I don’t throw around the word bubble too lightly. For example, what’s been going on with software-as-a-service stocks lately is certainly exuberant and probably not justified by fundamentals, but I wouldn’t slap the word bubble on it yet. If you want to see complete unrestrained animal spirits, however, the crypto world is currently serving it up in spades.

In fairness, there are reasonable bullish arguments for Bitcoin; I’m not in the camp that all crypto is going to zero anytime soon. It might, but it might turn into a decent asset class over time as well. There’s a reasonable debate there.

However, what’s going on in the altcoins, and in particular, in some traded derivatives of them, is truly astonishing. If there was ever a time to use the word “bubble”, it’s in looking at something like the Grayscale Bitcoin Cash Trust (OTCQX:BCHG).

Bitcoin Cash, for those unfamiliar, is a fork of the original Bitcoin. Bitcoin Cash split off in 2017, as a group of holders were unhappy with Bitcoin’s development and wanted to take the cryptocurrency in a different direction that would make it easier to use the coin for merchant transactions. There has been a great deal of controversy, and Bitcoin Cash itself forked again.

Source: Cointelegraph

Following all this, Bitcoin Cash has lost a great deal of value, both compared to Bitcoin and fiat. The value of Bitcoin Cash has fallen from 0.2 bitcoins at its height to just 10% of that now. Meanwhile, the price in dollars has plunged from a peak of more than $3,000 per Bitcoin Cash to just $325 as of this writing.

However, despite this dramatic underperformance, Bitcoin Cash has retained a following and does a fair bit of trading volume. Thus, it was a reasonable target for a new listed product from Grayscale.

Enter the Bitcoin Cash Trust, under ticker BCHG, which was set up this summer to allow speculators the ability to hold Bitcoin Cash via an exchange-traded product. As the SEC has been slow to accept crypto ETFs, the Grayscale products have had to stay over-the-counter, reducing trading access. Nonetheless, they’re finding an audience despite the lack of a major exchange listing.

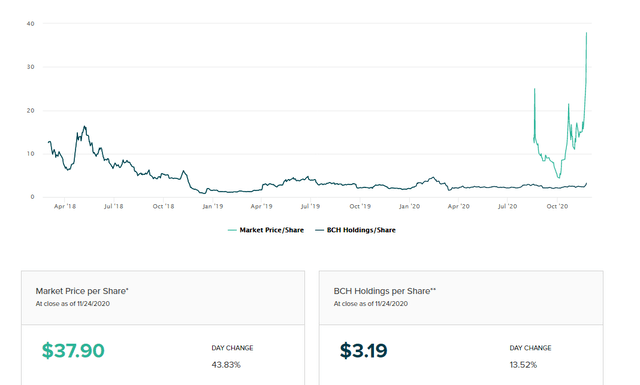

The Bitcoin Cash Trust started trading around $12, which was already a fat premium to the $3 or so of underlying assets per share in the fund. By the start of October, the Bitcoin Cash Trust price had plunged and was closing in on NAV. It seemed the market would be reasonably efficient. But then, things got weird…

Since the beginning of October, the Bitcoin Cash Trust share price is up nearly tenfold. The underlying price of the Bitcoin Cash cryptocurrency, on the other hand, has only advanced about 40% over the same stretch. A share of BCHG simply represents ownership of 0.00933862 units of Bitcoin Cash, so the value of BCHG should move at a nearly 1:1 correlation with the price of Bitcoin Cash. Instead, the Bitcoin Cash Trust has gone on an exponential moonshot even as the underlying assets it holds haven’t done much.

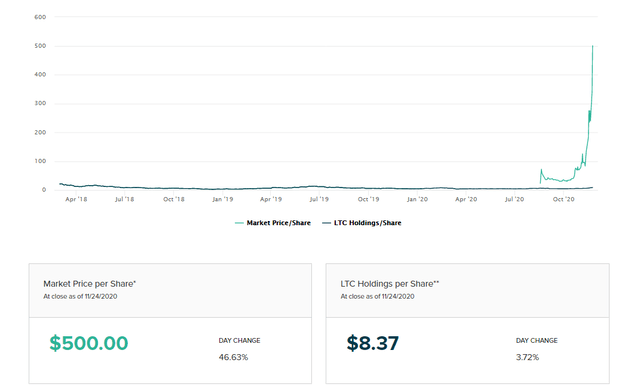

That’s not all. Grayscale also launched a Litecoin Trust (OTCPK:LTCN). This one is even more ridiculous, trading at a 5,000% premium to NAV:

That’s right – if you buy a share of LTCN now, you can pay $500 to get $8.37 worth of Litecoin cryptocurrency. Litecoin would have to go up 50x from the current price simply to break even if the Trust ever started to trade at NAV. On November 24th alone, as the chart shows, the market price of LTCN soared 47%, whereas the actual value of the underlying Litecoin assets increased just 3.7%.

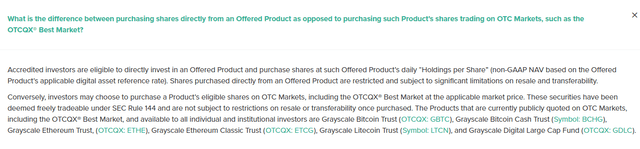

And the compression back to NAV may well happen in the future. My understanding, based on the verbiage below, is that Grayscale is able to issue more shares to accredited investors:

Source: Grayscale

Thus, for accredited investors with the ability to somehow short or hedge these altcoins elsewhere, this seems like an incredible arbitrage opportunity by investing directly in the offered product at NAV and shorting out the crypto exposure elsewhere.

While the premiums are unlikely to fully disappear anytime soon, given the restrictions on selling newly-issued shares, the odds of the Bitcoin Cash Trust staying at 1,000% premium to NAV and the Litecoin Trust at 5,000% seem pretty low. In any case, retail speculators should be exceptionally careful before trading these products.

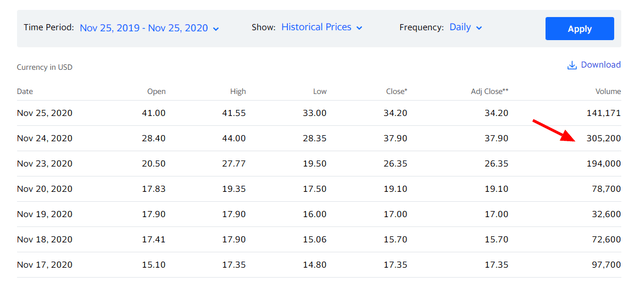

People arguing against a crypto bubble could say that these products are not representative of the broader space since they are fairly unknown funds trading over the counter. That’s a reasonable point, particularly on the Litecoin Trust, where trading volume is still minimal. On the Bitcoin Cash Trust, however, average trading volume is above 50,000 shares per day, and it’s topping 100,000 shares a day now as the price has spiked:

BCHG trading data. Source: Yahoo Finance

On November 24th, for example, the fund traded 305,200 shares in a single day, amounting to roughly $10 million of volume. So, make no mistake, these products are starting to attract some real flows now, even at these jaw-dropping premiums to NAVs.

You might be wondering, why not short BCHG then? For one thing, what’s to stop it from running up to a 2,000% or 5,000% premium to its NAV, like the sister Litecoin Trust? You’d have to use a really small position size on any potential short trade. Additionally, borrow is expensive and difficult to locate.

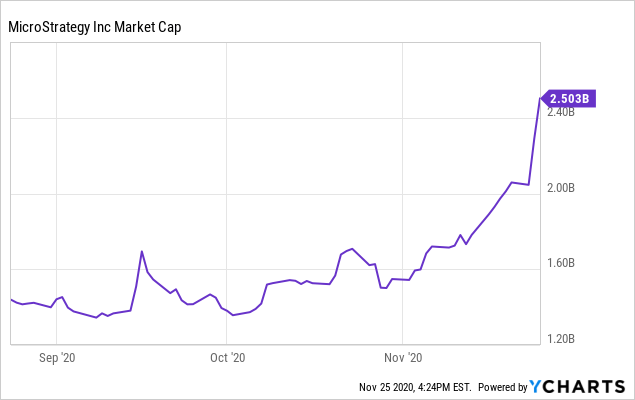

For one more example of current crypto-mania, consider MicroStrategy (MSTR). The business software firm decided to pivot in September. It converted its cash holdings to Bitcoin, with the CEO rightly concluding that the market would value that cash more if it were held in Bitcoins. Specifically, MicroStrategy bought 38,250 Bitcoins at a price of just over $11,000 each for a grand total of $425 million.

It’s not there yet, but for the sake of argument, let’s assume Bitcoin gets to $22,000 so that MicroStrategy earns a clean double on their investment. That would add $425 million to their market value, all else being equal. So, how much value have traders tacked onto MicroStrategy’s stock price in exchange for its roughly $350 million in Bitcoin gains so far:

Data by YCharts

Data by YChartsThat’s right, MicroStrategy has added a cool billion to its market cap for its $350 million or so of crypto gains. Bitcoin would have to reach almost $40,000 per unit to justify the current market cap of MicroStrategy, assuming the core software business is worth the same now as it was in September.

Needless to say, speculation is a lot more difficult if you need the price to double or more simply to break even on your play. In the case of the Grayscale Trusts, it’s much worse than that. Paying $37 a share for $3.19 in NAV of Bitcoin Cash is a questionable idea. And paying $500 for $8.37 of Litecoin is near indefensible.

My all-time, most-read article on Seeking Alpha was back in November 2017, when I suggested that The Big Short Moment was near for Bitcoin. The Bitcoin price peaked within two months and subsequently cratered. Sentiment is starting to get similarly frothy now as it was in late 2017, particularly in the altcoins. Be careful out there.

If you enjoyed this, consider Ian’s Insider Corner to enjoy access to similar initiation reports for all the new stocks that we buy. Membership also includes an active chat room, weekly updates, and my responses to your questions.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.