- Ripple is looking forward to a breakout to $1 as long as the price closes the day above the 50 SMA.

- The breakout to $1 is likely to encounter delays around $0.7 to $0.75 (supply range).

Ripple is still trading above $0.6 after a motionless weekend session. The cross-border cryptocurrency appears to have settled for consolidation just like Bitcoin as discussed earlier in the day. Meanwhile, a breakout is expected to come into the picture as consolidation is likely to hit a tipping point in the near term.

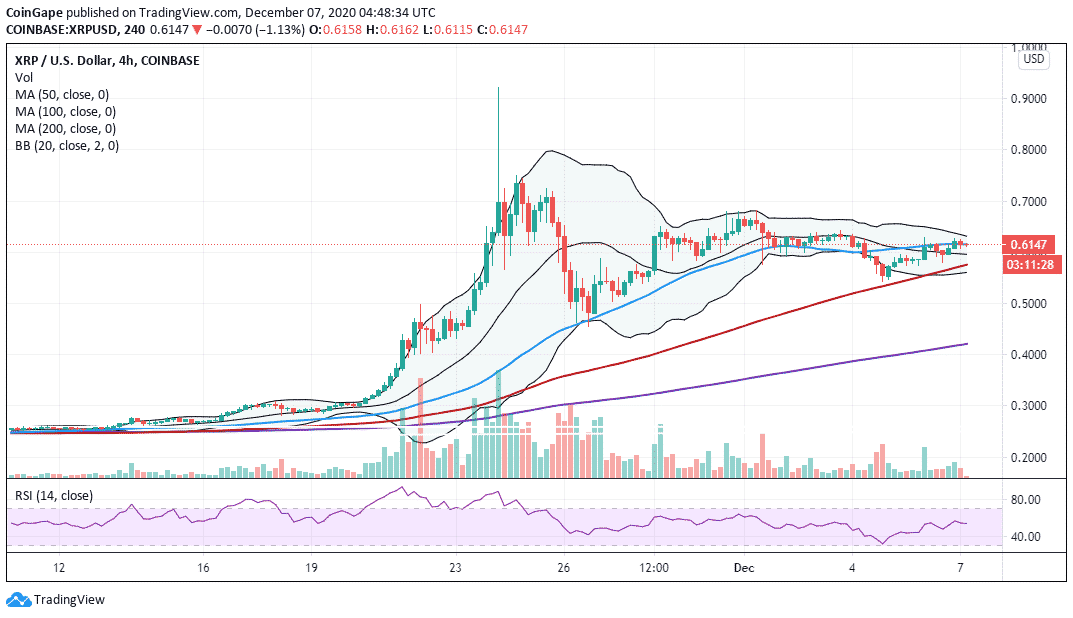

At the time of writing, XRP is doddering at $0.61 while battling an uphill task at the 50 Simple Moving Average on the 4-hour chart. Ripple will have to settle above the moving average level to first sustain the uptrend before confirming a breakout towards the next hurdle at $0.65. The rest of the journey to $1 will depend on the bulls’ ability to overcome the supply at $0.7 to $0.75.

XRP/USD 4-hour chart

The Relative Strength Index in the same 4-hour timeframe shows that sellers have the upper hand at the moment. If the negative gradient continues under the midline, a considerable breakdown would come into the picture.

On the downside, it is essential that XRP/USD holds above the middle boundary of the Bollinger Bands, to avert losses that might refresh 100 SMA support at $0.57. It is worth noting that a breakdown can occur following the Bollinger bands constriction, risking the progress made since the fall to $0.45. The 200 SMA is in line to absorb some of the selling pressure, and perhaps prevent Ripple from plunging sharply.

Ripple intraday levels

Spot rate: $0.61

Relative change: -0.008

Percentage change: -1.1%

Trend: short-term bearish

Volatility: Extremely low

To keep track of DeFi updates in real time, check out our DeFi news feed Here.

Share on Facebook

Share on Twitter

Share on Linkedin

Share on Telegram