- Ethereum is on the verge of a breakdown to $500, mostly if the support at $540 fails to hold.

- The bearish outlook will be abandoned if Ether closed the day above $540 and perhaps reclaimed the ground past $560.

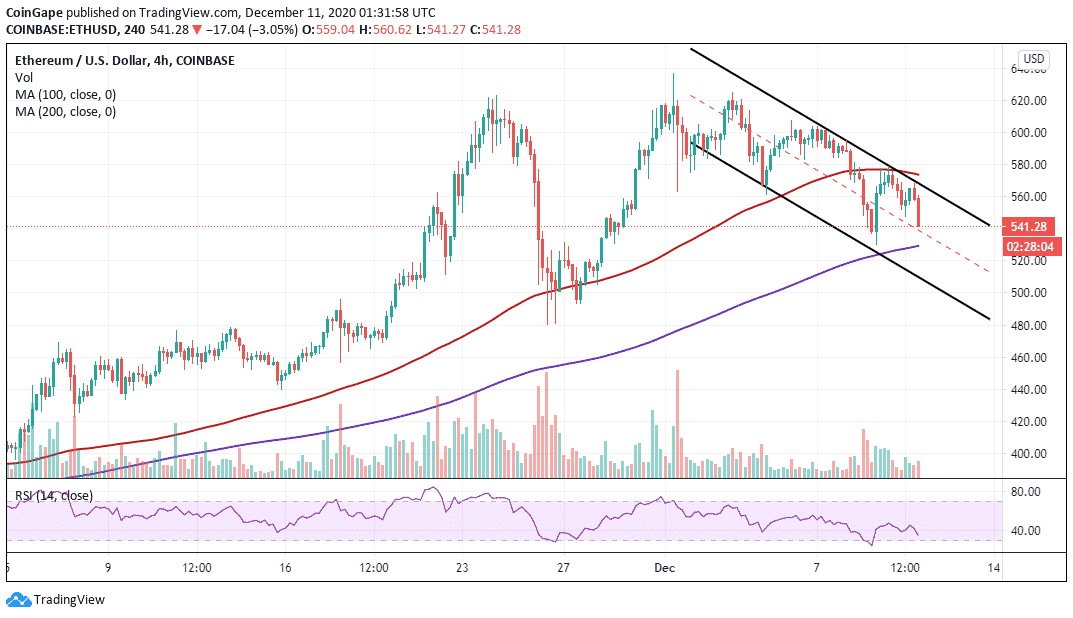

Ethereum is in the middle of a retreat that could soon touch $500 following a failed attempt to recover to $600. The flagship altcoin is teetering at $545 amid fresh declines from the recent rejection at $580. Ether might complete the bearish leg to $500 if a crucial support area is depressed.

Meanwhile, the descending channel’s middle boundary on the 4-hour chart seems to be holding the fort, allowing bulls to flex their muscles. This zone, in conjunction with the immediate support at $540, must hold to ensure that potential losses to $500 are averted.

The downtrend momentum appears to have been validated by the Relative Strength Index, especially now that the indicator is dropping fast towards the oversold area. An increasing volume suggests that the bearish pressure would be felt more because massive sell orders are likely to come into the picture if ETH breaks below the above-mentioned support levels.

ETH/USD 4-hour chart

The 200 SMA at $530 recently functioned as a key barrier and is likely to do the same. However, if declines stretch past the zone, the next tentative buyer congestion zone is at $500. For now, the least resistance path is downwards until Ether embraces robust support, strong enough to support a rebound.

It is worth noting that, the bearish outlook will be invalidated if Ethereum defends the immediate support area. Upward price action might push ETH above the channel’s upper boundary. Trading beyond $560 is likely to encourage more buyers to join the market, thereby pulling the price to $600.

Ethereum intraday level

Spot rate: $544

Relative change: -14

Percentage change: -2.5%

Trend: Bearish

Volatility: Expanding

To keep track of DeFi updates in real time, check out our DeFi news feed Here.

Share on Facebook

Share on Twitter

Share on Linkedin

Share on Telegram