Welcome to the U.S. elections – day one.

The situation is quite fluid, but at the time of this writing, Democrat Joe Biden is in the lead both in the popular vote and in confirmed electoral votes.

However, a total of six states with a combined total of 83 electoral votes have yet to deliver a final decision. This could really go either way.

The above map was created by me using the tool at 270towin.com. I know the different networks like to report numbers differently, so I’ve been keeping score myself and posting frequent updates on Twitter.

As far as how the six undecided states are leaning, we have made a few inferences on social media, but it’s important to note that each of these states could still fall either way.

The only thing that’s clear from the current state of things is that there is no red wave or blue wave. This is an incredibly close election.

As far as the time frame is concerned, we’re getting smarter by the hour, and I have a good feeling we can finish up tomorrow morning in the U.S., if not by the afternoon.

At that point, we’ll hopefully have a victory and concession. If not, well… all bets are off.

Market reactions

For all the hullabaloo around these elections, the markets have remained remarkably calm.

As it seems, the actual situation on the ground may not really change that much, at least as far as the partisan divide.

No matter who takes the White House, they will probably not be able to also hold congress.

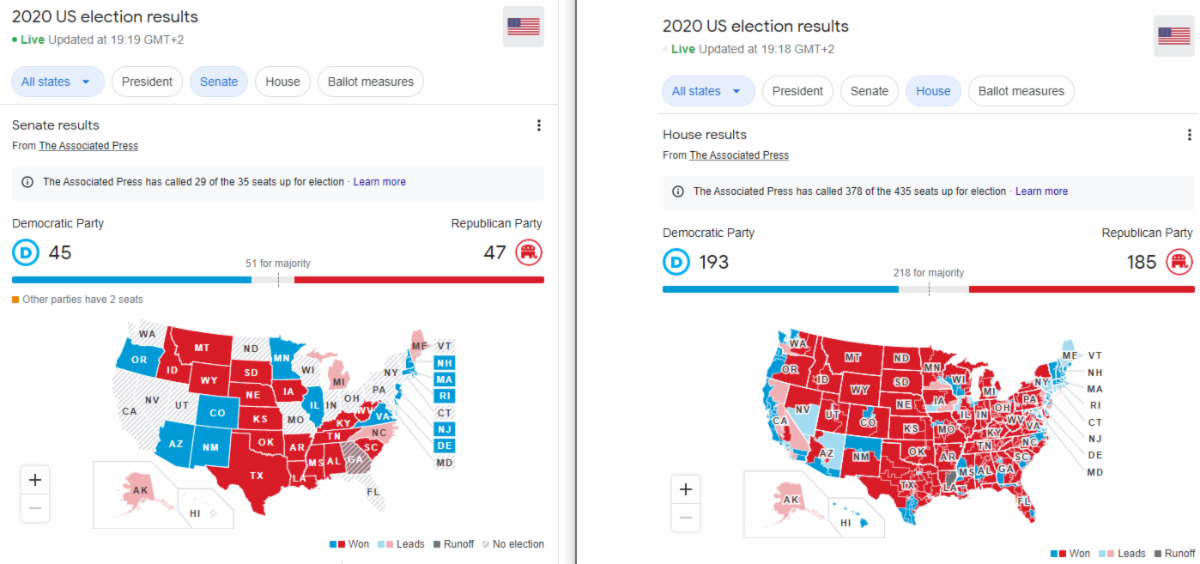

As it seems right now, the Democrats are set to retake the House, and the Republicans will probably retake the Senate. So preliminary results show there is no material change expected.

Understandably, the markets have been thoroughly unimpressed until now. The VIX is down 17% today, which goes to show just how much people are watching and waiting instead of trading.

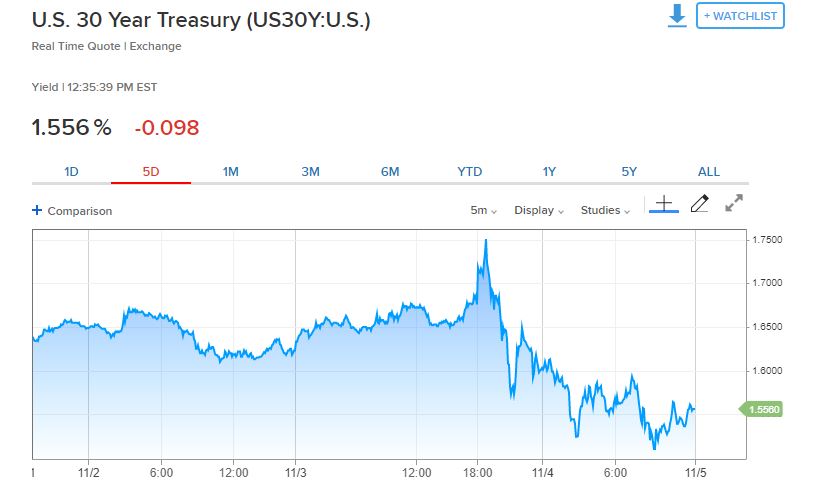

There was a rather dramatic move in the U.S. 30-year Treasury Bond early on. It seems some investors were expecting a big blue wave, and they had to quickly unwind once it became clear that wasn’t gonna happen.

Bitcoin’s reaction

Well, why would bitcoin react to the U.S. presidential election?

Bitcoin was created, and is currently being used by many, as a hedge against central banks, not against the White House.

Since members of Congress are the ones in charge of government spending, the puppet that sits as figurehead of the nation tends to play a side role in both fiscal and monetary policy.

Therefore, it’s impossible to discern definitively whether the current action we’re seeing in bitcoin is a result of the elections, the broad rally, or any other reason.

The movement may not be large in percentage terms, but as far as the charts go, we’ve just taken out a major technical barrier. Though the breakout could still reverse and turn into a false one, today’s close should prove more decisive at least than the elections have been so far.