Quick take:

- Total value locked in DeFi has risen by 2,000% in 2020

- January had a total value locked of $0.67B compared to the current level of $14.74B

- The total value locked will soon break $15 Billion

- DeFi tokens have also experienced a bounce in the month of November

- This might be the beginning of a new market phase of growth for DeFi

2020 has been a year of tremendous growth in the DeFi realm. According to data from CryptoRank Platform and DeFi pulse, the total value locked in DeFi has grown by a staggering 2,000% since the beginning of 2020. At the beginning of the year, $0.67 Billion in digital assets was locked in DeFi. This value now currently stands at $14.74 Billion.

Below is a chart demonstrating the incredible growth in the value of digital assets locked in DeFi in the past eleven months.

Total Value Locked has Grown by 32% in November

The month of November has also been one of growth in DeFi. The total value locked on the Ethereum network across smart contracts, protocols and DApps, has increased by 32% from $11.18 Billion to the current level of $14.54 Billion.

Therefore, it is safe to predict that the total value locked in DeFi will continue to grow past $15 Billion and further as time goes by. Furthermore, the growth of DeFi will be aided by the progress and hype surrounding ETH2.0.

DeFi Tokens Also Experience a Resurgence in November

The month of November also saw a resurgence in the value of DeFi tokens. According to the team at CryptoRank Platform, popular DeFi tokens such as Yearn Finance (YFI), Aave (AAVE) and Sushi (SUSHI), experienced double-digit gains last month. Below is a list of tokens identified by CryptoRank Platform as having bounced back by double digits in the month of November.

- Ramp DeFi (RAMP) – 250%

- Sushi (SUSHI) – 221%

- Yearn Finance (YFI) – 165%

- Polkstarter (POLS) – 164%

- Aave (AAVE) – 163%

- Unilend (UFT) – 150%

- BZX Protocol (BZRX) – 148%

DeFi Will Continue to Grow

As earlier mentioned, DeFi will most likely continue to grow with time as more crypto investors familiarize themselves with the industry and methods of yield farming. Institutional investors and professional users have also started flocking into DeFi as demonstrated by the quick growth in total value locked.

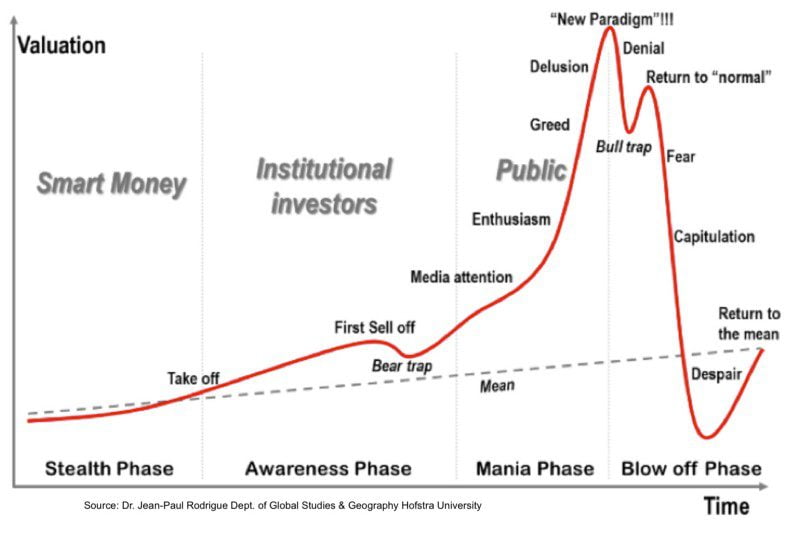

In a late September Twitter thread, Crypto Analyst and Enthusiast, Andrew Kang, compared the DeFi environment to being between the first sell-off and bear trap as demonstrated in the following chart of a standard market cycle. High chances are that the DeFi market has overcome the bear trap phase.

Back in September, Mr. Kang explained that total value locked and innovation in DeFi are two forces that will propel the industry forward.

In terms of DeFi activity growth, TVL continues to advance parabolically after a small dip even in the face of price stagnation indicating more assets moving in.

For both public and private DeFi projects, the innovation and pace of development continues forward at a blistering pace – even faster than it was two months ago. Early players created the building blocks for new developers to build off of or take inspiration from.