Chyna Qu is the Co-Founder and Chief Operating Officer of DeFiner, a decentralized finance network for crypto savings, loans, and payments.

_____

Yield farming has evolved as a mainstream DeFi (decentralized finance) practice, involving investors, or liquidity providers, putting cryptoassets to work across the many DeFi applications. Yield farmers leverage smart contracts and protocols to get maximum returns on their capital (tokens); they move their assets around using different strategies that involve offering liquidity and lending. While yield farming is a simple supply and demand loop, farmers face some considerable risks such as smart contract bugs, sudden liquidation, or token devaluation.

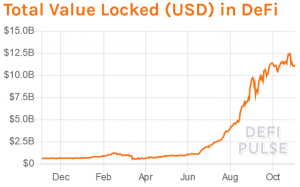

Just like the initial coin offering (ICO) boom of 2017 that attracted widespread media attention and increased adoption of blockchain technology, there is no doubt that DeFi has become the top crypto trend in this pandemic year. This is reflected in the total value locked up in DeFi contracts surging from just USD 1bn in February 2020, to USD 10bn by September 2020, with most of the growth recorded this year.

There are, however, a number of important differences between the current DeFi surge and the earlier ICO boom, which indicate that DeFi has reached a more sustainable market than the ICO heyday of 2017. For starters, the market is more mature, with seasoned investors getting involved through considered strategies. Secondly, the level of overhype around yield farming is significantly less than what we saw in 2017 and 2018 with ICOs. This begs the question: how will DeFi evolve to capture a more sustainable financial ecosystem?

How sustainable is the rise in yield farming?

June 2020 marked the rebirth of yield farming and its mainstream introduction when Compound started distributing their new token, COMP. Liquidity mining soon helped propel COMP to become the leading DeFi token in just a few weeks. Compound allowed users to earn COMP simply by borrowing and lending the governance token. Some farmers took out leveraged loans to borrow the tokens with the highest COMP yield, producing very high returns. This liquidity mining pattern soon became replicated on other DeFi projects and quickly became standard DeFi industry practice.

Now, there are many open-source projects and applications that are involved in liquidity mining and yield farming protocols. At the time of this writing, top projects like MakerDAO, Uniswap, and Aave now lead the DeFi space in total value locked.

The Sushiswap scandal that rocked the DeFi space in September shed a spotlight on devaluation risks, after the founder of Sushiswap had converted all of his 2.5m Sushiswap tokens to ethereum (ETH). Initially deemed a crypto exit scam by many, devaluation has now become one of the most feared yield farming risks. The Sushiswap saga left a trail of questions behind, the most significant one being: how sustainable is the rise in yield farming’s popularity?

For traditional finance experts and even blockchain enthusiasts, yield farming and DeFi have looked like too high a risk — exit scams, insane APYs (annual percentage yields), and failed projects are just some of the reasons why some critics and media have tipped yield farming to fail in the long run. However, we must remember that just like cryptocurrencies, excessive media frenzies and narratives are expected with every new decentralized financial concept.

While I agree platforms leveraging future earnings to reward users with excessive APYs may not be sustainable in the medium to long run, the rise in the number of new projects and products fueled by yield farming will ultimately set a precedent for the longevity of decentralized finance. Since many DeFi products thrive off large numbers and increased liquidity, most of its sustainability is tied to yield farming and how well new products thrive.

Scaling and regulation are the next steps for DeFi’s long term sustainability

These innovations have the potential to transform the face of finance and spur forward the mainstream adoption of cryptocurrencies and other similar assets.

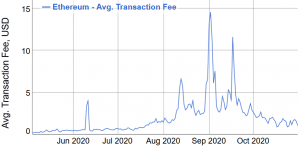

On the other hand, while yield farming continues to grow and boost recognition for DeFi, it now faces Bitcoin’s age-old problem: scalability. The capacity of the Ethereum network to handle multiple transactions is increasingly threatened, with network congestion leading to slower transaction times, and, ultimately, increased gas (transaction) fees.

ETH fees chart:

Each time I think of yield farming and open finance, I go back to Bitcoin’s history and reflect on how far the crypto and digital asset space has come. Over the next couple of months, some more failed projects, especially those with unrealistic APYs, may shine a negative spotlight on the DeFi world. But for the many DeFi projects that will remain, yield farming will become an industry standard that will transcend DeFi and become an innovative financial solution for many.

With the upcoming launch of Ethereum 2.0, which is expected to improve the service quality of DeFi by easing congestion on Ethereum and thus provide faster and cheaper transactions, the immediate future looks bright for DeFi. As DeFi assets under management accelerate, yield farming ought to offer practices that lay the foundations for a sustainable decentralized economy.

Yield farming has proved hugely popular for market participants looking to profit from the many DeFi projects emerging. But as the DeFi ecosystem moves to the next level of development, yield farmers ought to consider how their practices can evolve for the benefit of the wider decentralized economy. Only then will we have a truly scalable and transformative ecosystem capable of attracting the mass adoption that the original DeFi market makers first thought possible.

____

Learn more:

DeFi Winning ‘Bullish’ Fans, But Ethereum’s ‘Crown’ In Danger – Survey

Get Ready For Crypto Banking, DeFi & CBDC Surprises – Venture Capitalist

No DeFi Bubble, But Merely ‘a Blip’

Top 4 Risks DeFi Investors Face

The DeFi Sector Is Breaking The Law – It’s Time to Act