Three years ago, when the blockchain start-up Filecoin raised $257m with nothing more than a promise to build a decentralised marketplace for data storage, it looked like another example of the mania that was sweeping through the cryptocurrency world.

At the time, investors were pouring an estimated $20bn into so-called Initial Coin Offerings — sales of new digital tokens by projects which, like Filecoin, claimed to be building important new digital infrastructure. Many have since sunk without a trace, and ICOs quickly went out of fashion.

But in recent weeks, the Filecoin marketplace has finally seen the light of day. People vying to earn its tokens have already committed a combined 1.3 exabytes of storage capacity, according to Juan Benet, the project’s founder. An exabyte is equivalent to 500 times the data stored in all US research libraries.

Demand from customers looking to buy storage is still only a small fraction of this, but Filecoin’s first goal was to attract capacity, and progress has been ten times ahead of expectations, claimed Mr Benet.

The activation of Filecoin’s network is part of the belated emergence of a handful of blockchain projects, financed by the ICO bubble, that set out with big ambitions to change online activity.

Polkadot, a platform others can use to create their own blockchains, is close to completing the phased launch of its network. Others, like Cosmos, which provides a way to connect different blockchains, and Tezos, a “smart contract” competitor to Ethereum, have also gone live.

The founders of some of these projects admit that their ideas benefited from the wave of financial speculation. Gavin Wood, a founder of Polkadot, said that much of the money pouring into ICOs in 2017 represented the recycled profits from investments in Ethereum (which he also co-founded) and Bitcoin.

“Ultimately I think a lot of people viewed this as a sort of accumulator bet,” Mr Wood said. “They won a lot of money on Ethereum and they wanted to see if they could carry on rolling.”

Yet he and other crypto entrepreneurs claim that the technical innovations from a handful of survivors will prove more lasting than the financial mania surrounding the ICOs.

“These projects have built pretty significant things,” said Mr Benet. “I think the total capital organised [by ICOs] in the last three years is not — if you look at the rest of technology — out of the ordinary.”

Though some of the blockchain networks have gone live, the applications they were built to support have yet to be developed, making it hard to judge their ultimate impact.

The Tezos blockchain, for instance, was designed for “any place where you’re trying to create a digital economy”, like purchases made inside a video game, said Kathleen Breitman, one of its founders.

Other potential uses are in online “creator economies”, said Alison Mangiero, president of TQ Tezos — places where individual artists, entertainers and influences might see a benefit in “cutting out the middleman and working out ways to monetise their fan bases.” They promise applications like this will start to appear in 2021.

Meanwhile, a recent surge in interest in DeFi — decentralised finance applications that cut out traditional intermediaries — has also drawn attention to the blockchain platforms that could support it.

Polkadot has been one of the main beneficiaries of developer attention: its platform for interlinked blockchains could be well suited to DeFi, supporting a large number of simple applications that could be combined to create new and more complex financial products.

Platforms like this are not designed to simply deliver an existing set of services at marginally lower cost, said Mr Wood. Rather, they could support entirely new services, or ones that could only be provided with “orders of magnitude more overhead” using older methods, he said.

The same is true of data storage delivered over a blockchain, according to Mr Benet. Though it might sound like the ultimate undifferentiated service, the storage services sold by a handful of giant cloud companies like Amazon Web Services are highly complex and “anything but a commodity”, he added.

Opening up Filecoin’s network to smaller players, as well as developers who can build specialist services to make use of the raw capacity, will be as disruptive to the cloud companies as Airbnb has been in the hotel world, he said.

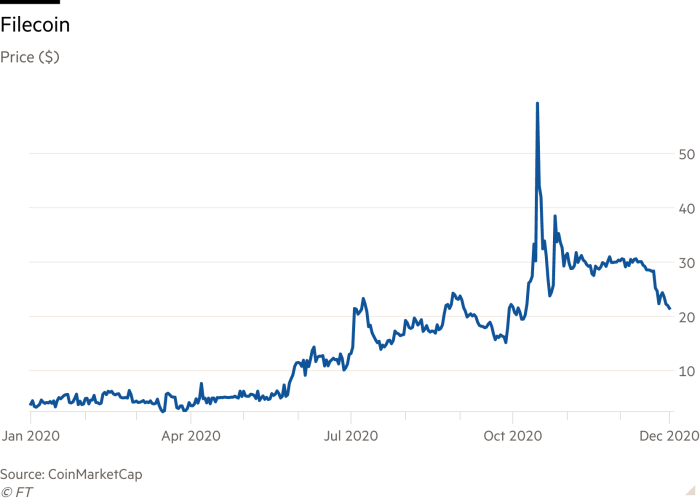

If new applications are still largely theoretical, the financial gains are all too real. The price of Filecoin’s tokens have risen 14-fold from the average price paid during its ICO, while Dots — the tokens used on the Polkadot network — are up nearly 20-fold.

The promoters of some of these projects also stand to be big winners. Filecoin, for instance, reserved 300m tokens for itself at its inception. That haul is currently worth around $7bn, though Mr Benet said the tokens will not fully vest for six years.

The recent Bitcoin boom has also cast some of the less successful veterans of the ICO bubble in a new light. Most accepted payment in Bitcoin and Ether in exchange for their own tokens, leaving them with a potential windfall. The Tezos Foundation took in $232m through its 2017 ICO — an amount that had risen to $652m by July this year. With more than 60 per cent of its reserves held in Bitcoin, it is now likely to be worth well over $1bn.

The value of their crypto holdings means that many of the less successful blockchain projects are now sitting on reserves worth more than their “market caps” — or the total value of their outstanding coins. That is likely to bring intervention from activist investors “holding projects’ feet to the fire” and forcing them to pay out some of their surplus cash, said Ryan Zurrer, a crypto investor and entrepreneur.

Tech history has seen this before. In the aftermath of the dotcom bubble, cash rich companies without viable business models sometimes lingered for years while investors agitated to get their cash back.

The dotcom period also produced a small number of big winners, including Amazon and Yahoo. The survivors from the ICO bubble still have a long way to go to prove they have anything like the staying power.