On Monday, the U.S. bank Wells Fargo’s wholly-owned subsidiary and registered investment adviser the Wells Fargo Investment Institute published an investment strategy with a page dedicated to the crypto asset bitcoin. The institute’s contributing author and head of real asset strategy, John LaForge, compared crypto investing to the “early days of the 1850’s gold rush.”

This week John LaForge from the American multinational financial services company Wells Fargo published an investment strategy editorial for the bank’s subsidiary the Wells Fargo Investment Institute.

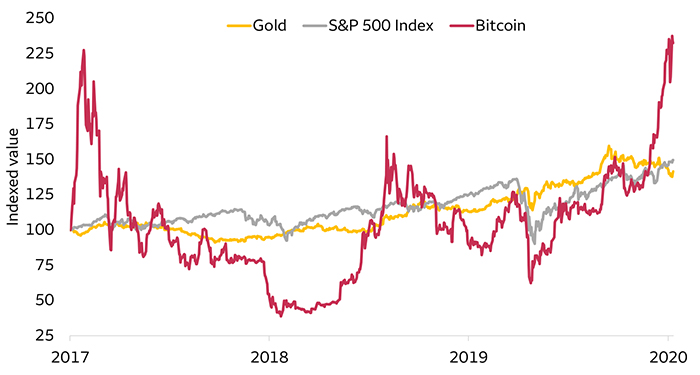

The guide discusses a number of traditional investments and trends taking place in the world of finance, but the seven-page update also commits a whole page to bitcoin (BTC) and the crypto economy in general. “[Bitcoin],” LaForge said is “2020’s best performing and most volatile” asset in comparison to the equities and other investment vehicles discussed in the strategy update.

“2020 has been a wild and crazy year, so it is only fitting that the best-performing asset group in 2020 has the craziest-sounding name — cryptocurrencies. Bitcoin, the largest cryptocurrency, is up 170% this year — that’s on top of the 90% gain it had in 2019,” LaForge’s report stresses. Despite the crypto hype, LaForge and the Wells Fargo Investment Institute are not swayed. The author adds:

If you feel left out of the craziness, don’t. Most investors have heard of cryptocurrencies, but few have ever bought or used one.

The author concedes that the bitcoin (BTC) chart against the U.S. dollar indicates that “bitcoin has indeed outperformed gold and the S&P 500 Index over the last three years.” But LaForge’s report insists that crypto proponents had a “volatile journey” to “endure to get there.”

“Cryptocurrency investing today is a bit like living in the early days of the 1850’s gold rush, which involved more speculating than investing,” the Wells Fargo head of real asset strategy notes. Still, the banking advisor cannot totally dismiss the crypto economy, and says that “cryptocurrencies could become investment-worthy one day.” For instance, LaForge underscores that during the last 12 years, they have “risen from literally nothing to $560 billion in market capitalization.”

The Wells Fargo analyst acknowledges that digital assets like bitcoin (BTC) are here to stay. “Fads don’t typically last 12 years. There are good reasons for this,” LaForge confesses. Further, the Wells Fargo Investment Institute contributor said that the bank will be publishing more on the “digital asset space” including its “upside and downside,” the author concluded.

What do you think about the recent Wells Fargo Investment Institute report concerning bitcoin investing? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, The Wells Fargo Investment Institute, Wikipedia,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.