The appearance of Bitcoin in 2009 led to the birth of the cryptocurrency market and blockchain projects. Potential use and the benefits of blockchain technology and cryptocurrencies were quickly seen by dozens of entrepreneurial people worldwide. They started to create companies to implement their business ideas. Most of them immediately faced the problem of raising funds to start and operate their companies. Since the cryptocurrency and blockchain market was just beginning to emerge in those years, raising venture capital or conducting a traditional IPO was impossible. The market started looking for a way out of this impasse, and it was found in 2013.

ICO (Initial Coin Offering)

The creator of crowdsale as a model for attracting capital to young cryptocurrency startups is an engineer from Seattle J. R. Willett, who described this idea in 2012 in his book “The Second Bitcoin White Paper”.

In 2013, Willett held the world’s first ICO (Initial Coin Offering) – a startup he created called Mastercoin (now OMNI). With only hastily written white paper, the project raised $ 5 million !!! Such a resounding success attracted the attention of the entire industry.

Finally, the industry got a tool to raise large sums of money for startups. This gave a massive boost to the development of the entire market. Most of the current projects from the TOP 100 Coinmarketcap have had their successful ICOs in the period 2014 – 2018. It is this period of time that can be called the “era of ICO”. The market recovery after the 2013 bullrun and the new, that began in 2017 contributed to the explosive growth of both the entire cryptocurrency market in general and ICOs in particular. People who invested in ICOs in 2017 in just a few months could receive income from their investment hundreds and even thousands of times higher than the initial investment. This situation played a cruel joke with the ICO, which subsequently led to the collapse of this fundraising model.

The main reasons for the ICO crash include:

- Fraud – The lack of government regulation and the almost complete absence of any rights from ICO investors, as well as the super-profits that early participants in the ICO received, attracted a huge number of fraudsters to the market. This phenomenon reached its peak in 2018 and began to take on truly catastrophic proportions when hundreds of millions of dollars of investments were stolen by fraudsters.

- The destructive role of Venture Capital (VC) funds – These funds were not interested in long-term investment in the project; their main mission was to make money quickly. Offering startups large sums for investment, in case of consent, in exchange, the fund received startup tokens at a price 5 to 20 times less than during the main ICO round. After the listing of the project on the exchange, VC began to sell their tokens, which led to a mighty dump sending the token price almost to 0. This caused severe damage to the startup and hampered its further development.

- The downturn in the market after the end of the bull run in 2017 – and the ensuing large losses of market participants (traders, holders, investors) from the fall in the rate of Bitcoin and especially altcoins, which led to a massive outflow of capital from the industry. Under these conditions, it has become much more difficult for new cryptocurrency startups to attract investments.

In 2018, it became clear to everyone that the era of ICOs was coming to an end. The market began to look for a new fundraising model that could restore investor confidence. In 2019, a solution was found and got its name – IEO (Initial Exchange Offering).

IEO (Initial Exchange Offering)

The main task that IEO was supposed to solve:

- Elimination of fraudulent projects that sell tokens.

- Reducing possible manipulations by shady VC`s.

With rare exceptions, IEOs have solved this problem. The exchanges took it upon themselves to verify the team’s personalities and the reality of their intentions to develop their projects. The exchange’s reputation for hosting the IEO was put on the line in the IEO. And if the exchange allowed a fraudulent IEO to be held on its site, it would have suffered catastrophic reputation and legal losses. Therefore, the exchanges very scrupulously approached the verification of the projects that they admitted to the IEO.

For investors, the benefits of participating in IEO became clear after the very first IEO. When opening trading, the exchange set a price for the project’s IEO tokens several times higher than that which was during the IEO. In addition, trading bots of market makers or the exchange itself were launched very powerfully, starting immediately after the opening of trading with a frantic speed to buy tokens by sending their price to the moon. Super profits from the participation in the purchase of tokens of crypto startups have returned to the industry. An investor who managed to buy tokens during IEO could absolutely not bother or worry about increasing his investment size by 2-50 times in just a few weeks.

But any success comes at a cost. And IEO’s flaws started to show up pretty quickly as well.

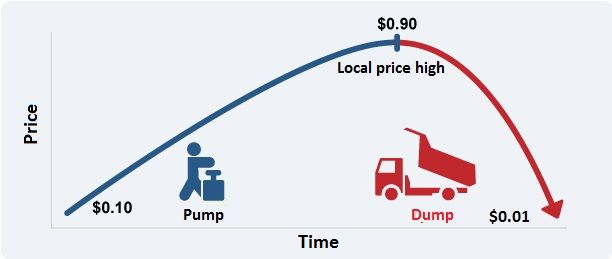

- Price manipulation – Since IEO is conducted on one exchange, there is a great deal of centralization in the distribution of tokens. A handful of large investors, the exchange, or the project itself, can control the lion’s share of all tokens, leading to price manipulation. After the opening of trading, a pump followed, which sent the price of the token to the moon in most cases. Greed and the desire to make easy profits pushed many players who failed to participate in IEO to jump on this rocket. But the rapid growth could instantly be replaced by the same rapid fall, forcing these players to fix significant losses or become long-term holders of these tokens in anticipation of the next pump.

- IEOs were supposed to democratize the token distribution process by making them available to a wide audience. However, the situation soon began to change rapidly, and one exchange after another began to change the rules. Already, significant advantages are on the side of investors with a large number of native exchange tokens. This approach allows to cut off many small investors, reducing the hype around crowdsales and, therefore, reducing the load on the platform. This also stimulates the demand for exchange tokens, for which you can buy coins of IEO projects.

IEO is a transitional model for cryptocurrency fundraising. After the ICO bubble burst and the entire cryptocurrency market fell into a recession, the industry needed a push to attract new players and regain interest in participating in token sales from old ones. IEOs certainly played a positive role in this process. Gradually, the hype around IEO subsides under the pressure of negative factors, and the leading industry experts are creating a new model of cryptocurrency fundraising designed to solve the problems inherent in both ICO and IEO. A possible applicant for this role has already been created.

DYCO (Dynamic Coin Offering)

The ideal cryptocurrency fundraising model should meet several basic requirements, such as:

- Maximum investor protection

- The full degree of protection against price manipulation by large players, the project itself or the exchange.

- Maximum protection against fraud

The new token sale model – DYCO (Dynamic Coin Offering) developed in 2020 meets the stated requirements.

The main feature of DYCO is that USDC backs 100% of the tokens sold under this model during the first 16 months. This is achieved since the project does not keep the bulk of the funds collected during the token sale but on a separate, secure, insured wallet, to which the project team does not have access.

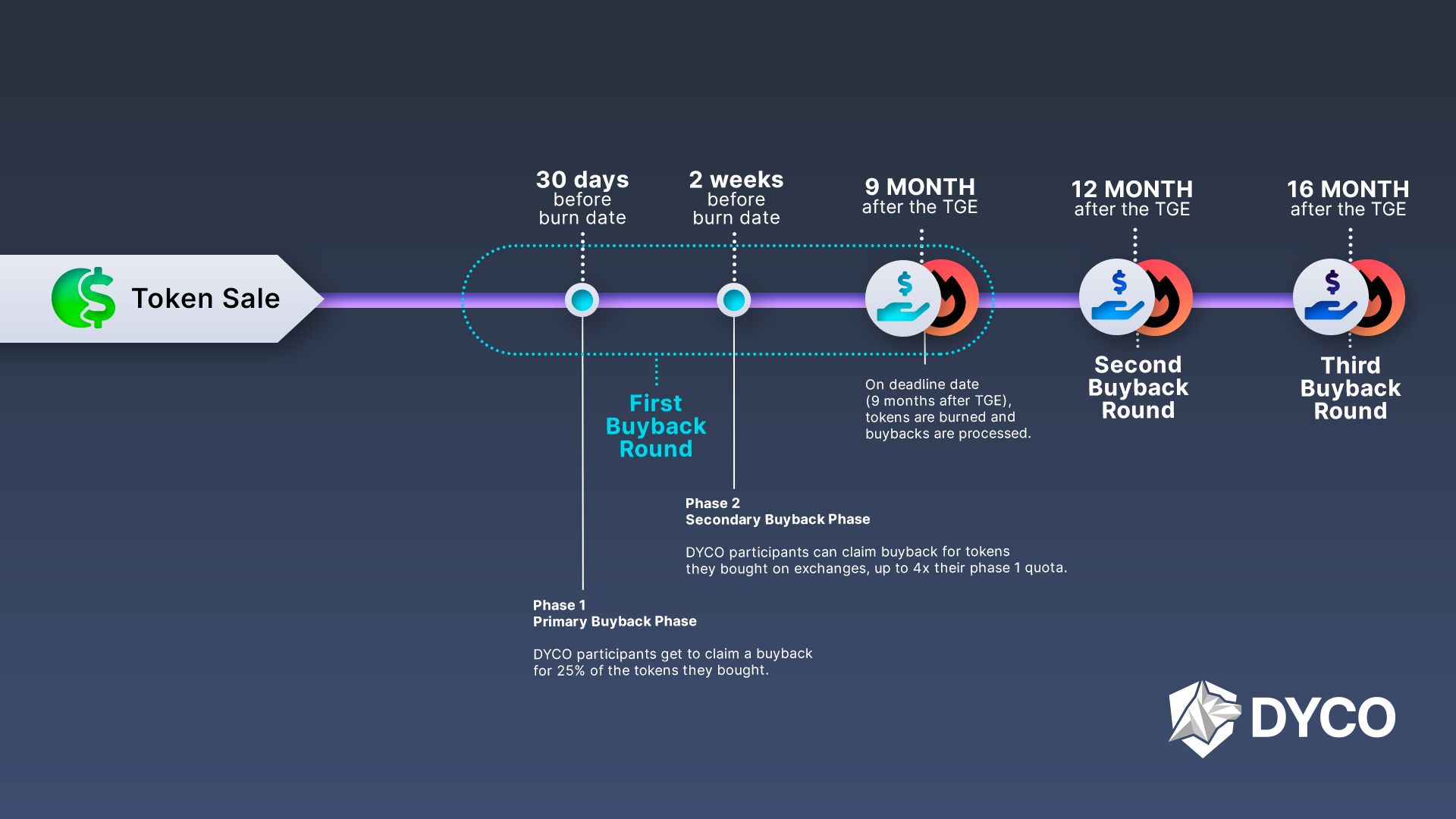

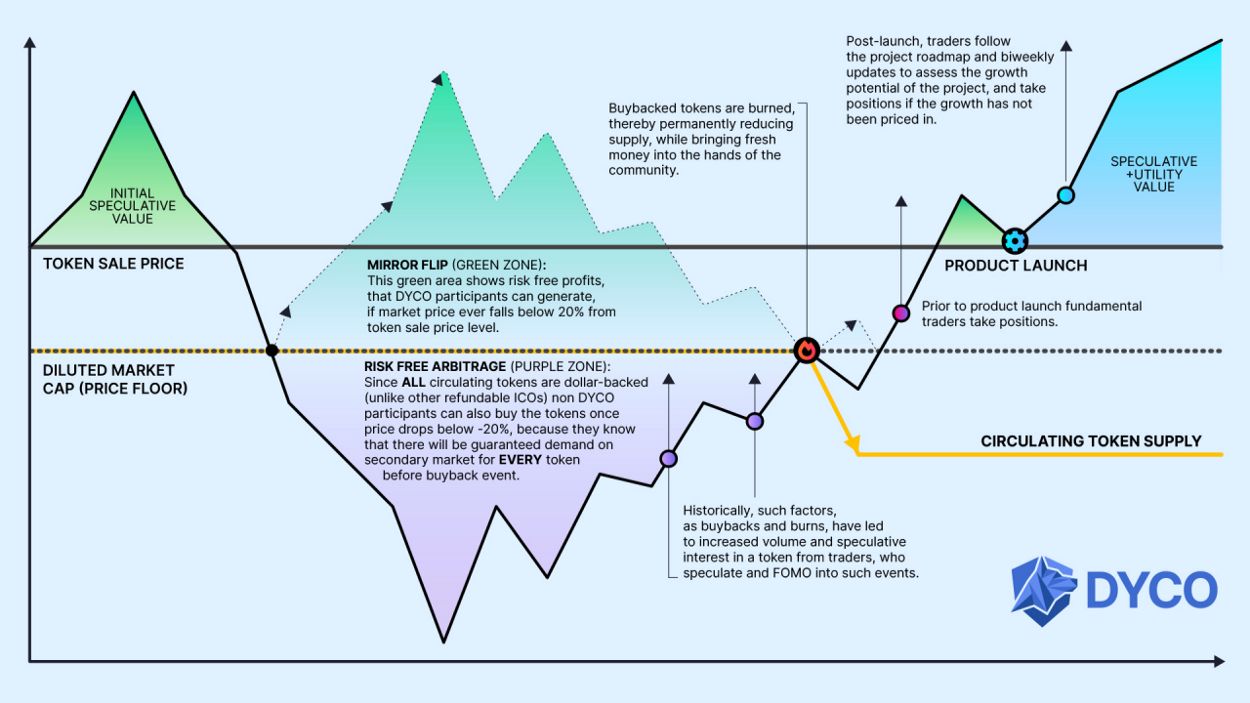

If the token’s value falls by more than 20 percent from the initial price of DYCO, the user whose wallet address is whitelisted can request a guaranteed buyback of his tokens. Tokens are buybacks in 3 stages at 9, 12, and 16 months after the DYCO, as shown in the infographic below. All tokens purchased from users are burned, reducing the circulation of tokens. Any unsold tokens, such as tokens for the team, fund, marketing, consultants, etc., start to unlock after the 16th month.

Thus, investors have a powerful lever of pressure on the team, encouraging it to fulfill the roadmap and established goals.

Backing tokens with money issued under the DYCO allows you to profit from the token, even if it falls in price. This is possible by buying tokens below the price level ( buyback value) and then demanding a buyback for a risk-free profit.

A Mirror Flip is created: the profit received from buying a token below the buyback price floor reflects the effect of selling a token above the ICO price.

For example, buying a token 10% below the price level and then requiring a buyback is profitable, just like selling a token 10% above the ICO price.

Only DYCO members can demand a buyback; the possibility of Mirror Flip increases this privilege value.

To make the value of tokens sold under the DYCO model sustainable and to reduce the risk of price manipulation by large players, all sold tokens have long blocking periods and a flexible release schedule. Some of the tokens are issued during the TGE, while the rest are issued in small parts over many months.

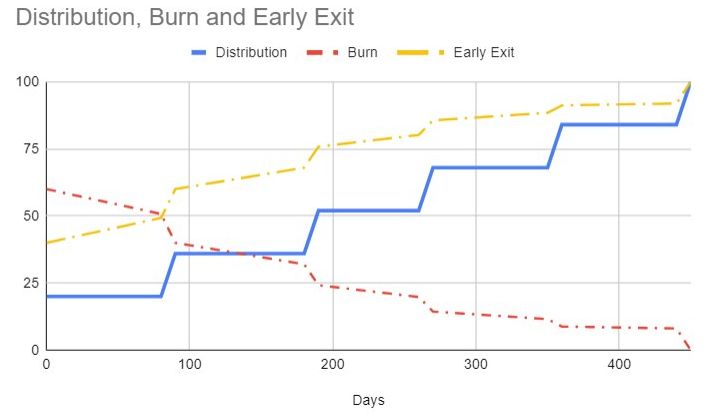

At DYCO, a deployment contract that distributes tokens to buyers acts like a Tall Bridge (toll bridge). DYCO members may claim their entire purchased allocation on Day 1, Day 100, or any other day of their choice. They can remain committed to long-term token issuance or shorten the time frame, but for a fee. Toll Bridge requires primary buyers who want instant unlock to burn some of their allocations. The size of this burn decreases every day and becomes equal to 0% after completing the final distribution of tokens.

This reduces extreme price volatility as the surges in secondary market demand are met by primary buyers who want to capitalize on their purchase as quickly as possible. Meanwhile, holders can remain committed to a long-term release schedule. With Tall Bridge, there is a great deal of confidence that any market price will not be too distorted by future releases since primary buyers do not have to wait for an unlock to sell; they can sell at will if the price is already attractive for their purposes.

Finally, the DYCO model almost completely removes cheaters from the game. Since the major part of the collected funds is not at the disposal of the project and is stored in a place inaccessible to them, this completely deprives the scammers of the financial benefit from such a token sale. This gives investors additional confidence that the project and its team running DYCO are real people and will not disappear with the collected money immediately after completing the token sale.

Orion Protocol was the first project that held its token sale on the DYCO model in July 2020. The token sale was a huge success; the Hard Cap was assembled. The oversubscription to participate in the sale was 600%, convincing proof that the market and investors are interested in this new fundraising model. After successfully completing DYCO, the project has thus gained a large community interested in the project’s success.

The second company conducting its token sale according to the DYCO model is the company itself that developed this model – DAO MAKER. Their token sale is taking place now and will last until the end of January 2021.

DYCO developers carefully analyzed all the risks and problems identified or emerged during the ICO and IEO eras. At DYCO, these risks have been minimized or eliminated entirely. Investors have an unprecedented level of protection for their investments previously not available in the crypto market. A flexible issuance schedule, toll bridge, and flaring of repurchased tokens will contribute to price stability, smoothing out surges in the secondary market.

You can find more information about the DYCO model here.

The market is already demonstrating high interest in this cryptocurrency fundraising model, and only time will show how successful it will be.

Tags

Create your free account to unlock your custom reading experience.