On Thursday, December 24th, the ETH is declining, trading at 580.00 USD.

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

- Tech analysis of ETH/USD

- The ETH dragged down by the XRP

- About 2 million ETH are blocked in the Ethereum 2.0 contract

On W1, ETH/USD keeps correcting in an uptrend. The asset is trading near 38.2% Fibo, aiming at 50.0% in its further growth. The MACD histogram has been positive for several weeks already, promising soon restoration of the ascending dynamics. The signal lines of the indicator have crossed zero and keep growing, which is yet another support of the uptrend. The Stochastic rests in the overbought area, possibly on the verge of forming a Black Cross, which will signal a correction before further growth. From all these facts we can figure that in the nearest future, the ETH/USD quotations will keep correcting and resume the uptrend when the correction is over. The aim of the growth is 750.00 USD.

Photo: RoboForex / TradingView

On D1, the situation is rather similar to that on W1: the pair continues the bounce off the upper border of the ascending channel and remains near 38.2% Fibo. The aim of the pullback, in this case, is the resistance level near 540.00 USD. The MACD histogram keeps declining, enhancing the signal for a correction. The signal lines can form a Black Cross in the nearest future, which is yet another signal for a correction. The aim of the pullback is 540.00 USD.

Photo: RoboForex / TradingView

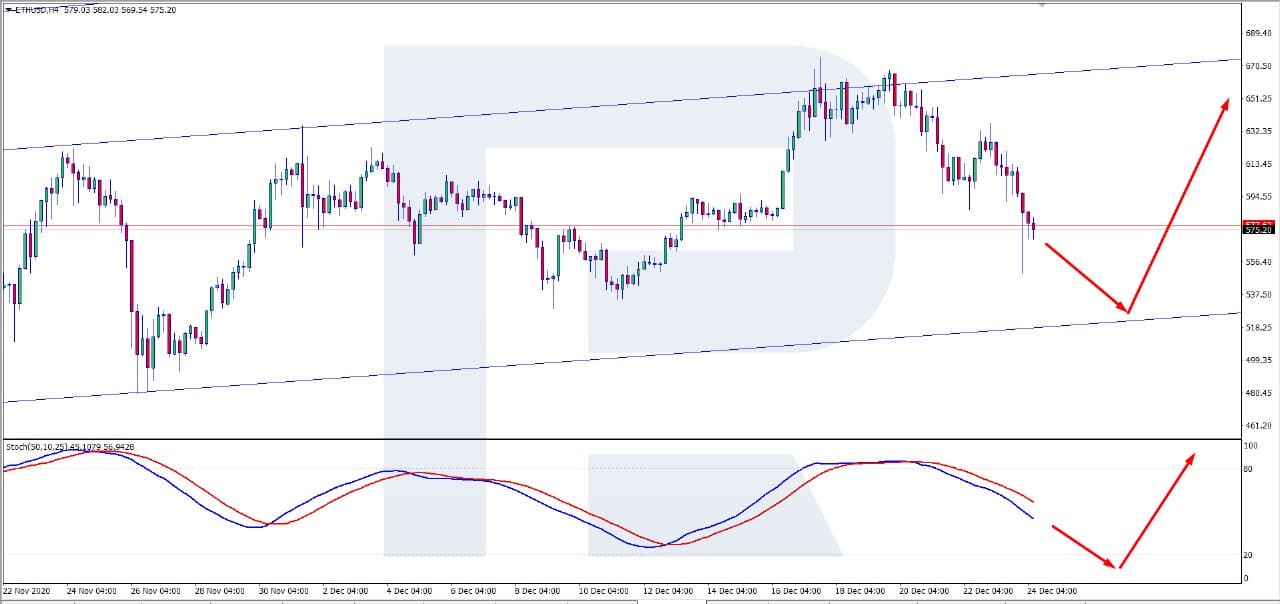

On H4, the picture is yet similar to that on D1: the pair is correcting from the resistance level inside the ascending channel. After the pullback is over, it has all the chances for further growth. The Stochastic has formed a Black Cross in the overbought area, which is another signal for a correction before the ascending dynamics resumes. The aim of the growth (as on the larger timeframe) is 750.00 USD.

Photo: RoboForex / TradingView

Since yesterday, the ETH has dropped by over 7% due to the panic in the sector of altcoins, where the XRP dropped deeper than any other coin. There is definitely a serious fundamental reason: the US SEC sued Ripple for attracting a large sum by selling non-registered securities disguised as the XRP tokens. This serious lawsuit can harm the whole crypto sector. The flagship of the BTC will be hurt just slightly while the sensitive ETH might react more noticeably.

Currently, about 2 million ETH got frozen inside the Ethereum 2.0 contract, which is about 1.2 billion USD today.

The update of the Ethereum network is, indeed, long-anticipated and important for the crypto sector. According to Dune Analytics, the minimal threshold of stored coins necessary for launching the network has already been exceeded by 380%. Reaching such volumes required about 45 thousand transactions.

The 2.0 network is promising to be super modern, quick, available, and allowing for passive income. Investors have been waiting for the launch super patiently, especially if we recall that Ethereum has given no clear indications of possible starting dates and kept rescheduling test launches.

For this article, we’ve used ETHUSD charts by TradingView.

Disclaimer: Any predictions contained herein are based on the author’s particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European online foreign exchange forex broker.