- According to a new investment report, Ripple is the fourth most valuable Fintech company worldwide, ahead of Coinbase and Robinhood.

- The Coronavirus has boosted e-commerce and with it the use of payment solutions, such as On-Demand Liquidity from Ripple.

Ripple provides payment solutions for businesses to quickly offer cross-border transactions at low cost. The company does not only concentrate on large financial giants, but recently changed its focus to support SMEs in micro transactions. According to a new report, Ripple’s services and focus make it one of the most valuable fin-tech companies in the world.

Ripple ranks 4th among the most valuable Fintechs worldwide

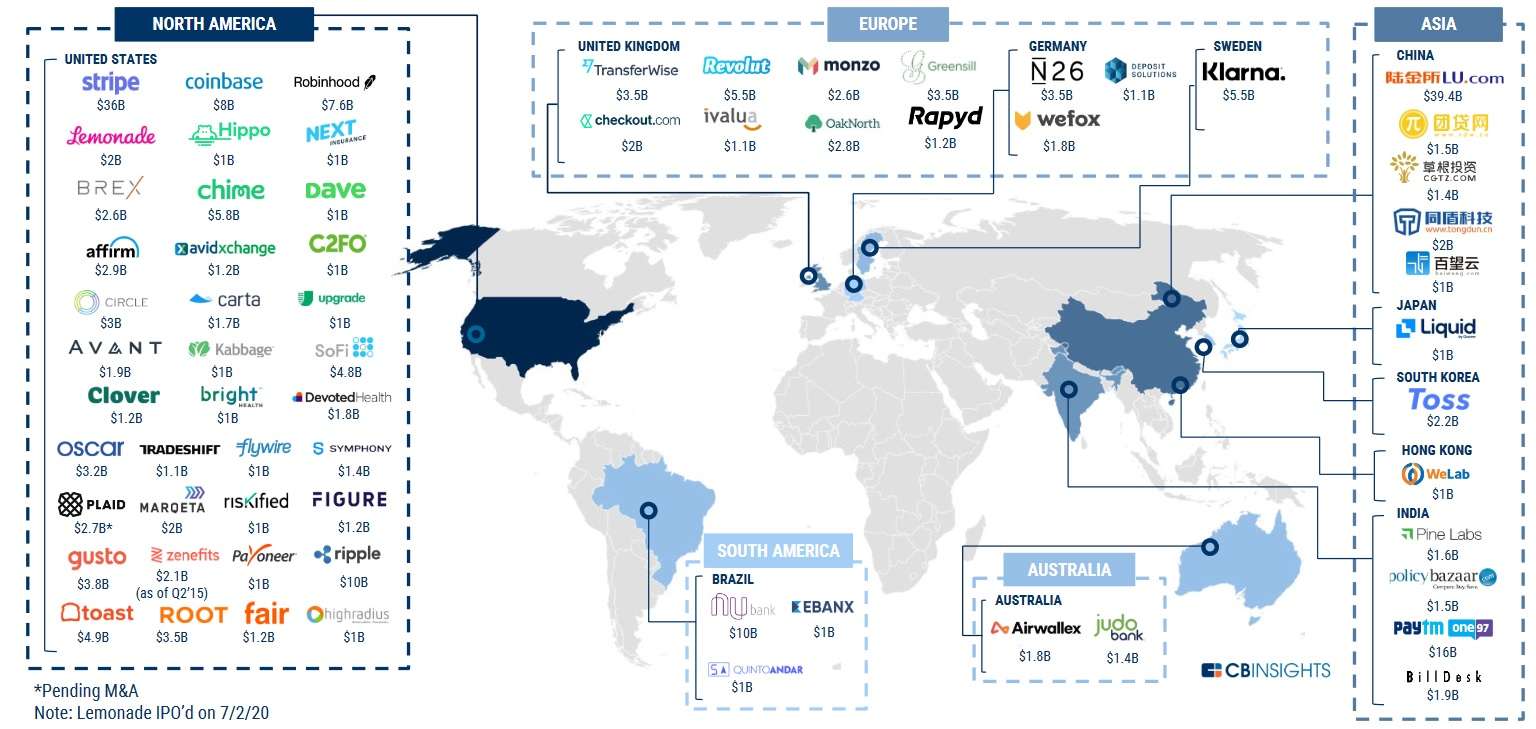

According to a new report by CBInsights, Ripple ranks fourth in a list of Fintech companies, each worth more than $1 billion. Ripple has received a company valuation of $10 billion, behind Paytm One97 ($36 billion), Stripe ($39.4 billion) and Lufax ($16 billion). The following chart shows all the companies evaluated in detail and their headquarters in detail.

Source: https://www.cbinsights.com/reports/CB-Insights_Fintech-Report-Q2-2020.pdf

Other well-known heavyweights in the industry are Coinbase ($8 billion), Robinhood ($7.6 billion), Toast ($4.9 billion) and Circle ($3.5 billion). Ripple raised more than $200 million in a financing round last year to further expand and adapt its services.

In addition, Ripple invested more than $50 million in the remittance giant MoneyGram, buying a total of more than 10% of all ordinary shares. MoneyGram uses, among other things, RippleNet, so that Ripple is driving the further adaptation and use of XRP through this partner. Furthermore, Ripple has grown to more than 500 employees worldwide and has more than 300 partners on RippleNet.

Due to the unfavorable location conditions in the United States of America, Ripple is currently considering moving its headquarters to London, where XRP is clearly classified as a commodity rather than a security. Most recently, Ripple has opened a branch office in Dubai, as the regulatory environment there is well suited to accelerate its continued presence in this area and in Asia.

The company generates a large part of its revenues through sales by XRP to institutional investors. Ripple has committed to freeze 55 billion XRP in an escrow account in 2017 and to release one billion XRP per month for sale. According to the third quarterly report, both XRP sales and ODL transaction volumes have increased by more than 100% globally.

In an interview with the Financial Times, CEO Brad Garlinghouse stated that XRP is part of the company’s cash flow, but that there are many other revenue streams:

Well, XRP is one source. I don’t know how to answer that because if you took away our software revenues, that would make us less profitable. If you took away all our XRP, that makes us less profitable. So I don’t think about it as one thing…

We would not be profitable or cash flow positive [without selling XRP], I think I’ve said that. We have now.

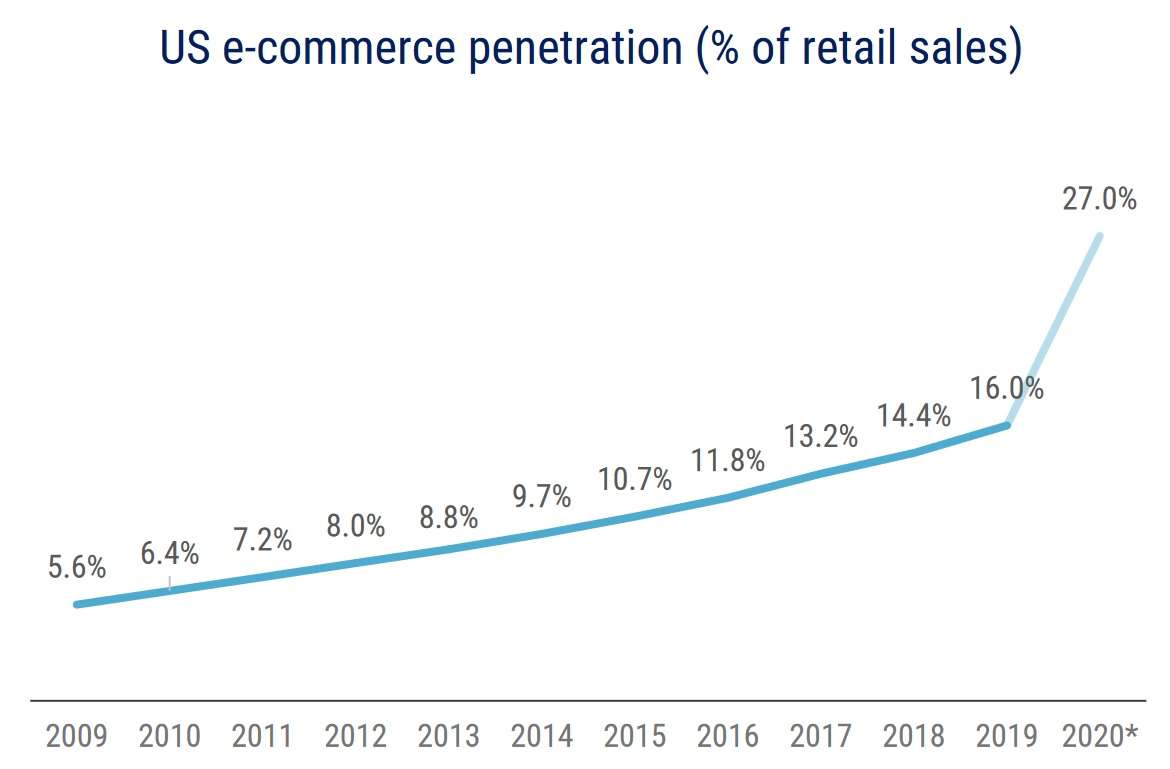

Coronavirus drives adaptation

The report goes on to say that the corona pandemic has been a decisive factor in the adaptation of the e-commerce market and thus also in the acceptance and dissemination of new technologies such as the blockchain. John Collison, Co-Founder of Stripe, describes that there has been a huge shift from offline to online economy. The following diagram shows this development in detail.

Source: https://www.cbinsights.com/reports/CB-Insights_Fintech-Report-Q2-2020.pdf