The Bitcoin Cash (BCH) community is slated to initiate yet another hard fork on November 15, 2020.

The blockchain split represents the culmination of a series of disagreements and tensions related to proposed changes in the underlying code as well as the future of Bitcoin Cash.

Find out more about why BCH, the 5th largest crypto network by market capitalization, is about to fork and what you can expect to happen afterward.

Ironic history

Bitcoin Cash was created as a result of intense disagreements between members of the Bitcoin (BTC) community. The tensions were primarily centered around proposed changes to Bitcoin’s block size. Unable to come to any agreements, the Roger Ver-led “big blocker” camp forked to create Bitcoin Cash on August 1, 2017.

Dubbing itself “The Real Bitcoin,” BCH had a rough patch when a year later, similar tensions led to another hard fork in its camp. Tensions between a Ver-led faction and Craig Wright/Calvin Ayre-led group led to the creation of Bitcoin SV (BSV) (now 12th by market capitalization) after a hard fork.

Ironically, the Bitcoin SV hard fork happened on November 15, 2018, and now two years later, Bitcoin Cash prepares itself for yet another contentious hard fork.

The conflict over Satoshi’s vision

The conflicts leading up to the November 2020 BCH hard fork are related to Amaury Séchet’s (a BCH developer) ABC node and the differences in opinion his camp has with the rest of the BCH community.

Since its inception, the goal of BCH was to become a global peer-to-peer digital currency for low-cost, high-speed, borderless transactions.

This driving philosophy, the Bitcoin Cash community believes, is in line with Satoshi Nakamoto’s vision. However, the BCH community is unable to agree on the architectural changes to the blockchain which are in line with this ideal.

There are a number of implementations active in BCH currently. However, the most popular are Bitcoin ABC, BCHN, and Bitcoin Unlimited.

The Bitcoin ABC camp, led by Séchet, is credited with creating the mining node in BCH, which gathered its own fanbase and solidified bitcoin cash’s place among the top digital currencies in the market. The ABC node is technologically advanced and supports a number of innovative changes, creating the foundational architecture for future improvements.

The BCHN camp, led by Roger Ver, is largely responsible for BCH notoriety or fame within the crypto market due to Ver’s controversial yet somewhat popular persona. The BCHN node, along with the other implementations, are also in favor of technological changes, albeit in a much slower manner.

Due to the differences in opinion relating to how quickly (or if) changes should be made to the Bitcoin Cash code to support technological advancements like Merklix based sharding, adaptive block size, and Mitra, the BCH community is split into opposing camps.

The two main factions are led by Séchet and Ver.

ASERT Vs. GRASBERG

The November 2020 update was supposed to be a blockchain wide update of the BCH Difficulty Adjustment Algorithm (DAA) to a new algorithm called ASERT, proposed by developers Jonathan Toomin and Mark Lundeberg.

However, according to J.Stodd, a former BCH developer who moved to Avalanche (AVAX), Séchet announced in August that the ABC implementation would employ an algorithm called GRASBERG. The algorithm is identical to ASERT except that it also fixed a historical drift. Unfortunately, Séchet’s move was met with considerable disdain from the BCHN camp.

Stodd said that,

“Because Bitcoin ABC did not credit Jonathan Toomim with the new development, and because there was no discussion had about Grasberg prior to the announcement, BCHN decided to become ballistic about this move, and brought back all the Anti-ABC rhetoric.”

Following the uproar after the GRASBERG announcement, Séchet returned to the initial ASERT algorithm slated for the upgrade on November 15. However, he added a component that further ignited tensions and escalated the disagreement to a somewhat irreconcilable level, triggering a hard fork. Séchet added a Coinbase Rule that dictates that “all newly mined blocks must contain an output assigning 8% of the newly mined coins to a specified address.”

This update would mean that miners would receive only 92% of the block reward on the ABC implementation. Additionally, the funds would be sent to an address that, as some worry, might be controlled by Séchet, given his leadership position at ABC.

Séchet claimed that

“the November upgrade of Bitcoin ABC software will have a Coinbase Rule that fully aligns the incentives of Bitcoin ABC with the sustainability and security of the network.”

The ABC camp believes that aligning the wealth of the development team is essential to the growth of the blockchain. This is because it ensures that the developers will always act in a manner that is best for the blockchain as it will also be in favor of growing their wealth.

Additionally, Séchet believes it is important for the developing team to have access to funds that are not beholden to any other authority which may undermine the security of the blockchain. This practice is not new to the sector and is known as the Infrastructure Funding Plan (IFP).

While there are definite ideological differences between the opposing camps, it is important to note that there are personal differences influencing the split as well. Séchet has had a long-standing conflict with FreeTrader, another developer who runs in the same circles. As Stood said, it is likely Séchet is fed up with the dynamics surrounding BCH.

Following Séchet’s announcement, the BCH community further fractured along ideological lines. Ver posted a tweet announcing the upcoming hard fork saying, “Bitcoin ABC and deadalnix have announced that they are forking away from BitcoinCash on Nov 15th. We wish them good luck with their new coin and thank them for the free airdrop to all BCH holders.”

However, just a day earlier Ver had stated:

“Diverting part of the Bitcoin Cash block reward to pay a single development team is a Soviet style central planner’s dream come true.”

This sentiment encapsulates the prevailing response to the ABC announcement. Additionally, there are valid concerns over the fact that the Coinbase Rule was not a discussion rather a unilateral decision. On the developer front, some support ABC, while some argue that Séchet should resign.

According to coin.dance data, out of 1,250 public nodes on the BCH network, 505 of the nodes use the Bitcoin ABC client, 559 use Bitcoin Unlimited, and only 146 employ BCHN. Despite this, as things stand, it looks like the BCHN camp has the most support and will likely end up with the BCH ticker.

The Ver-led BCHN camp has garnered the most support from miners, exchanges and the general community. Binance, Huobi, BTC.Top, Hashpipe, P2Pool, F2Pool, Easy2Mine, and Bitcoin.com are adding ‘powered by BCHN’ in the Coinbase parameters of the blocks mined via their platforms.

If you are holding bitcoin cash, ensure that the wallet provider you are using supports the fork. If not, transfer your funds into a non-custodial wallet where you hold the private keys. Then, you will be able to receive your forked coins.

Also, be mindful that many service providers may halt BCH transactions around the time of the fork. Major hardware wallet manufacturer Ledger, for example, will halt its bitcoin cash services on November 15 to prevent replay attacks.

Exchanges preparing

As Cryptonews.com reported, a number of leading Japanese crypto exchanges, perhaps led by their previous experiences with forks, revealed that they would pause withdrawals and deposits in BCH in the days leading up to November 15, as well as leverage trading.

Many of the other major exchanges across the world have made similar announcements.

OKEx has announced their support for the hard fork, stating that, should it be successful, OKEx users holding BCH prior to the fork would receive the two new assets, BCH ABC and BCHN. In the days leading to the fork the BCH margin lending function, spot and margin trading services, and deposit function will all be suspended.

Huobi Global made similar statements, adding that “after the community has formed a consensus on BCH naming, we will end the transition period and rename BCHA or BCHN.”

Binance will suspend BCH deposits and withdrawals on the day of the hard fork, then act depending on which of the two presented scenarios comes true: there are two competing chains, or there is no new coin.

FTX also discussed the competing chain scenario, stating, as Binance did, that “users will be credited with the BCH from the chain with the most work done.”

In the meantime, Poloniex told its users that they can either hold their BCH which will be converted to BCHABC and BCHSV after the fork, or they can convert their coins into BCHABC and BCHSV before the fork and trade those tokens in the BTC and USDC markets. Both chains will be supported, but if only one remains technically and economically viable “we may rename it BCH,” they said.

BitMEX said that the products and indices affected by the fork “will follow one side of the fork only and we aim to keep markets open when the fork occurs,” adding that product and index names will remain unchanged.

Meanwhile, other exchanges, like Bitfinex, which supported the previous fork, as well as Coinbase, seem to not have made a statement on this fork yet. But in 2019, and citing the previous BCH hard fork, Coinbase stated that, while it’s an “important tool for innovation in the ecosystem,” a fork can also be a security risk. Therefore, “during contentious hard forks,” they implement their own replay protection strategy to mitigate replay attacks. Lastly, Kraken stated previously that “Clients should not assume that Kraken will list or credit any fork, airdrop, or any other cryptocurrency.”

On Thursday, 17:16 UTC, BCH traded at USD 250 and was up by 3.6% in a day, trimming its weekly losses to 6.5%. The price was up by 10% in a month and it dropped by 17% in a year.

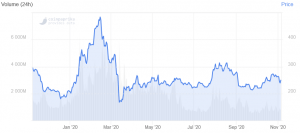

BCH price chart:

____

Learn more:

From Cash to Cat – A New Attempt to ‘Make Bitcoin Great Again’ In Works

Bitcoin Bull Tim Draper Finds Himself In Bitcoin Cash Shilling Mystery

Buterin’s ‘Ethereum+Bitcoin Cash’ Scalability Solution Draws Criticism