Monetary Policy cannot suffice. Moreover, the longer easy money policies continue, the greater the risk of fueling financial excess… There has to be a new momentum… in order to avoid the risk that the world gets stuck in the new mediocre.

– Christine Lagarde (2014), current President of the ECB, former IMF Chief.

We have created undue risk on the false premise that governments can divert the economic cycle. The mechanisms to divert the cycle are lowering rates and increasing the money supply, thereby incentivizing more debt and devaluing the currency in circulation. When the foundations of that system become shaky, governments simply double down on what created the instability in the first place—easy money and too much debt. As we reach a level of debt saturation, we have entered an era of permanently low growth, low inflation, low rates, and excess risk taking.

We have entered Christine Lagarde’s “new mediocre.” This article is not an armageddonist assertion that a massive repricing of risk assets is due. In fact, I am constructive on U.S. equities based on a lens of available liquidity. Instead, this article asserts that equities, government bonds, and credit markets are all being held up by artificial liquidity and permanently low rates. Currency devaluation is the only way to prevent a deflationary spiral based on forty years of financial repression. While traditional assets have limited upside based on current valuations, monetary assets provide asymmetric risk/reward.

Rethinking Stocks

In his book, The Only Game in Town, former Allianz CEO and co-CIO Mohamed El-Erian states that markets are at a T-junction. Either fundamentals will converge onto inflated asset prices through the wealth effect, or asset prices will converge onto weaker fundamentals. This price-to-fundamentals disconnect has even confounded Warren Buffett, who sits on a mountain of cash after selling his airline stocks for a loss before a massive recovery.

Both are right to note the disconnect. Apple’s (NASDAQ:AAPL) stock has gained 92% this year with revenue increasing by only 1%. Additionally, the chart below shows that we are at historical highs for 11 out of 15 valuation metrics on the S&P. Yet some pundits will tell investors that we are in the early stages of a recovery and now is a great time to buy stocks.

(source: Twitter @TaviCosta)

I wrote about this in a previous article, but investors who allocate capital to equities based on a framework of fundamental valuation will not do well in this environment. Historically, stocks are in bubble territory as seen above. Also historically, we have never seen this amount of stimulus and Central Bank activity aimed at preventing asset price collapse.

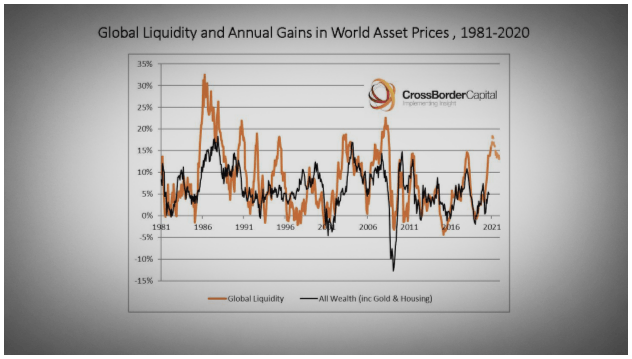

As the chart below shows, world asset prices are still lagging the current supply of total liquidity. With more stimulus on the horizon, total liquidity is set to increase in the coming months. Therefore, in terms of global liquidity, this is not a stock bubble.

(source: Real Vision – “The Debt-Liquidity Spiral”)

(source: Real Vision – “The Debt-Liquidity Spiral”)

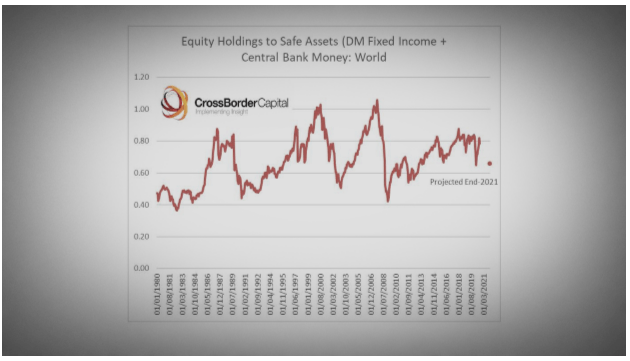

The next chart shows Equity to Safe Assets Holdings. At 0.75, it is slightly above the long-term average of 0.7. However, this metric is nowhere near previous bubble allocations of above 1. This tells us that most investors are still positioned defensively, and we do not have the massive participation of previous bubbles. Using a fundamental valuation framework will tell you to stay away from equities. Using a liquidity framework will tell you that equities still have a decent amount of upside before we call this a bubble.

(source: Ibid.)

(source: Ibid.)

Bonds Provide False Diversification

The risk-free rate is the yardstick by which we value stocks and compare investments. As artificial Central Bank demand pushes the risk-free rate farther away from free market levels, measurements become false and financial distortions abide in the form of too much debt. It also incentivizes excess risk-taking by creating a duration bubble. Low yields force investors to find yield elsewhere and move further out into the risk spectrum – whether by longer duration or reduced credit ratings. Bond prices based on Central Bank purchases, stock prices that base valuations on distorted bond prices, and corporate or high yield credit that see excess demand from yield-starved investors are all one in the same trade.

Additionally, buying the 10-year at 0.80% yield is a bet that yields will go to zero or negative. While very much a possibility given that real yields will need to remain low to help debt-servicing, there are better investment opportunities out there, especially with Central Banks signaling that they are pushing for higher inflation.

Monetary Assets

Gold and bitcoin are monetary assets because their primary function is as a store of value against a currency with a stated objective of 2% annual debasement. That means $1 becomes $2.69 after fifty years. If rates are already at zero, if we know that governments are about to pass stimulus that will need to be monetized by the Fed, and we know that the Fed is now pursuing an “average” inflation target of 2% (hence they are aiming above 2%), investors would be prudent to front-run the printing presses by owning monetary assets.

During risk-off environments, gold’s stability makes it a better investment than bitcoin. During risk-on environments, bitcoin outperforms everything. Over the long run, I believe bitcoin is better than gold. If the main attraction of monetary assets is their scarcity, bitcoin is the only asset in existence to achieve perfect scarcity. Even gold miners introduce 2-3% new supply annually.

Bitcoin is getting institutional buy-in from the likes of Paul Tudor Jones, Stan Druckenmiller, PayPal, Square, MicroStrategies, and more. It has a measly $200 billion market cap. For comparison, the market cap for fine art is $17 trillion. As on-ramps get more effective and institutional money begins pouring into such a small asset class, a $100,000 price target in 2021 is not farfetched at all.

Conclusion

Even though we have entered a new mediocre for the global economy, stocks will continue to perform well as Central Banks continue to inundate financial markets with liquidity through deficit monetization. Bonds may have more upside at 0.8% on the 10-year, but this constitutes a limited upside for a massive downside if we in fact see the inflation that Central Banks have stated they want to create. The inverse of bond’s asymmetric risk/reward is gold and bitcoin, with a preference for bitcoin.

Disclosure: I am/we are long BTC-USD, GLD, SPY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.