Digital currency markets have climbed significantly in value all year long, despite the gloomy global economy and the aftermath of Covid-19 responses. Bitcoin prices have been hovering at values not seen since 2017, and the top crypto asset in terms of market cap has gained a whopping 159% since January 5, 2020. In fact, many crypto assets have seen spectacular 12-month returns, and the following editorial is a look at the top crypto gainers and the biggest losers in 2020.

This year has been a crazy one, to say the least, and while many global economies worldwide shudder, the crypto economy is thriving. Covid-19 and the nation-states’ responses to the virus, which entailed shutting down large sections of the global economy and locking down healthy citizens, wreaked financial havoc on the masses.

Moreover, stocks, bonds, equities, and a myriad of traditional commodities lost considerable value and on March 12, 2020, the bottom dropped out on everything including digital asset markets.

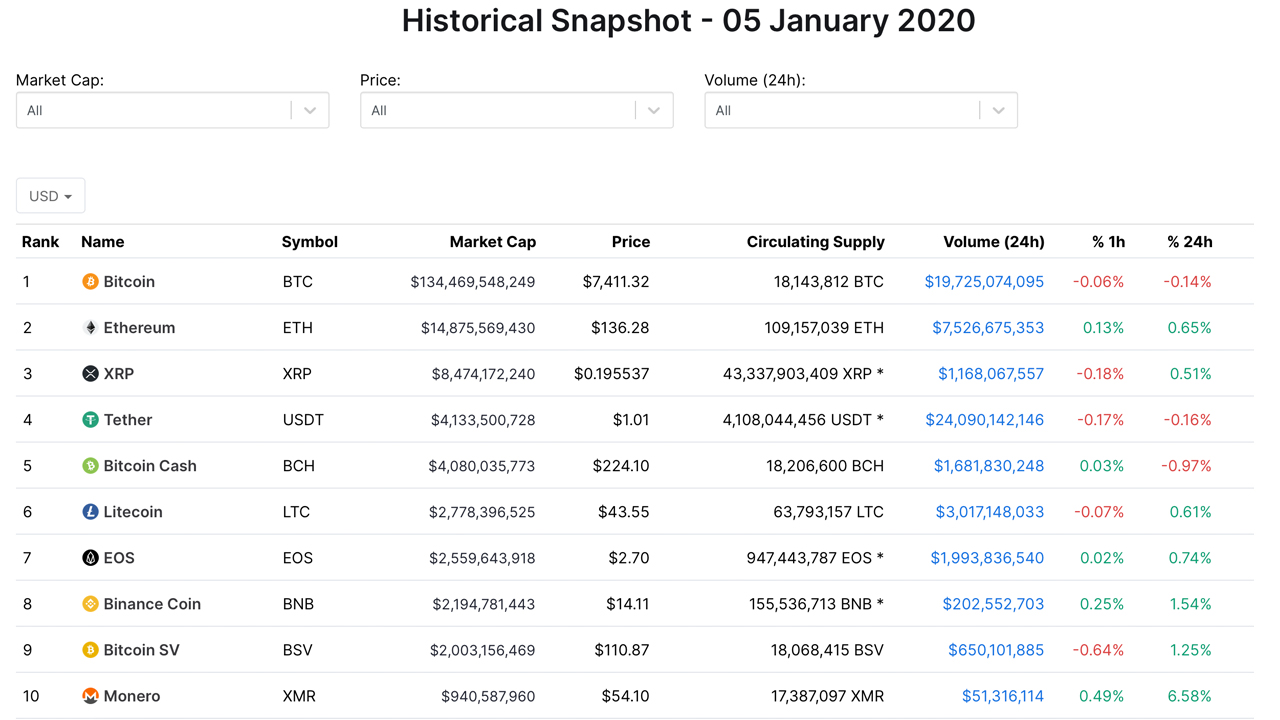

However, cryptocurrency markets have persevered, and numerous digital assets have outperformed nearly every traditional investment under the sun. According to data from coinmarketcap.com’s historical snapshots, bitcoin (BTC) was trading for $7,411 per coin on January 5 and it has since gained 159% to-date.

In fact, if one was to measure the crypto asset’s 2020 bottom on March 12, otherwise known as ‘Black Thursday’ at $3,600 per unit, bitcoin (BTC) at $19,200 per BTC has gained a colossal 433% since that date.

Even though BTC is the top blockchain in terms of market valuation, it was not the top-performing crypto-asset during the last 12 months. Many other top ten assets performed a whole lot better than BTC, even though these specific digital currencies have not yet surpassed all-time price highs.

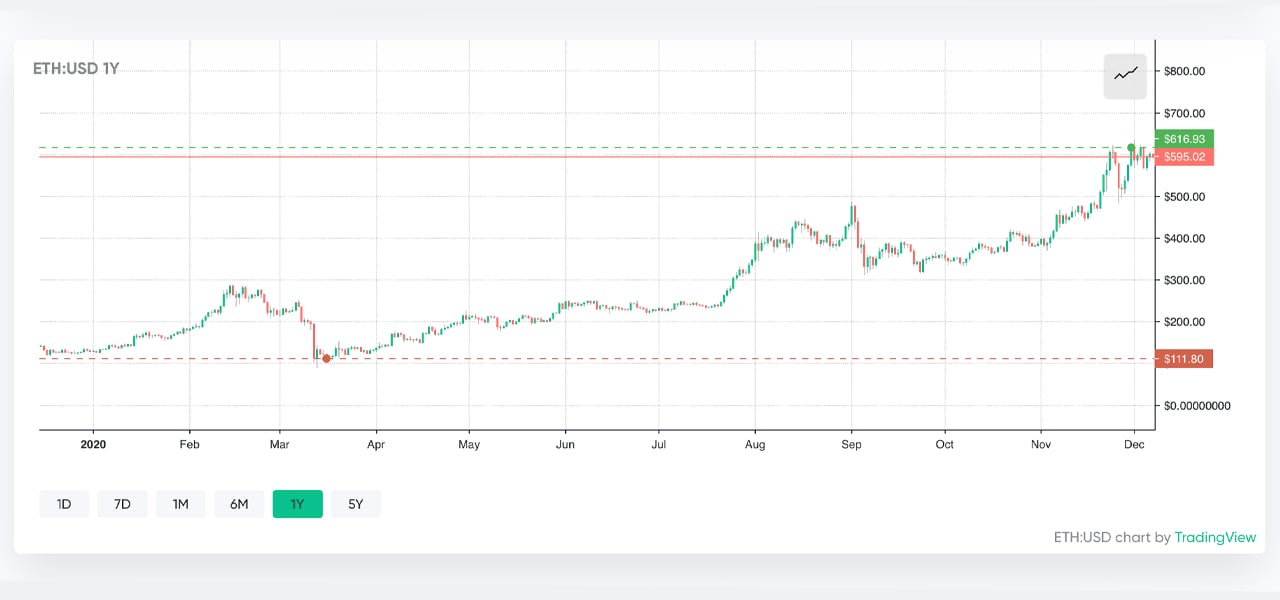

For instance, historical snapshots from January 5, indicate that ethereum (ETH) was swapping for $136 per coin. Today with ETH prices hovering around $595 per unit, the coin has gained 337% in value since then.

XRP did better than BTC too, with a 12-month jump from $0.19 per coin to $0.61 a token giving XRP a 221% gain. On January 5, Chainlink (LINK) was holding down the 20th largest market cap position and was swapping for $1.81 per token. Today, LINK is up 629% at a $13.20 price per unit, and chainlink has captured the seventh largest position.

Cardano (ADA) holds the eighth position this week, when back then it held the 13th position during the first week of the year. On January 5, ADA was trading for $0.03 per coin and it has since jumped 400% to $0.15 per coin. Out of the top ten coin market caps, BTC, ETH, LINK, XRP, and ADA performed the best in 2020.

Of course, a number of lesser known tokens saw some super large gains in 2020, and a few dozen outpaced some of the top ten performers by a long shot. For instance, data shows that during the last 12 months against the USD, gamestars (GST) jumped over 68,999%. Following gamestars includes tokens like zap (ZAP 6,374%), auctus (AUC 5,489%), aave (AAVE 5,121%), and starchain (STC 3,674%).

There were also a number of coins that lost over 90% of their value in 2020, and some coins over 99%. This includes coins like aleph.im (ALEPH 99.96%), kimchi.finance (KIMCHI 99.51%), orion protocol (ORN 98.98%), and covesting (COV 97.96%).

Moreover, because of the last 12 months of issuance, top coins like BTC have seen market caps swell since the first week of January 2020. On January 5, bitcoin’s (BTC) overall market valuation was $134 billion and there were only 18.1 million BTC in circulation.

Today, BTC’s market cap has increased by 164% and circulating coins have increased by 18,564,743 BTC since then. Ethereum’s (ETH) market valuation on January 5, was $14 billion and there was 109,157,039 ETH in circulation at that time. ETH’s market valuation increased 378% during that time frame, and coins in circulation have increased by 4.19% to 113,735,027 ETH.

What do you think about this year’s crypto market performances? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, coinmarketcap.com, markets.Bitcoin.com,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.