- As the U.S. gets closer to have its 46th U.S. President and a knife-edge electoral fight between both the presidential candidates going on, the overall market conditions are showing stability in terms of price movement and almost covered the losses of Tuesday’s market session

- The overall market capitalization has reached $394.18B resulting in an increase of 0.82% over the day

- The overall volume traded has reached $86.46B resulting in a decline of -8.51% over the day

- The dominance of the crypto king has reached to 64.23% resulting in an increase of 0.18% over the day

Trump or Biden? Cryptomarket Shows Stability Amid U.S. Elections 2020

The overview of the market reflects that the overall market conditions are trying to avoid any volatile movements as the people of the United States gear up for Election Day. Bitcoin made another attempt to reclaim the crucial mark of $14K and nearly missed the level with the day-high of $ 13968.83. Ethereum, on the other hand, is looking to retest the major resistance level of $395.00. We can conclude that the overall market is not moving in a certain way as the presidential race is currently too close to call.

Bitcoin Price Predictions

Bitcoin nearly reclaimed the crucial price mark of $14k on Wednesday’s market session with the day-high around $13960. The CMP is placed at $13657.02 having an overall gain of 1.10% bringing the market capitalization to $253,111,780,106 with the 24-hour volume traded of $ 31,956,186,857. The dominance of the crypto king has reached 64.2%. If the overall market conditions continue to sustain this positive sentiment for the world’s largest crypto asset, we can expect the price levels to surge above $14k soon.

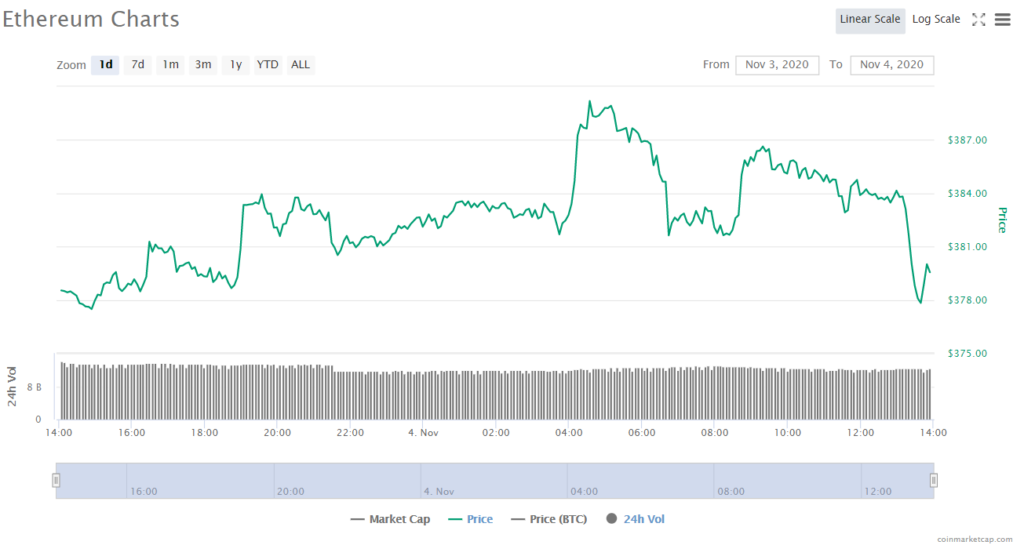

Ethereum Price Predictions

Ethereum nearly retested the major resistance level of $395.00 again in the market and faced negative reversals. However, the positive sentiment for the crypto asset is looking sustained as it is having an overall gain of 0.87% bringing the CMP to $381.59. The only current bearish aspect for the coin is the negative performance of the ETH/BTC pair. The pair are performing negatively facing a marginal loss of -0.21% bringing the current level to 0.02792341 BTC. If the pair turns positive soon and the overall market conditions continue to favor the price momentum of Ether, we might witness another retesting of the resistance point of $395.00.

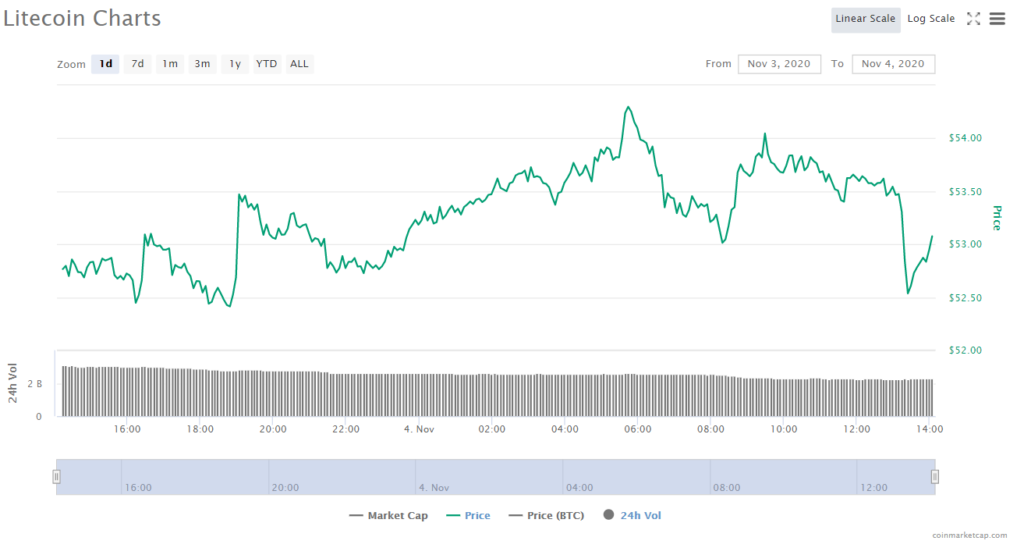

Litecoin Price Predictions

Litecoin is still targeting sustainability above the crucial price mark of $50.00 as the price levels are currently facing an overall loss of -0.30% bringing the CMP to $52.69. The market capitalization has reached $3,461,243,405 with the 24-hour volume traded of $ 2,474,814,216. The LTC/BTC pair continues to perform negative and facing a loss of -1.48% bringing the current level to 0.00385225 BTC. The negative performance of the pair might affect the price levels in a bearish manner but the digital asset is currently having a major support level of $50.00.

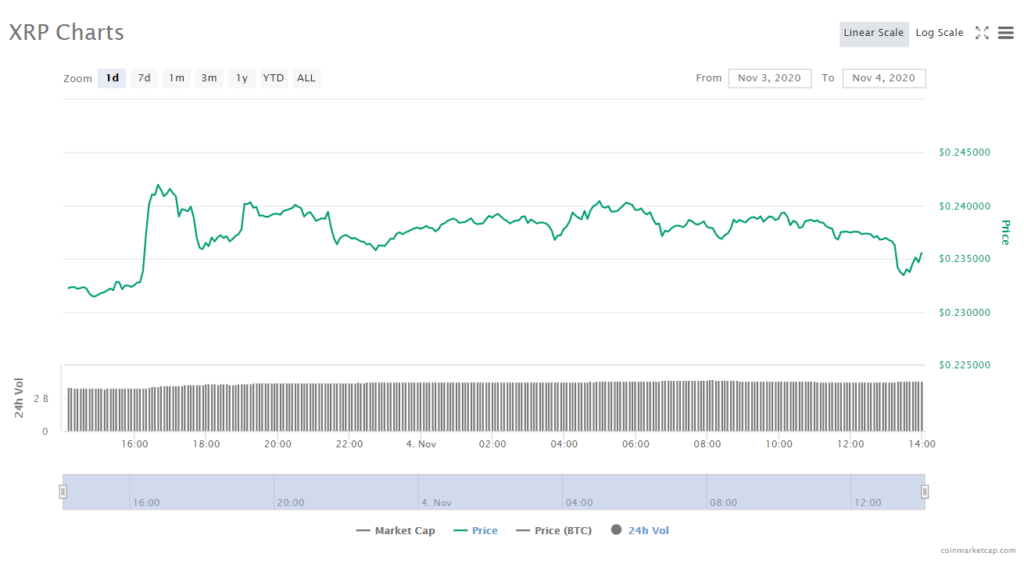

Ripple’s XRP Price Predictions

Ripple was able to perform positively on Wednesday’s market session with an overall gain of 1.53% bringing the CMP to $ 0.235901. The XRP/BTC also turned positive with a profit of 0.54% which brought the levels to 0.00001729. The pair has turned positive after a long duration and is expected to provide positive momentum to the price levels further ahead in the market. The market capitalization is at $ 10,682,692,793 with a 24-hour volume traded of $ 3,075,526,381. The price levels need to have a positive breakout above $ 0.250 for its inception of impactful recovery action.

Chainlink Price Predictions

Chainlink has now arrived at its one of the important support levels of $10.20 due to the ongoing downtrend which has forced the price levels to face an overall loss of -1.28% on Wednesday’s market session. The CMP is placed at $10.24 with a market capitalization of $ 3,998,327,971 with a 24-hour volume traded of $ 1,383,081,712. If the price levels continue its downtrend, they are having the next support point placed at $9.80 meaning a downfall below the crucial mark of $10.00 which might put the crypto asset into a vulnerable position further ahead in the market.