Heading into the Thanksgiving trading period, bitcoin assets experienced heavy selling pressure that sent BTC-USD valuations below important price levels at $16,500. On November 26th alone, BTC-USD fell by more than 15% (which translates to massive losses of more than $3,000 in a single day).

However, the fact that these declines happened as bitcoin valuations approached new records (near $20,000) might be what was most alarming for cryptocurrency investors. As a result, sharp moves to the downside have emerged as traders caught long at unfavorable levels may have been stopped-out of their positions.

Since this might be the market’s last opportunity to buy bitcoin before we see new record highs, let’s take a look of the trends in market price activity that have preceded this historical breakout in order to better assess potential trends in the cryptocurrency’s price behavior going forward.

Source: Author via Tradingview

Volatility is a feature of the cryptocurrency market that is almost expected by the majority of the market, so potential investors must have a sense of what is likely to be driving sentiment in this type of environment.

As unfortunate as they may be, daily declines of +15% are not exactly a rare event for traders in bitcoin assets or other cryptocurrencies. That said, the face that similar declines were seen in many other coins suggests that more sellers are likely to exist near this well-touted $20,000 level than many bitcoin bulls probably believed. According to Antoni Trenchev of Nexo:

Long term I don’t see anything derailing Bitcoin’s irrevocable rise higher. That doesn’t mean we won’t have pullbacks along the way. Look what happened in March; Bitcoin plunged 40% in one day during the coronavirus market panic. 20-30% falls can and should be expected. Any healthy market needs to have pullbacks and periods of consolidation. Already in 2020 we’ve seen a gain of 160%.

In our view, widespread sell-offs are generally significant because they suggest that investors have become negative on the sector as a whole. Since closing prices tend to have more significance in defining trading sentiment over a given time period, cryptocurrency investors now find themselves at a critical inflection point that could define the general trading tone that is experienced through most of 2021.

Source: Author via Tradingview

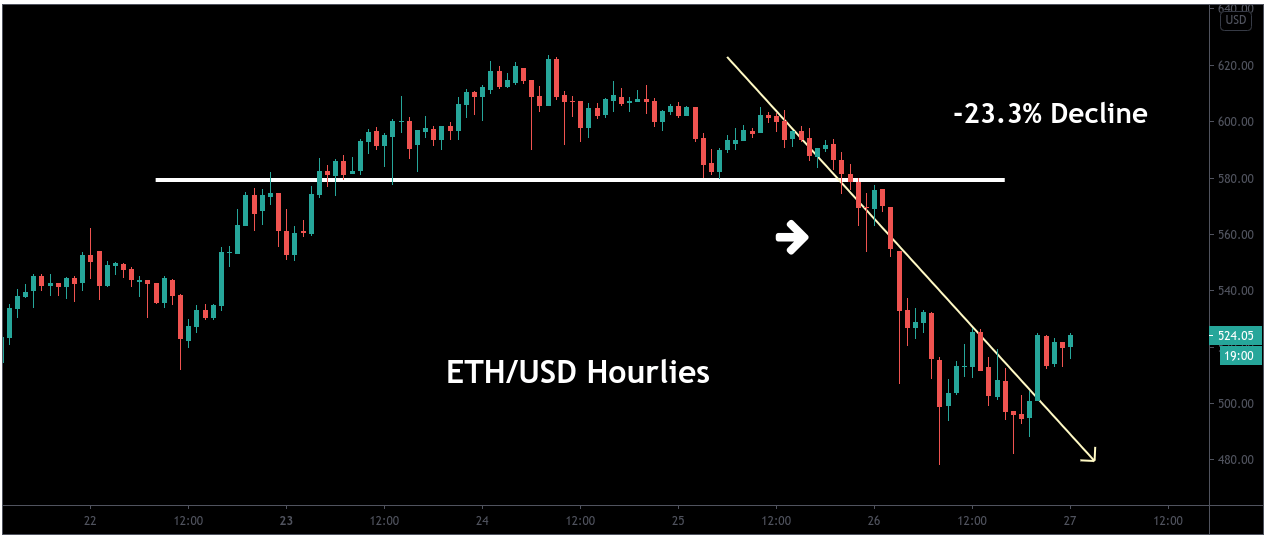

Ethereum valuations are also trading lower but what is most interesting here is the fact that ETH-USD has lost even more during this process. Measured from peak to trough, declines in ETH-USD were much larger when compared to similar trending moves in BTC-USD (coming in at -23.3%).

In part, this can be explained by differences in liquidity levels and it seems entirely possible that ETH-USD markets were caught off-guard by the recent sell-off in crypto. Unfortunately, bearish trends emerged at somewhat random levels (roughly $620 in ETH-USD) but this makes it clear that growing bearish momentum has started to take shape throughout the alt-coin space.

Source: CNBC, Youtube

Of course, the recent selloff activity in BTC-USD might almost have been expected, given the higher probabilities for investors to take profits (or even establish outright sell positions) whenever we are trading within close proximity to well-established psychological resistance levels.

Since this was somewhat likely to be the case for BTC-USD near the $20,000 level, short-term traders would have been exposed to excessive risk levels with any trades established in the upper half of the 19k handle and potential losses can become large quite quickly when traders are using leverage in their positions. In our view, these failed positions are likely the positions that magnified any short-term pullback that might otherwise have been visible on bitcoin’s approach to 20k.

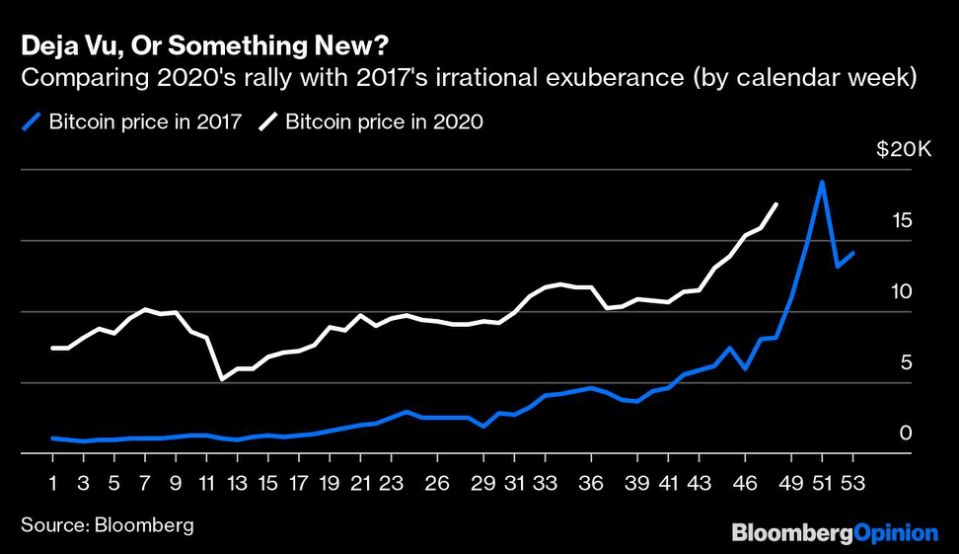

Source: Bloomberg

In this chart, we can see some of the similarities that characterized the bullish trends in both 2017 and in 2020. In our view, what is most striking is the fact that the 2020 rally is actually much more stable in nature. Of course, this is surprising because we have seen unprecedented price volatility in most of the financial markets during this turbulent year and bitcoin is stereotypically considered to be a “risky” asset that has the potential to exhibit exceedingly unpredictable price trends at random moments.

In actuality, what this chart really shows us is that bitcoin assets should not be characterized in this fashion and that they have reached a point of maturity that could actually be described as quite stable in nature. In 2020, bitcoin’s ascent has been much more measured in nature and this tells us that the sector’s prior “irrational exuberance” has officially left the market.

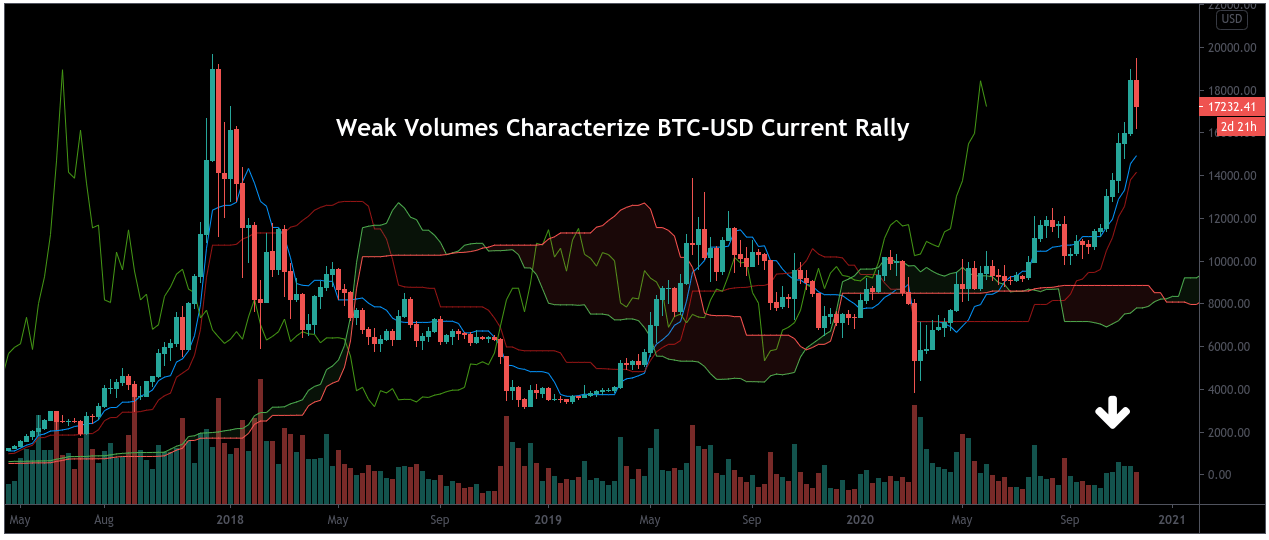

Source: Author via Tradingview

Despite these favorable fundamental factors, bitcoin traders must keep a few things in mind when making decisions to buy or sell BTC-USD. First, recent rallies have been somewhat extreme in nature because downside corrections have been almost non-existent since the beginning of September. In addition to this, bitcoin’s latest rally has also been characterized by low volume levels and this suggests that the majority of the market might not be watching this story as closely as though with a specialized focus on cryptocurrency assets.

If these arguments turn out to be accurate, it could mean that an initial break through the important psychological resistance at 20k might be somewhat short in nature. That is to say, a quick move through 20k could see a “buy the rumor, sell the news” type of event that leads with a significant round of profit taking once this critical price level is breached.

However, longer-term we remain of the belief that global stimulus strategies have doomed fiat currencies around the world and rising levels of M2 money supply in the United States should help bitcoin outperform the greenback without much difficulty in 2021. Ultimately, this means BTC-USD remains a buy at current levels – even if markets were seen having some difficulties on the first attempt to vault the $20,000 level.

Thank you for reading. Now, it’s time to make your voice heard.

Reader interaction is the most important part of the investment learning process. Comments are highly encouraged! We look forward to reading your viewpoints.

Disclosure: I am/we are long BTC-USD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.