Simon Seojoon Kim is the CEO and Managing Partner at South Korea-based blockchain accelerator Hashed.

____

I. Bitcoin

A solid and continuous Bitcoin (BTC) bull run is expected in 2021.

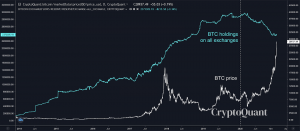

Since the inception of Bitcoin, the amount of BTC owned by the exchanges has steadily increased. However, starting from February 2020, institutional investors have started to withdraw large volumes of BTC from these exchanges for strategic long term holding. Such withdrawals have created pressure on BTC liquidity, and the sell-side crunch has driven up the BTC price since mid-2020 according to the chart below. We expect this trend to continue in 2021, and due to the decrease in BTC supply, the price of BTC is reasonably expected to align with the trend.

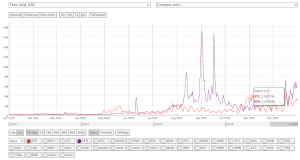

Grayscale in the US provides further evidence of the increasing institutional interest as it is a vehicle through which institutional investors have gained exposure to BTC. In early 2020, Grayscale started out with USD 2bn in assets under management (AUM), and the AUM rapidly grew to USD 20bn by late 2020. Most of its assets are concentrated in BTC, and it is expected that such a focus will be maintained.

12/31/20 UPDATE: Net Assets Under Management, Holdings per Share, and Market Price per Share for our Investment Pro… https://t.co/dlRiq1L0ZL

Moreover, the CME recently overtook OKEx on the trade volume of futures, and the news indicates that institutional interest in Bitcoin will outweigh, if not already, retail interest as more players enter into the market through traditional entities. Combined with the phenomenon that more and more public companies such as MicroStrategy are directly purchasing bitcoin, the maturation of digital assets as an attractive investment asset class will naturally lend to more players seeking to hedge against the quantitative easing of central banks.

Amid such indicators, it is worthwhile to note that BTC’s total market capitalization has exceeded that of the stressed countries’ currencies such as Venezuela. In 2021, there may be even countries purchasing bitcoin as a reserve asset.

With these in mind, Hashed will be making the following predictions for 2021:

- Prediction 1 — Bitcoin ETF will be approved for the first time in history.

- Prediction 2 — The price of Bitcoin will test USD 100,000.

II. Ethereum

While the media has so far focused on the price of bitcoin in 2020, the price of ethereum (ETH) rose at a more rapid rate compared to that of Bitcoin.

- BTC: USD 7,195 → USD 29,001 (4.03x)

- ETH: USD 129.6 → USD 737.8 (5.69x)

The on-chain fundamentals of Ethereum have also dramatically improved compared to that of Bitcoin. As DeFi (decentralized finance) activities, or financial services and products within the Ethereum ecosystem, exploded with innovative experiments in 2020, on-chain transaction fees of Ethereum have exceeded those of Bitcoin.

Given such substantive use cases of Ethereum, it is only reasonable to expect that institutional investors will also diversify their digital asset portfolio to include ethereum. It is no coincidence that the CME Group will be launching ETH futures in February 2021.

As for the ETH 2.0 update, it is slowly but gradually achieving its development milestones. The fulfillment of Phase 0 staking target demonstrates the firm support of Ethereum core communities including both retail investors and institutions who participated in the staking.

It is also likely that financial institutions that have jumped into the crypto market early on will not only perceive ETH as an investment asset, but also realize its full potential to innovate the entire financial system given its smart contract and ETH-based cryptocurrency features. More robust and aggressive experiments on Ethereum could lead to revolutionary effects in 2021.

- Prediction 3 — Ethereum price will reach new ATH.

(Note: At the time of writing the original text in Korean, the all-time high price of ETH was about USD 2,100 with a significant premium in KRW)

III. Stablecoin

Apart from China, there will be countries that start test operating CBDC (central bank digital currency), which will accelerate and enforce the digitization of conventional financial systems and assets.

CBDC is based on private blockchains and is easily integrated and applied to conventional financial institutions; however, using private blockchains means that CBDC will not be able to utilize the open-source ecosystem or develop innovative composability cases. Also, their origins cannot be free from the central government censorship debate. Given the conflicting philosophies between public and private blockchains, the expansion of CBDC may actually become the driving force behind the growth of public blockchain-based stablecoin ecosystems.

For public blockchain supporters, it is only reasonable to expect that stablecoins will further gain importance in crypto exchanges, DeFi, and ultimately diverse areas of the fintech sphere including payment, remittance, investment, etc. In fact, since the Office of the Comptroller of the Currency (OCC) in the US has just announced that banks can use stablecoins in banking transactions, private financial institutions and banks will competitively seek to issue their own stablecoins and be forced to consider the benefits of decentralized systems.

In the end, it is likely that stablecoins issued based on algorithms or crypto collaterals such as DAI with sufficiently decentralized and operating entities will prove more successful than centralized stablecoins to withstand against time-and-time tested obstacles of abuse and censorship.

- Prediction 4 — Stablecoins based on public blockchain will exceed the market capitalization of USD 100bn.

IV. DeFi

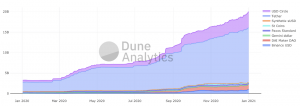

The growth of the DeFi sector in 2020 proved to the world that the on-chain protocol economy can go beyond the store of value feature of digital gold, and develop into a complex financial paradigm. Along with supporting trends such as the spread of diverse crypto asset wallet solutions, DeFi will integrate with more B2C fintech services and pursue a better user experience, ultimately leading to an increase in Total Value Locked in 2021.

High fees and lagging transaction confirmation speed, major downsides of DeFi, will be resolved through diverse Layer 2 projects and technologies such as zkRollup. And as these solutions are integrated into major DeFi projects in 2021, the interoperability among DeFi projects in different Layer 2 solutions or even different main chains will become the new focal points of interest with even more explosive potential.

Due to the early phase of smart contracts, DeFi applications leave more room for bugs than traditional applications. The inherent nature of DeFi applications that involves leveraging existing infrastructure components may be a contributing factor; however, these innovative attempts have also added significant complexity to the overall DeFi ecosystem. And as more experienced developers enter the market, it is likely that even more sophisticated products will become available. Andre Cronje, the founder of yearn.finance (YFI), is a good example.

This is not to deny that the world will witness more hiccups and hacks within the DeFi sector. But as the sector matures, the overall efforts of passionate developers and community members will culminate in a more robust architecture that keeps perfecting. In fact, we are currently witnessing more insurance protocols coming into the market, and once the ideal combination is reached between risks and risk management, the overall DeFi market has many reasons to flourish.

- Prediction 5 — DeFi TVL will surpass USD 100bn.

- Prediction 6 — By the end of 2021, DeFi tokens will be 13+ among the market cap top 50 tokens (i.e. 30%+ increase).

V. DEX (Decentralized Exchange)

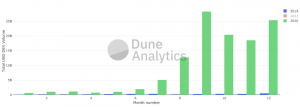

In 2020, the annual total DEX transaction volume reached approximately USD 116bn. It is a 39x growth compared to how DEX performed in 2019. This trend is expected to grow as more DEXs migrate to Layer 2 in 2021. They are positioned to process even more transactions as they are equipped with better infrastructure: lower transaction fees and faster transaction speed.

In addition, we expect to see more newly created decentralized derivative exchanges. Crypto natives have already witnessed that futures transaction volume exceeding spot transaction volume among the centralized exchanges. This trend will probably persist in the DEX ecosystem too.

- Prediction 7 — Total DEX transaction volume will grow to USD 500+ billion in 2021.

VI. Security Tokens

During his panel discussion with Brian Brooks, the Acting Comptroller of the OCC, Jay Clayton, the previous Chairman of the US Securities and Exchange Commission (SEC), stated, “if you talk about trading today, all trading is electronic…That was not the case 20 years ago…It may very well be the case that those all become tokenized.”

As many have anticipated for long, security tokens are gaining momentum in public awareness to become the superset of existing stocks. With appropriate regulatory developments, security tokenization can entail many immediate benefits superior to those of traditional stocks such as easier authentication, more efficient management, lower transaction costs, and even programmable issuances and distributions.

Security tokens may lay a technical foundation for ‘protocol economy’ — an idea of opening up governance and distributing fair compensation to platform economy participants. As the South Korean Ministry of SMEs and Startups announced that it will proceed with the protocol economy blueprint as its policy direction starting from 2021, we expect to see more countries and industry sectors paying attention to security token issuance and distribution and crafting relevant regulations and guidelines.

It is also important to note that such possibilities may not be limited to regulated government entities since as crypto exchanges seek to diversify their business models they may also offer token securitization for new business opportunities.

- Prediction 8 — Some companies will start to issue certain portions of their own stocks as tokens.

VII. IPO & M&A

As the biggest US crypto exchange, Coinbase, announced its pursuit of IPO, we can expect more institutional money coming into the crypto and blockchain space. And this trend will lead to more vibrant M&As and IPOs of crypto and blockchain companies.

Such M&As and IPOs may also give rise to novel forms as mergers between on-chain DeFi projects can be more efficient and effective due to their very nature of interoperability. The result may prove to add more competition in the market and produce other beneficial synergies among different communities.

To illustrate, there are beginning signs of such opportunities as yearn.finance and Pickle Finance announced their merger. But unlike this particular incident where the merger was more of a marketing stunt rather than a fundamental integration both, there will be more substantial cases to witness in 2021.

- Prediction 9 — Starting from 2021, there will be more blockchain company M&As including DeFi projects.

VIII. NFTs (Non-fungible Tokens) & Blockchain Gaming

Although the blockchain gaming industry did not see that much of a growth in 2020, gaming giants like Ubisoft, Square Enix, and Atari are starting their blockchain gaming initiatives with their strong IPs. Indeed, 2021 may be a better year for the blockchain gaming industry.

With many content providers and entertainment companies exploring the idea of the metaverse, more research is being done on how to combine metaverse and NFTs. This experiment will lead to the issuance of unique digital avatars. For instance, The Sandbox is already experimenting with IPs like Smurfs and Care Bears for its NFTs.

Art is opening its door to NFTs as well. Dapper Labs is cooperating with Genies to create virtual avatar and goods ecosystems. In fact, a virtual influencer, Miquela, issued its NFT through crypto art issuance/brokerage platform SuperRare and reached a sale of USD 100,000. Also, the world’s biggest auction house Christie’s auctioned bitcoin-inspired art and associated NFT. As we see more frequent attempts to integrate NFTs into our lives, we may find a successful formula for NFT this year.

So far the NFT market has exhibited graduated growth heavily dependent on powerful individual contents and intellectual properties, which, to note, is contrary to DeFi which grew organically. While we are expecting various use cases of NFTs to emerge in bar gaming, it is extremely difficult to predict the magnitude of growth level of the NFT market nor use any metrics as a holistic index. However, at least we could estimate the extent of public acceptability of blockchain-based asset ownership certification by looking at the price of a single NFT being traded at the market. By far the most expensive NFT was an NFT character by Axie Infinity which topped USD 130,000 (ETH 300 at the time).

- Prediction 10 — A single NFT will be issued at a price of more than USD 300,000 in 2021.

Appendix: Looking Back “Hashed 2020 Blockchain and Cryptocurrency Market Prediction”

In this appendix, we are reviewing “10 Predictions of 2020 Blockchain and Cryptocurrency Market” which was presented during the Year-End Meetup at Hashed Lounge in December 2019, which was published by The Korea Economic Daily (Hankyung).

1. Banks and security companies will proactively enter the crypto market while complying with regulations.

→ O: As South Korea’s Act on Reporting and Using Specified Financial Transaction Information is drawing near to its enforcement, multiple Korean banks are entering into the virtual asset market. KB Kookmin Bank has formed a joint venture KODA — a virtual asset management company. In the US, every bank is able to provide a custody service on virtual assets under OCC’s guidelines.

2. Those exchanges under jurisdictions that failed to diversify business models will have to strive for survival.

→ O: Many small and medium crypto exchanges have gone out of business or bankrupt. We anticipate that not many companies will be able to acquire virtual asset business licenses under the Act on Reporting and Using Specified Financial Transaction Information which is due to become effective in March 2021.

3. Chinese digital yuan and its national blockchain that backs the system will be launched.

→ O: China’s blockchain network BSN (Blockchain Service Network) is launched and three of its cities are testing digital yuan.

4. Libra and other competitor blockchain platforms with global IT giants will be launched.

→ △: Facebook-led project Libra (now – Diem) has delayed its launching and is expected to be launched by early 2021 along with a single USD-pegged stablecoin. Celo represents itself to be the competitor of Libra, and it was launched with the participation of around 50 corporations. Kakao’s Klaytn and Line’s Link have successfully launched their mainnets, and they are focusing on expanding their businesses. Their native tokens have been listed on domestic exchanges, and Tencent and other China’s conglomerates are also taking their part in BSN.

5. Klaytn and Link will reach more than 10m mainchain monthly active users by accommodating the public of East Asia.

→ X: Both projects integrated crypto wallet services to their messengers (Kakao and Line, respectively) after launching their blockchain mainnets. However, no effective promotions or exposures to their users took place due to an immaturity of third-party dapp (decentralized app) ecosystems and regulations. We are expecting Klaytn and Link to proactively build their ecosystems in 2021.

6. DeFi sector total value locked (TVL) will grow to a value of more than USD 2bn and will attract 3 times more fintech start-ups than it is now.

→ O: DeFi sector TVL has grown to USD 15bn: it is 7 times more than what we have expected. Also, the engagement between DeFi and fintech/centralized finance services is growing at scale.

7. There will be blockchain games that have daily active users (DAU) of more than 30,000.

→ X: Growth in blockchain gaming was slower than we expected. In October 2020, Axie Infinity recorded 5,500 DAU.

8. Traditional venture capitalists (VCs) will start to make an equity investment in startups that create revenues with public blockchain ecosystems.

→ O: Onchain data analysis company, Chainalysis, listed its name as a unicorn start-up followed by a USD 100bn investment led by VCs such as Addition, Accel, Benchmarket, and Rabbit. Chai Corporation which grew rapidly with its partnership with Terra blockchain closed KRW 88bn (USD 80m) from traditional VCs through series A and B. Uniswap is considered to be a decentralized exchange with the most liquidity in DeFi as it raised USD 11m from a16z and USV even before issuing its own token. Compound, a crypto lending protocol, was also invested by VCs before issuing its native token.

9. Bitcoin price will be at all-time high.

→ O: BTC price is on a record-breaking rally both in KRW and USD.

10. There will be multiple BTC funds that retail investors can chip in.

→ O: In April 2020, a Bitcoin fund was listed for the first time in history in the Toronto Stock Exchange. Bitwise Asset Management, Inc. also launched an index fund that tracks 10 crypto assets for American investors in December 2020. A number of financial institutions have already announced that they will launch crypto funds in 2021.

Overall: 7.5/10

_____

Disclaimer: Hashed has invested in Klaytn, Link, Ethereum, Terra, Chai, The Sandbox, Axie Infinity, among other companies.

__

Find more insights about the crypto trends in our special series Crypto 2021.

__

A new record!

A new record!