Key Takeaways

- XRP skyrocketed more than 200% following the break of a multi-year resistance barrier.

- Despite the massive gains posted, a particular technical index suggests that a correction is underway.

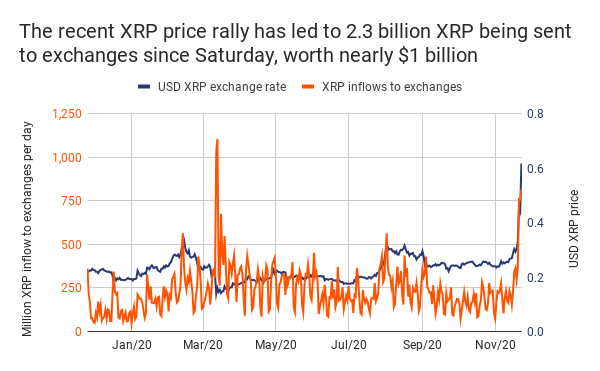

- The bearish thesis holds when looking at the number of tokens sent to exchanges over the past few days.

Share this article

Like a few other altcoins, XRP has profited from Bitcoin’s impressive rally as of late.

The cross-border remittances token is up more than 200% in the past two weeks, but several technical and on-chain metrics suggest that prices may retrace before higher highs.

Breaking Through Multi-Year Resistance

XRP’s price action had been contained by the $0.32 resistance level since mid-August 2019. But on Nov. 20, the cross-border remittances token was able to slice through this major hurdle and surge nearly 140%.

The bullish impulse allowed prices to reach a high of $0.78, which is the highest level seen since late September 2018.

From a technical perspective, Ripple’s native token seems to have broken out of a massive ascending triangle that developed within its daily chart for the past eight months. A horizontal resistance wall formed along with the swing-highs, while a rising trendline was created along with the swing-lows.

The distance between the widest point of the triangle anticipated an upswing to $0.84.

However, this target can be regarded as complete due to the rapid upward price action XRP has seen in the past few days.

Indeed, the TD Sequential indicator suggests that the altcoin may be trading in overbought territory. This technical index presented sell signals in the form of green nine candlesticks on XRP’s 12-hour and 4-hour charts.

The bearish formations estimate a one to four candlesticks correction before the uptrend will resume.

Although the TD setup’s forecast has yet to be validated by a spike in sell orders, it appears that some investors are preparing to cash out.

XRP Hodlers Prepare to Realize Profits

More than 2.3 billion XRP tokens have been sent to multiple cryptocurrency exchanges since prices began to take off. This represents a 330% increase in daily exchange inflow, worth nearly $1 billion.

Considering the number of investors that went from underwater to profitable positions, such a spike in exchange inflow may lead to mounting selling pressure.

“The 30-day investors are up +159% on average in the past month alone. And when an asset is gaining over +5% returns per day for an entire month, history says there will be a period that will allow traders to catch their breaths at best, and kick themselves for not selling at worst,” said Brian Quinlivan, Marketing and Social Media Director at Santiment.

In the event of a correction, the most significant support level underneath XRP lies at $0.32. But before prices can fall to this point, there are two other demand areas that this cryptocurrency must break.

These areas sit at $0.54 and $0.45, respectively.

On the flip side, the bearish outlook will be invalidated by a daily candlestick close above $0.78. If XRP bulls manage to push prices above this supply wall, a further advance to $0.84 or even $1 will be almost guaranteed.

Share this article

Ripple Rebrands PayID After 13 Banks Sue for Copyright Infringement

San Francisco-based crypto company Ripple has registered a new trademark for a product called PayString with the U.S. Patent and Trademark Office (USPTO). Based on court documents, however, the rebrand…

Japanese Obsession With XRP Explains Ripple’s Relocation Interest

In an interview, Ripple’s CEO Brad Garlinghouse is adamant about his dislike for crypto regulations in the US and has even shortlisted several jurisdictions for relocation. CEO Rails American Regulators…

Avoiding Common Trading Mistakes

Being a successful trader is one of the most difficult pursuits that any person can undertake. The path to success is littered with countless examples of even those who are…