridor since December 16 on the 4-hour chart, which was not impacted by the Monday selloff.

The trading day on Tuesday was extremely volatile. BTC/USD dropped down to $30,000 in the morning, then climbed back up and closed in green, touching $34,000.

On Wednesday, January 6, the coin skyrocketed to new highs. This time it reached $36,850, which resulted in an 8.3 percent increase for the day.

The Thursday session brought a brand new all-time high. BTC hit the $40,000 level and even though it stopped at the zone below it, at $39,563 to be more precise, the move clearly demonstrated that the bulls are still not out of steam.

The last day of the workweek was again a volatile one. Bitcoin was trading in the wide range between $42,000 and $36,650 before closing with a short green candle to $40,711.

The weekend of January 9-10 was when bears finally showed up for the party. First, on Saturday, they pushed the price down to $40,170. Then on Sunday, we saw BTC buyers failing to counterattack and allowing further decreases to $38,150. What’s more, the coin was seen as low as $34,415 during the intraday.

As of the time of writing, it is losing even more ground, now situated near $33,800 and under heavy selling pressure.

ETH/USD

The Ethereum Project token ETH surpassed the weekly resistance at $790 on January 3 and stopped at the next major barrier on that timeframe – $980. The coin added 26 percent to its value during the Sunday session and ended the week 43 percent higher compared to the previous seven-day period.

On Monday, the ETH/USD pair formed a third consecutive green candle on the daily chart and moved further up to $1,043 breaking the psychological mark of $1,000 for the first time since 2018. The coin was jumping up and down the zone between $1170 and $890 during intraday, which was to be attributed to BTC’s derivative- caused flash crash event.

The price of ether surged during the next two sessions by first hitting $1,100 on Tuesday then $1,211 on Wednesday. It grew by 16 percent for the period.

On Thursday, the Ethereum token tried to climb above the solid weekly resistance at $1,230, but failed to do so and only formed a large wick on the daily candle, closing at $1,226.

The last day of the workweek came with a flash crash. The ETH/USD pair nosedived to $1,062 during intraday before recovering late in the evening part of the session. It stopped at $1,217.

The first day of the weekend was again colored in green. Buyers did not allow further decreases and supported the continuation of the uptrend to $1,280. Then on Sunday, the ether briefly touched the next major weekly/daily resistance line at $1,360 before closing the day at $1,255 with a small loss.

It is not trading significantly lower, at $1,053 following the example of BTC.

Leading majors

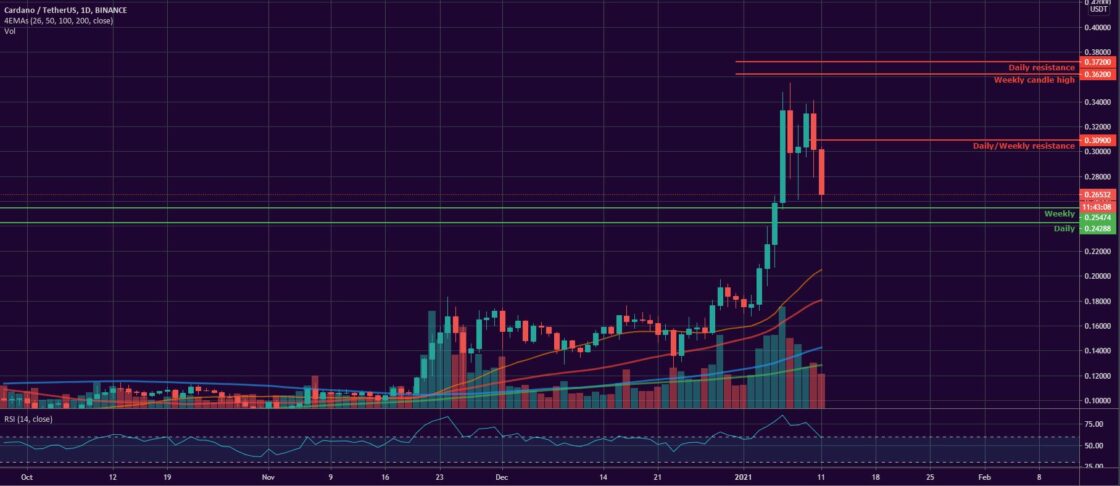

- Cardano (ADA) added 75 percent to its value on a weekly basis, which helped it re-enter the Top 10 list. The coin was on its way up ever since it broke above the 50-day EMA on November 20, but in the last seven days was totally on fire.

Investors are accumulating ADA driven by the stable technical and history of the project combined with the upcoming improvements to the Shelley mainnet network which was launched last year. Cardano was trading close to the solid S/R line at $0.31 before yesterday’s market crash. Its current price is $0.265.

- Bitcoin Cash (BCH) reminded its days of glory during the last week. The biggest BTC fork rose by 70 percent for the period and is also 126 percent up for the last 30 days. The coin registered a daily high of $630 on Sunday, January 10, hitting the lower boundary of the very solid daily/weekly resistance cluster from 2018 – the $630 -$660 zone. Its current price is $476.

Altcoin of the Week

Our Altcoin of the week is Stellar (XLM). The “little XRP” as it is known due to its links with some of Ripple’s founders, added the stunning 128 percent to its value for the last seven days and stormed into CoinGecko’s Top 10 yesterday, now ranked at #11.

The announced agreement with the government of Ukraine according to which the Stellar Foundation will partner with the Eastern European country to facilitate the future development of the virtual assets ecosystem was the main reason for the recent surge in the price of XLM.

The project is now valued at $5.5 billion is one of the leading altcoins in terms of performance.

XLM peaked at $0.395 on Thursday, January 7 and as of the time of writing is trading at $0.243 against USDT on Binance:

Like BTCMANAGER? Send us a tip!

Our Bitcoin Address: 3AbQrAyRsdM5NX5BQh8qWYePEpGjCYLCy4