The XRP price performed particularly well when Bitcoin started to rally from $16,000 to $19,915. In the past several days, however, the “OG” altcoin has significantly underperformed against the dominant cryptocurrency.

XRP was one of the best-performing large market cap altcoins during the November rally. From November 1 to 24, it rallied by around 280% on Coinbase, surging from $0.2415 to as high as $0.9210.

In the past four days, from its highest point on December 6 to its lowest level on December 9, Bitcoin dropped by nearly 9%. In the same period, the XRP price declined by around 20%, suffering a significantly deeper correction.

The 1-hour XRP price chart with short-term moving averages (MAs).

TradingView.com

Other major altcoins, including Stellar, Ethereum, and decentralized finance (DeFi) tokens, all saw a similar trend.

However, even as the Bitcoin price began to recover from its recent drop to sub-$17,600, the XRP price sharply fell. There are three key reasons why XRP likely struggled in the past three days. The potential reasons are relatively low volume compared to Bitcoin, uncertainty in the market, and a sell-the-news drop after an airdrop to XRP holders.

The biggest catalyst of the XRP price throughout the past week has been the airdrop of Spark tokens. Major exchanges, like Bitstamp, supported the airdrop to allow XRP holders at Bitstamp to receive Spark tokens.

“Each Bitstamp customer that holds XRP will receive new Spark tokens as part of the airdrop. How much Spark you are going to receive depends on how much XRP you have in your account on 12 December 2020,” the Bitstamp team said on December 8.

An airdrop is a mechanism that allows the holders of an existing cryptocurrency to receive a newly created crypto asset. In the case of Spark, the airdrop was designed for XRP holders, which might have caused a sudden increase in demand for XRP in a short period.

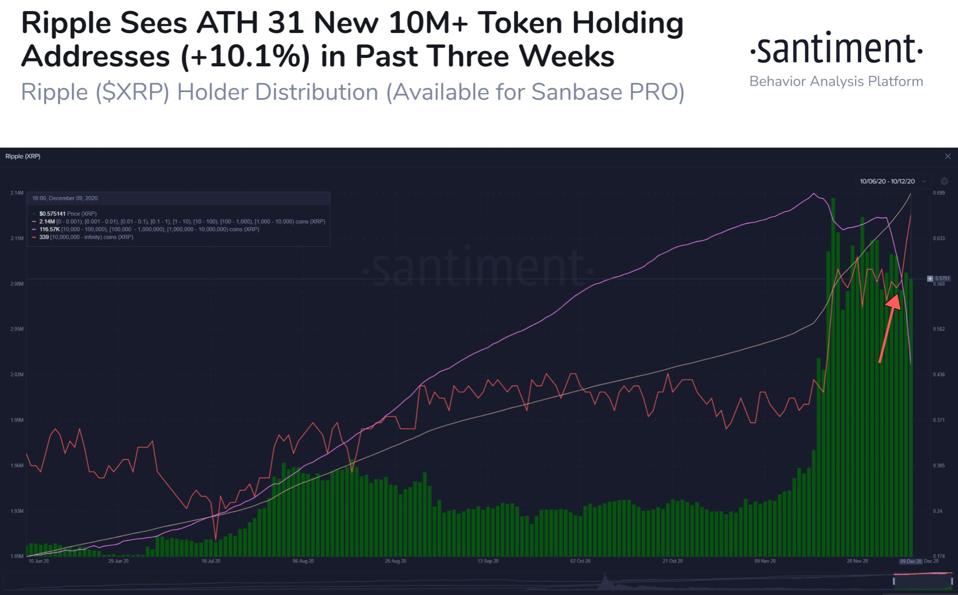

After the airdrop was announced, researchers at Santiment found that the trading volume for XRP almost briefly overtook ETH.

“Looking at how trading volume has compared for the four most discussed crypto assets, BTC has risen as prices dropped to below $18,000 for the first time in 11 days. Also, XRP is edging closer to overtaking ETH again in anticipation for the airdrop,” Santiment researchers wrote.

The volume trend of XRP.

Santiment

The XRP price likely corrected because there was a massive influx of demand before the airdrop. After the snapshot of the airdrop was finalized, a sell-off occurred, causing the asset to stagnate.

In the short term, low time frame charts suggest that the XRP price is consolidating and recovering after a highly volatile period. The cryptocurrency saw 10% to 20% moves within a span of hours since December 9, which likely strained the futures market.

The price of a cryptocurrency typically consolidates after a highly volatile period because the derivatives market cools down.

The altcoin market cools down as the XRP price stagnates despite Bitcoin’s recovery.

AFP via Getty Images

When a futures market’s open interest drops substantially, which is the total sum of all active open positions, it takes time for the asset to see renewed momentum. In the foreseeable future, this raises the probability of a low-volatile consolidation phase for the XRP price.