Despite warning investors on the bitcoin hype fueled results of Square (SQ), the market continues to pay up for the stock. Another big quarterly beat always helps fuel momentum, but the numbers were again boosted by bitcoin. My investment thesis is very bearish on the stock around $200 similar to my call when Square originally reached $100 back in September 2018 and fell over 65% in the next 18 months.

Image Source: Square website

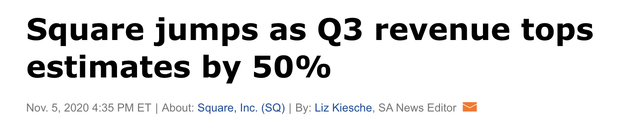

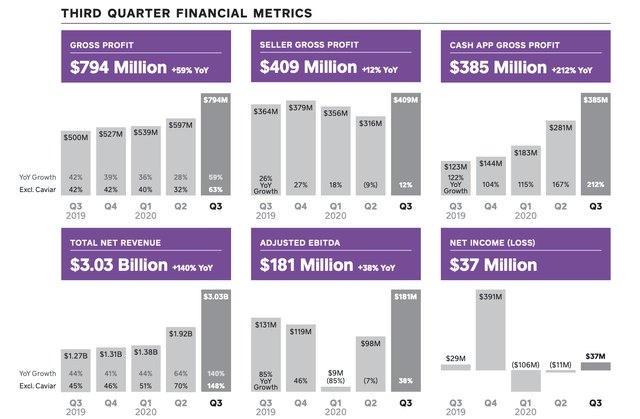

One Table Matters

The Q3 news headlines tell all the story an investor needs to see. A company just doesn’t randomly beat revenue estimates by 50% unless the revenues are low calorie.

In this case, bitcoin falls into the extreme low calorie category. My warning last quarter occurred when bitcoin revenues were only $875 million. This quarter, related revenues nearly doubled sequentially to $1.6 billion, up ~$1.5 billion from last Q2.

Source: Square Q3’20 presentation

So, anybody paying attention should realize that bitcoin revenue accounted for over 50% of Q3 revenues when the related revenues were less than 10% last Q3. Why this matters is that bitcoin costs were a very similar $1.6 billion. The bitcoin business only generated ~$32 million in gross profit. Anybody looking at gross margins would shun a stock where total gross margins fell to only 26% from 39% last Q2.

Even the core seller GPV business only produced 9% growth. Transaction-based revenues were up approximately the same as payment volumes. Sure, the real excitement was around the Cash App revenues. But here again, these numbers were boosted by bitcoin trading revenues.

When stripping out bitcoin, Q3 revenues were $1.4 billion versus $1.12 billion last year. These net revenues only grew 25%. Even worse, bitcoin trades at multi-year highs. Square could see reported revenues collapse next year with any dip in the cryptocurrency.

Source: Coindesk

Extreme Valuation

Square has 515 million shares outstanding, placing the market valuation at an insane $103 billion. When stripping out the bitcoin trading revenues, the mobile payments company only generated $1.4 billion in quarterly sales and just $910 million in the adjusted revenue metric used prior to the SEC guidance requirement.

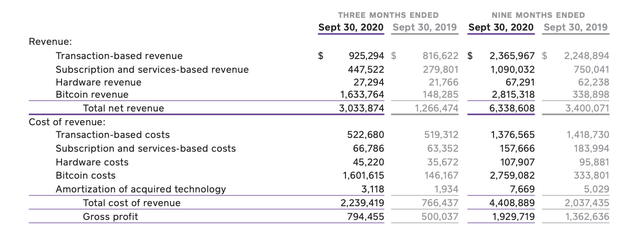

Outside of these revenue numbers not jiving due to bitcoin, the bottom line financial metrics tell a much different story than the inflated revenue metrics. For Q3, Square only generated a meager $37 million net income.

Source: Square Q3’20 presentation

Source: Square Q3’20 presentation

The market will likely start focusing on the adjusted EBITDA metric to value Square. For Q3, the metric jumped to $181 million, up 38% from the $131 million level last Q2.

Yes, the number was impressive considering some of the pressure on the Seller ecosystem. At the same time, the Cash App appeared to benefit from the economic shutdowns as consumers moved more to online money transfers. The big question exists on where product demand will exist in a more normal economy and the market is already paying up for the stock.

Even under a scenario where the annualized EBITDA is over $700 million, Square trades at nearly 150x those targets. Again, the fintech already has EBITDA margins of ~20% based on the adjusted revenue figure. Remember, this is the number of revenues where Square can derive a profit considering both transaction and bitcoin related costs are all pass through numbers no matter how much sales the company generates.

The point is that Square already generates substantial EBITDA margins, providing less upside in the future. This isn’t the story of a company with meager margins where EBITDA will grow 10 fold as sales double.

Takeaway

The key investor takeaway is that Square continues to trade up based on some of the low calorie revenues from bitcoin. The fintech actually has a meager revenue base with substantial EBITDA margins already. Square doesn’t warrant the current inflated stock price.

In addition, the mobile payments company faces the real scenario where bitcoin sales could fall next year. In such a scenario, the stock is highly unlikely to hold the current valuations.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to catch the next multi-bagger gain.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.