In summary:

- Grayscale Investments has accumulated 388,714 ETH in 30 days

- This is the equivalent of $215.7 Million using an Ethereum value of $555

- Grayscale’s Ethereum trust now has $1.61 Billion in Ethereum holdings

- ETH2.0 staking might be one reason for the accumulation

- Staking might be a good way to utilize all that Ethereum held by Grayscale

Bitcoin is not the only digital asset Grayscale Investments has been accumulating. According to data from Bybt.com, the Wall Street company has added 388,714 ETH to its Ethereum trust in the last 30 days. This amount of Ethereum is worth roughly $215.7 Million using an exchange rate of $555 per ETH. This brings the total of Ethereum held by Grayscale to 2.94 Million ETH with a USD value of $1.61 Billion.

Below is a screenshot of the digital assets currently held by Grayscale courtesy of Bybt.com. The Ethereum accumulated has been highlighted in red.

ETH2.0 Progress Could Be the Reason for the Accumulation

Grayscale accumulating 388,714 ETH in 30 days is a clear indicator that the Wall Street firm is also seriously considering other digital assets apart from Bitcoin. From a numerical point of view, the amount of Ethereum added to the Grayscale Ethereum trust is impressive in such a short time period and could be due to the progress of ETH2.0. What remains to be seen, is whether Grayscale will stake the Ethereum to capitalize on the rewards of ETH2.0.

Staking the 2.95M ETH Could be a Good Way to Add Value to Grayscale’s Holdings

What remains to be seen, is whether Grayscale will stake the Ethereum to capitalize on the rewards of ETH2.0.

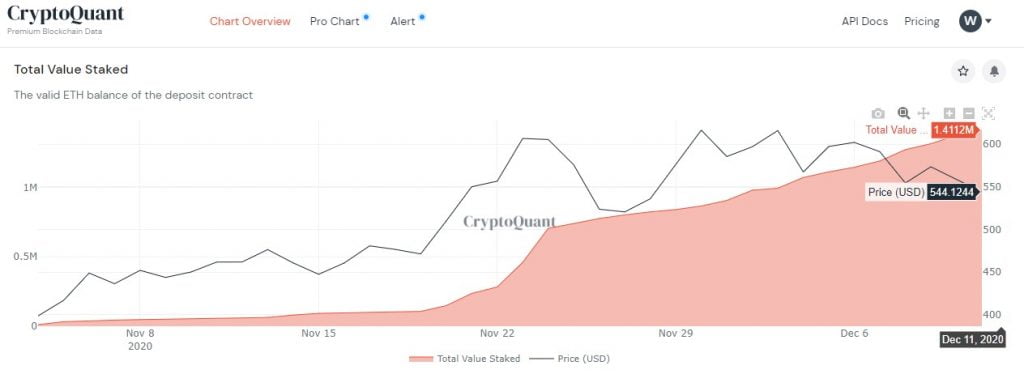

With respect to staking on ETH2.0, Ethereum investors are still sending their coins to the staking contract despite the minimum requirement being reached on November 24th. According to data from CryptoQuant, a total of 1.411 Million ETH has been sent to the deposit contract as of yesterday, December 11th. The deposits to the staking contract have also been constant by the day as seen via the following chart also via CryptoQuant.com.

Such an impressive increment in deposits and commitment by Ethereum investors is a positive sign for the future of the ETH2.0 network. Furthermore, it could provide an incentive by Grayscale to dive into ETH2.0 staking. However, such an endeavor will depend on numerous factors including SEC approval and the security of the Ethereum funds.