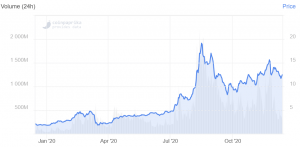

2020 may be a hard act to follow for the cryptoasset market. Beginning on January 1 with a total market capitalization of around USD 190bn, the entire market has grown over USD 560bn in December.

This increase has unsurprisingly been paralleled by the performances of individual cryptoassets, with bitcoin (BTC) rising around 150% over the same time frame, and with ethereum (ETH), XRP and chainlink (LINK) rising by around 330%, 190% and 590%, respectively. Assuming that the above coins simply replicate this year’s performance in 2021, they will rise to around USD 45,900 (BTC), USD 2,400(ETH), USD 1.6 (XRP), and USD 84 (LINK) by the end of next year.

But what do people within the industry think are realistic price targets for six of the biggest cryptos — BTC, ETH, XRP, litecoin (LTC), LINK, BCH — in 2021? To answer this question, Cryptonews.com has talked to a selection of analysts. If they’re right, 2021 may end up being even better than 2020.

Bitcoin price predictions for 2021

In November, bitcoin already started its series of hitting all-time highs (ATH) and pretty much everyone seems to think that bitcoin’s price will move even higher in 2021. And while it may seem almost incredible to anyone who bought bitcoin not so long ago at USD 10,000, quite a few people are targeting a high of around USD 100,000.

“It’s very likely bitcoin will reach USD 100,000 in 2021 just based on corporate and institutional demand alone. We’re seeing sustained demand for hosting of miners as well, which usually indicates bullish trends in mining from months ago,” said Blockstream’s Chief Strategy Officer Samson Mow, speaking to Cryptonews.com.

Mow isn’t the only one touting this benchmark. Also pointing towards institutional and corporate demand, Quantum Economics analyst Lou Kerner thinks bitcoin will increasingly eat into gold’s share of the store-of-value market next year.

“I expect bitcoin at USD 100,000 in 2021 as demand continues to accelerate led by traditional investors, followed by public companies and even smaller governments will begin to use it as treasury,” he told Cryptonews.com, adding that at this price BTC would achieve 17% of the gold market capitalization, “which feels doable.”

In fact, for Kerner, USD 100,000 is more of a realistic target, and he even suspects that bitcoin could go even higher than that in 2021.

According to him, if BTC repeats its 100x jump from previous lows, given the Dec. ’18 low of USD 3,200, “we’d be over USD 300,000 in Dec. 2021.”

But some analysts aren’t stopping with USD 300,000. Nexo Co-founder and Managing Partner Antoni Trenchev thinks the highest upper limit could be somewhere close to USD 500,000, driven by bitcoin’s rising status as an inflation hedge and the arrival of fintech behemoths such as PayPal and Square.

“This superstar combination, in our view, is a recipe for strong price appreciation in 2021. Whether the next big resistance will be at USD 50,000 or USD 500,000 is anyone’s guess but we firmly believe the risk/return is skewed to the upside,” he told Cryptonews.com.

At the other end of the spectrum, some industry figures are being more conservative. Tim Rainey, the Chief Financial Officer at powerplant-cryptomining hybrid Greenidge Generation, is one of these figures, telling Cryptonews.com that he’s eyeing an upper limit that would represent a 65% increase over where bitcoin is today.

“Unlike the 2017 bubble, bitcoin’s latest price rally is driven by stronger fundamentals — institutions saving reserves in cryptocurrency or integrating cryptocurrencies into their services. Thus, we remain bullish on bitcoin’s outlook in the long term, and I believe that the price could easily reach the USD 25,000-USD 30,000 range,” he said.

Ethereum price predictions for 2021

Ethereum is a trickier crypto to call, with a smaller number of analysts willing to stick their necks out with a definite 2021 price prediction. That said, Lou Kerner expects a rising bitcoin price would help boost ethereum in tandem.

“Ethereum is harder to predict. But given the 5x rise for bitcoin, assuming they keep the same relative value, I’d predict USD 3,000 for ethereum in 2021,” he said.

Nexo’s Antoni Trenchev doesn’t provide a specific figure, but he does claim that Ethereum’s fundamentals will help push up the price of ETH.

“With the Beacon node now officially launched, bridges between ETH1.0 and ETH2.0 have already started to emerge, hinting that 2021 might be the year of ETH. The long-anticipated transformation will enhance scalability and economics, enabling the expansion of the staking industry as we’ve never seen before,” he said.

Elsewhere, popular crypto Youtuber Ivan Liljeqvist (AKA Ivan on Tech) has predicted an ethereum price of USD 6,000 by December 2021, placing him among the most bullish analysts as far as ETH is concerned.

XRP price prediction for 2021

Those willing to speak to us about XRP have been fairly bearish about its prospects in 2021, at least compared to other major coins.

“With regulatory pressure seemingly fading away and the Flare Networks Airdrop’s potential to play a central role in the DeFi ecosystem, 2021 could be a whole new ball game for XRP. That said, we are reasonably pessimistic about XRP’s recovery in 2021 unless Ripple decides to completely change the business model, tokenomics, and use cases of XRP,” said Antoni Trenchev.

Likewise, Nishant Sharma, the founder of crypto mining PR consultancy BlocksBridge, also thinks XRP may have a relatively difficult year.

“A lot of XRP price movement might depend on its legal status, which is still pending, as compliance has remained one of Ripple’s main values. Meanwhile, Facebook’s Libra, now rebranded as Diem, could potentially challenge XRP in facilitating cross-border transactions for mainstream players if it manages to convince regulators at last,” he told Cryptonews.com.

The Diem project is reportedly preparing to launch as a single coin backed one-for-one by the dollar as early as January.

That said, on the almighty Crypto Twitter, certain anonymous players are much more sanguine about XRP, for example, predicting USD 15 by May 2021, and a price as high as USD 100 by December 2021.

Litecoin price predictions for 2021

As with XRP, litecoin is likely to benefit from any general upswing in the cryptoasset market, but few analysts believe it will outperform other coins.

“We expect the currency to sustain momentum by adding opt-in privacy capabilities (the Mimblewimble project), while reaping the benefits of having gathered a great team. A partnership with a project with a strong community, like Cardano for instance, could also be a great price catalyst as it will bring an army of new potential investors,” said Antoni Trenchev.

He added, however, that “a 2021 price beyond pre-pandemic levels seems unlikely as bears will hardly ever give up.”

In other words, he doesn’t estimate LTC has a great chance of returning to triple figures, or at least not a great chance of passing its ATH of USD 360.

Still, some analysts do think litecoin can break into triple figures again in 2021. Trading platform Currency.com set USD 140 as its price target for 2021 in a recent video, while still noting that such an upswing wasn’t certain.

Chainlink price predictions for 2021

As the intro to this article indicated, chainlink was the best-performing major cryptocurrency in 2021, starting the year at USD 1.76 and hitting a peak of USD 19 in August (it’s at USD 12.66 as of writing). It’s unlikely to match this kind of percentage rise next year, but analysts think it will continue to rise.

“Chainlink is a great company, but at risk of getting surpassed by better technology. I’d predict Chainlink at USD 25 in 2021,” said Lou Kerner.

Antoni Trenchev noted that LINK will be boosted by the fact that it’s integrated with a growing number of platforms.”

“Chainlink has now built up a commanding lead when it comes to industry integrations. Should a big enough portion of these clients make a splash in 2021, so will Chainlink, and, in turn, the LINK token,” he said.

He added that strong price catalysts in the form of Chainlink’s staking feature could also catapult the price.

“The project is by far the most active recruiter in the space which will sooner, rather than later spur innovation, further market adoption, and continue to drive LINK’s price up,” he said.

Some, again anonymous analysts have predictably gone further in their enthusiasm, penciling in a target of USD 400 for LINK.

Bitcoin Cash price predictions for 2021

Lastly, bitcoin cash has risen by ‘only’ 29% in the year to date, from around USD 205 on January 1 to over USD 260 in December.

It’s therefore the worst-performing of the six cryptocurrencies featured in this article. However, analysts claim that its fundamentals will support its price into 2021, despite recent controversies surrounding its November hard fork.

“BCH has a string of aces up its sleeve: a well-educated community, loyal investors, retail distribution, and actual real-life use cases. We believe that these benefits could change BCH from an underdog to a medal-winner in 2021 if only Bitcoin Cash gets its act together,” said Antoni Trenchev.

Trenchev doesn’t give a price target, yet Bitcoin Cash champion Roger Ver has recently said that the cryptocurrency could double over the course of 2021, to pass USD 500. Likewise, Nishant Sharma said that “as cryptocurrencies get more widely adopted in 2021, bitcoin cash’s price may cross USD 500 and go higher.”

A similar increase as 2020 — 29% — would imply a price of about USD 342.

______

However, everyone should know by now that past performance is not indicative of future results and markets can always surprise both the bulls and the bears.

___

Learn more:

Crypto in 2021: Bitcoin To Ride The Same Wave Of Macroeconomic Problems

Crypto in 2021: Institutions Prefer Bitcoin, Retail Open to Altcoins

In 2021, Bitcoin To Hit USD 25K, Ether – USD 900 – Median Estimates Of Pre-rally Survey

‘Bitcoin on Track for USD 100,000 in 2025’ – Bloomberg Intelligence