- Ripple slides marginally under $0.6, but buyers rush in to save it from a massive drop to $0.3.

- XRP/USD potential breakout would elevate it to highs around $0.8 as consolidation ends.

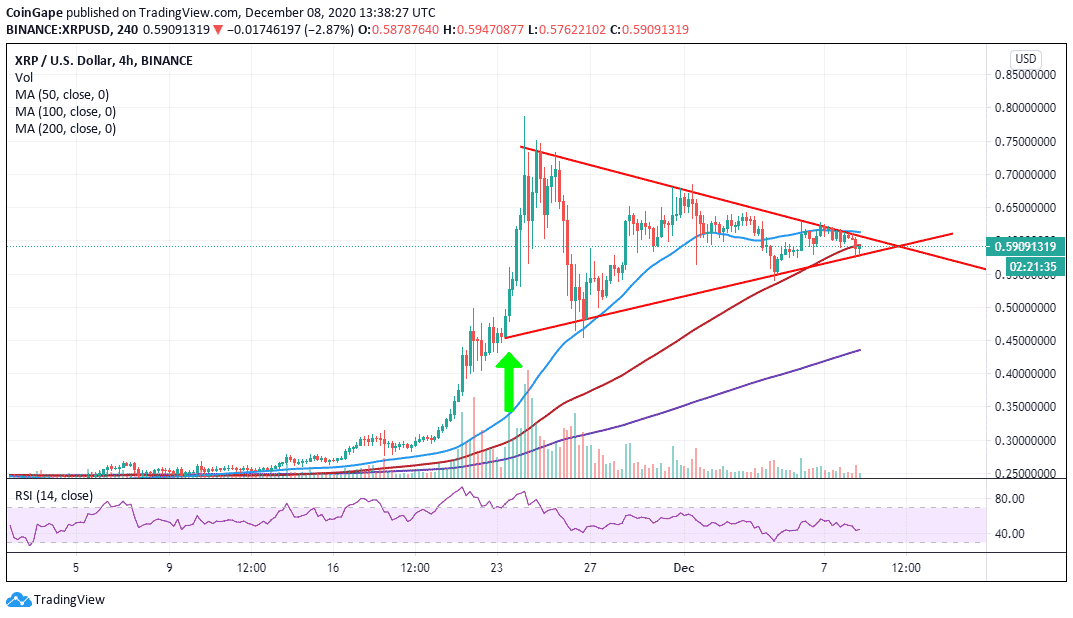

Ripple has corrected under $0.6 but is unlikely to extend the bearish leg further down. Closing the day on Monday under the 50 Simple Moving Average saw the minor declines on Tuesday validated. However, XRP is most likely to resume the uptrend and perhaps push for massive gains towards $1.

For now, holding above the lower trendline of the symmetrical triangle is key to the bulls amid the fight to avert massive losses. Moreover, the bullish narrative will be validated if Ripple closed the day above the 100 Simple Moving Average on the 4-hour chart.

On the upside, some resistance is anticipated at the 50 SMA, but a break above the triangle would catapult XRP 36% higher to $0.8. It is worth noting that there will be hurdles at $0.7 and $0.75 as these zones recently prevented Ripple from trending higher.

Buyers seem to have started getting ready for an uptrend, as illustrated by the Relative Strength Index. The RSI has embraced support at 40 and is pointing upwards as buy orders increase.

XRP/USD 4-hour chart

On the other hand, the bearish leg will significantly continue if XRP/USD ends the day below the 100 SMA. Massive losses will come into the picture under the symmetrical triangle. On the downside, the potential support would be the buyer congestion at the 200 SMA. If push comes to shove, Ripple might overshoot the moving average support and retest the anchor at $0.3.

Ripple Intraday chart

Spot rate: $0.59

Relative change: -0.02

Percentage change: -3%

Trend: Bullish

Volatility: Expanding

To keep track of DeFi updates in real time, check out our DeFi news feed Here.

Share on Facebook

Share on Twitter

Share on Linkedin

Share on Telegram