- Litecoin is on the verge of a breakout to $100, mostly if the seller congestion at $80 is overcome.

- The bullish narrative might be invalidated if the TD Sequential indicator’s sell signal on the weekly chart is confirmed.

Litecoin is in the middle of a recovery mission after bouncing off the support of $64. The digital asset is trading at $79 while battling the resistance at $80. A break above $80 is likely to catapult LTC towards the coveted $100.

Litecoin prepares for the rally to $100

Holding above the 50-day Simple Moving Average has been a critical bullish indicator that the uptrend would continue. Besides, the Relative Strength Index hit support at the midline and recovered towards the overbought region.

As the resistance at $80 becomes an uphill battle, the RSI starts to level, hinting at consolidation. However, a spike above $80 would call for more buy orders, creating enough volume for gains above $90 and $100, respectively.

LTC/USD daily chart

The 4-hour chart confirms the selling pressure at $80, but if Litecoin closed the day above the 50 SMA, a breakout might ensue, targeting $90 and $100. On the downside, immense support is expected at the 100 SMA to help refocus LTC in case of a correction from the hurdle.

LT C/USD 4-hour chart

IntoTheBlock’s IOMAP model reveals a relatively smooth path to $90. Meanwhile, buyers must focus on breaking the resistance between $81.5 and $84. Here, roughly 43,600 addresses had previously bought nearly 1.2 million LTC. With enough buying pressure, LTC could extend the uptrend to $100.

Litecoin IOMAP chart

On the downside, immense support behind the cryptocurrency shows that the uptrend could remain intact. The most robust buyer congestion zone runs from $69.7 to $72. Here, about 45,000 addresses had previously bought roughly 4.1 million LTC. It is doubtful that declines will overshoot this support range to retest last week’s anchor at $64.

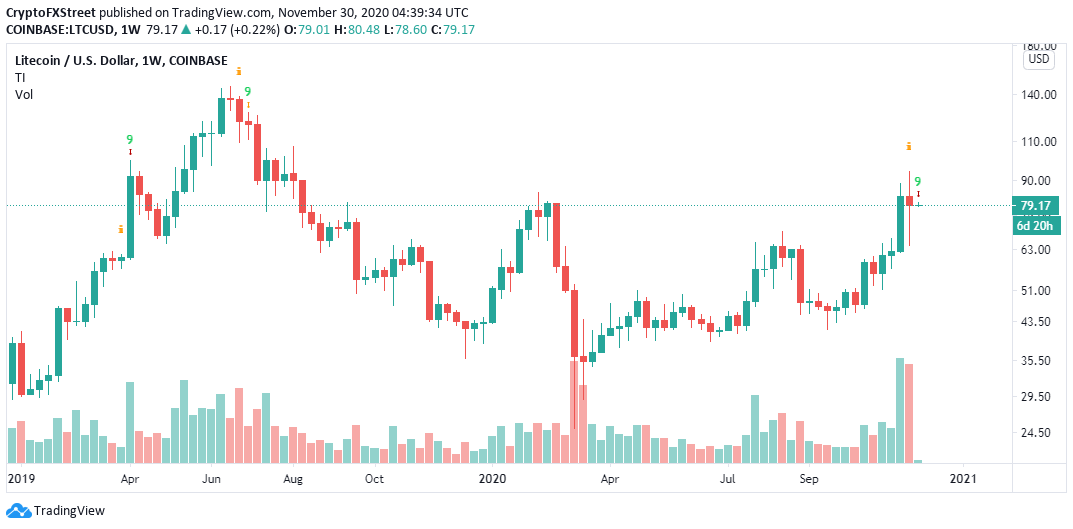

LTC/USD weekly chart

It is worth mentioning that the TD Sequential indicator has presented a sell signal on the weekly chart. The call has manifested in a green nine candlestick. If the signal is validated, Litecoin might fall in one to four daily candlesticks. Moreover, an increase in LTC supply could see the price get back to the gains-trimming exercise where losses could overshoot the support at $64.

%20(13)-637423091236681340.png)

-637423089332604715.png)