For the tenth anniversary of the Forbes 30 Under 30 list of business leaders paving the way for future generations, ten bitcoin and blockchain leaders were added to the list. While it took a couple years for Forbes to start counting bitcoin entrepreneurs—then any entrepreneur using the underlying blockchain technology—this year’s list shows how important the sector created by the mysterious Satoshi Nakamoto has become.

The most talented young leaders in the cryptocurrency space are truly among the most talented young leaders in the world. Period. As evidence of the breadth of impact crypto is having, this year’s 30 Under 30 list included seven people in the finance category, one in venture capital, one in energy, and one in manufacturing.

Click here to read the entire Forbes 30 Under 30 list.

If crypto is your only passion, scroll down here to see who made this year’s list.

Volt Capital

Soona Amhaz, 27

Founding Partner, Volt Capital

San Francisco, California

Amhaz is the founder of Volt Capital, a contrarian crypto fund managing capital on behalf of investors like USV’s Albert Wenger and Founders Fund’s Brian Singerman. She has led eight investments to date, backing startups including Magic, Valiu, Cozy, BuyCoins and Matrix League. For Amhaz, crypto investing is personal: her family residing in Lebanon have suffered from the depreciation of the country’s currency, driving Amhaz to help them convert some to bitcoin to preserve what they had left.

Alameda

Sam Bankman-Fried, 28

Founder, FTX

Hong Kong, Hong Kong

The founder and CEO of quantitative crypto trading firm Alameda Research, managing $2.5 billion in assets, mostly from the Serum (SRM) coin that Bankman-Fried helped create. In 2019, he founded crypto-derivatives platform FTX, which recently raised $40 million at a $1.2 billion valuation. FTX trades futures on cryptocurrencies. He owns approximately 50% of the company, which generated roughly $50 million revenue so far this year, with a profit of $30 million.

Augur

Joseph Krug, 25

Cofounder, Augur

San Francisco, California

The co-chief investment officer of Pantera Capital helps manage $442 million across three crypto-related funds. The largest fund increased 240% this year to $227 million in initial coin offerings (ICOs), including Ethereum competitor Polkadot, now valued at $5 billion and a cryptocurrencies fund increased 135% annually to $40 million. Before Pantera Krug organized the first ICO on Ethereum raising $5.7 million for Augur, a peer to peer betting platform with a total market value of $152 million.

Forbes

Alexander Liegl, 28

Cofounder, Layer1 Technologies

San Francisco, California

“Mining bitcoin is about converting electricity into money,” says Alexander Liegl. So it helps to be where the electricity is cheapest. Liegl is betting $50 million in funding from the likes of billionaire Peter Thiel that he’s found the cheapest juice out in west Texas where wind turbines outnumber oil wells. In exchange for cheap power, Layer1 helps the local power grid manage their load. If the wind stops blowing, Liegl agrees to shut down his bitcoin mining machines. “We act as an insurance underwriter for the energy grid,” says Liegl. It costs him about $1,000 to mine a single Bitcoin, which currently trades at roughly $13,000 on the open market.

Zap

Jack Mallers, 26

Founder, Zap Solutions

Chicago, Illinois

CEO of Zap, a bitcoin investment and payments company that transacts over the Lightning Network. Zap recently closed a $3.5M seed round led by Greenoaks Capital and employs about 20 people. It recently announced it’s working with Visa as the payments and credit card giant introduces clients to bitcoin. Mallers’ father founded and sold one of the largest futures brokerages in Chicago and introduced him to bitcoin in 2013.

BlockFi

Flori Marquez, 29

Cofounder, BlockFi

Brooklyn, New York

The cofounder of cryptocurrency lending platform BlockFi, which allows crypto holders to lend out cryptocurrency at rates as high as 8.6%. The platform also offers crypto trading services and has raised over $100 million in equity from venture capital firms including Galaxy Digital, Susquehanna, and Winklevoss Capital. After generating $4.5 million revenue in 2019, BlockFi has 100,000 funded accounts and is on track to earn $120 million revenue this year and is preparing for an IPO.

Paradigm

Charlie Noyes, 21

Partner, Paradigm

San Francisco, California

An investment partner at crypto venture fund Paradigm Capital, currently overseeing $100 million in positions for the largest crypto fund in the world. Noyes was a personal seed investor in institutional cryptocurrency trading platform Tagomi, eventually resulting in a $12 million Series A in the firm and a 2020 exit to Coinbase. He also contributed to a $1 million seed investment in Uniswap, a token now trading at a $3 billion valuation.

CoinList

Brian Tubergen, 29

Cofounder, CoinList

New York, New York

The founder of CoinList, an investment platform that helps promising crypto companies raise money and allows investors to trade those companies’ cryptocurrencies. Since inception in 2017, CoinList has raised over $800 million for crypto companies, which are backed by venture firms including Sequoia, a16z, USV, GV, Bain and Lightspeed. A former intern at Google, Microsoft and Facebook, Tubergen kicked off his career as director of product at AngelList after graduating from Princeton University.

Amiti Uttarwar

Amiti Uttarwar, 28

Bitcoin Protocol Engineer, Bitcoin Core

Incline Village, Nevada

The first known woman Bitcoin Core contributor received a joint $150,000 grant from OKCoin and HDR Global, in June, making her one of the few paid coders developing bitcoin’s underlying code. The daughter of Indian immigrants, a graduate of Carnegie Mellon University and veteran of Silicon Valley startups, she represents a new movement of software engineers developing open-source money. She started The Bitcoin Zine a publication covering the lighter side of bitcoin development.

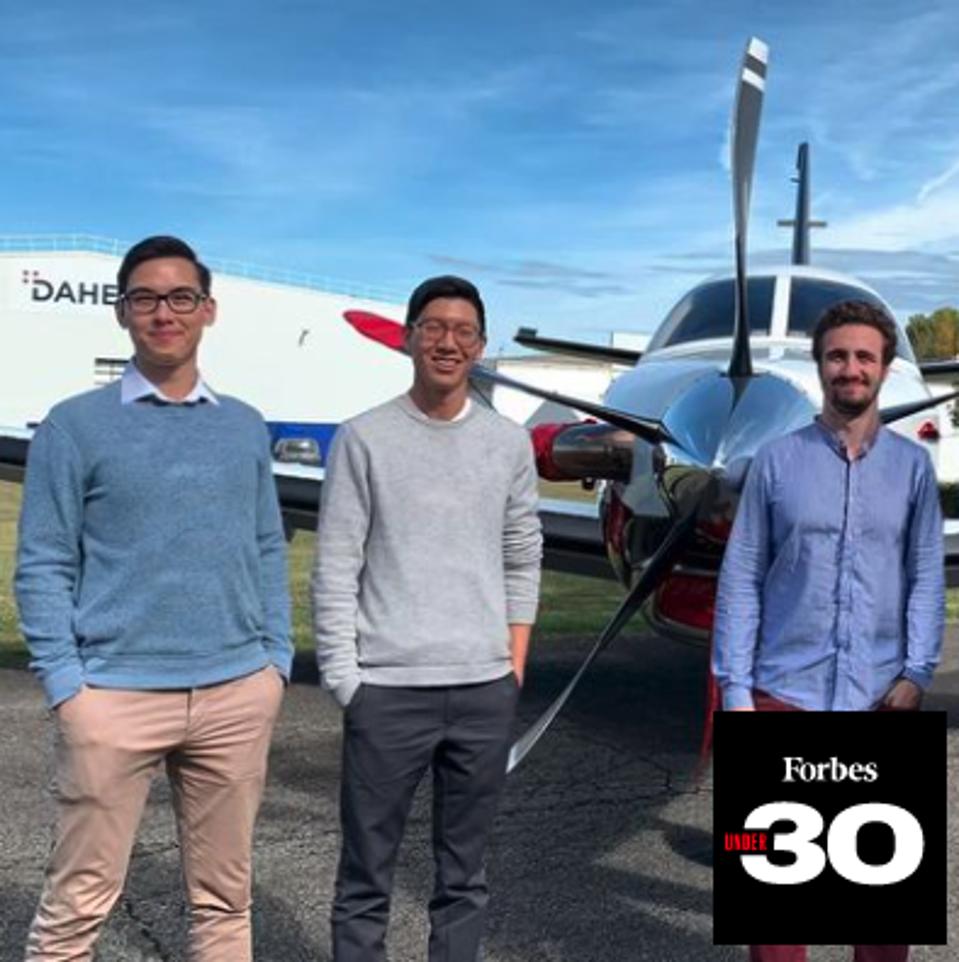

Authenticiti

Andrew Yang, 27; Jeong Woo Park, 25; and Athanasios Karachotzitis, 26

Cofounders, Authenticiti

This supply chain data platform powered by blockchain was launched in 2016. They’ve raised $2.1 million to centralize the siloed enterprise systems of modern supply chains and aggregate data to one source. A pilot project aggregated order-to-cash data between GE Aviation’s and Lockheed Martin’s siloed systems to provide real-time shared visibility into the shipment of gaskets. Revenue is expected to reach $2.6 million in 2020.