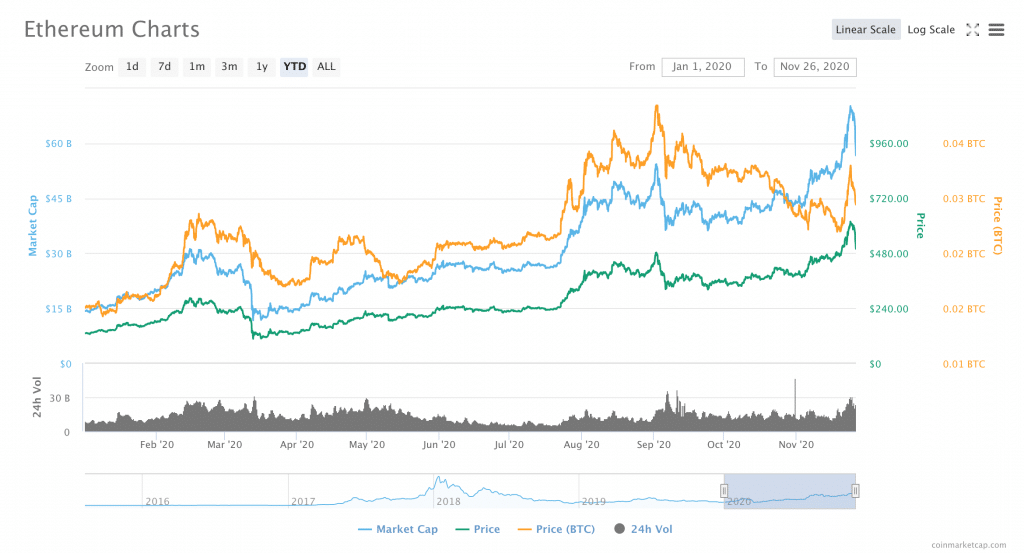

All eyes have been on Bitcoin and Ethereum over the course of the last week as both coins shot for the moon: Bitcoin saw an impressive push to nearly $20,000, while Ether was on a bull run of its own. ETH reached highs of nearly $620 earlier this week, its highest point since June of 2018.

However, it seems that the bull run that both coins were riding for most of this month may be coming to an end. At press time, the price of ETH was down nearly 16.5 percent over the course of the last 24 hours; Bitcoin was down nearly 11 percentage points.

Still, it’s possible that the drops in the price of both assets could be short-lived: there’s a chance that buyers could scoop up both BTC and ETH at a “discount” when both assets fall below a certain level, which could stabilize the slides.

Bitcoin plunges more than $2,000 in hourshttps://t.co/HkUFrhH3JZ pic.twitter.com/JPg0WWZBxh

— Bloomberg Markets (@markets) November 26, 2020

Just as the Bitcoin rally earlier this month seemed to positively affect ETH, the drop in the price of Ethereum could be related to the double-digit BTC price drop that has also taken place in the last 24 hours.

Indeed, Iraklii Dizenko, trader-analyst at Binaryx, told Finance Magnates before the price drop that “a market reversal will certainly affect Ethereum and this will undoubtedly lead to a stop in growth and a decrease in its price.”

“One of the possible factors is that investors will take their profits before the Christmas and New Year holidays,” Dizenko said. This could be what’s happening now.

”If the BTC bull market continues you’ll see more funds allocated to ETH and other altcoins.”

Still, despite today’s downward motion, it seems that both BTC and ETH are on the way up for the long term.

A lot of discussion has been devoted to what could be driving BTC up–and, in fact, a number of analysts agree that part of ETH’s rise is actually a result of the Bitcoin bull run.

Philip Gradwell, the chief economist at cryptocurrency data analysis firm Chainalysis, told Finance Magnates that “the Ethereum price will benefit from the bitcoin bull run as people spread their bets and take Bitcoin’s price as a signal of broader crypto adoption,” he said.

Scott Freeman, co-founder of JST Capital, also believes that the ETH price may be experiencing a run-off effect from the Bitcoin rally: “everyone is moving into Bitcoin, especially as the price inches closer and closer to $20K, and this bullish mentality is spreading outwards to other tokens in the ecosystem,” he said in a statement shared with Finance Magnates earlier this week.

“Ethereum is one of the biggest benefactors of the increasing inflow of investors in the digital asset space, with its price surpassing the $600 mark on Monday. I expect that this movement into altcoins will only continue as the marketplace matures and continues to attract all types of investors.”

Indeed, “ETH is the first stop after BTC on the crypto risk curve,” Freeman told Finance Magnates. “It’s likely if the BTC bull market continues you’ll see more funds allocated to ETH and other altcoins.”

The rise of DeFi could be contributing to ETH’s price increase over the long term

However, the Bitcoin run isn’t the only reason that Ethereum seems to be trending up over the long term.

Indeed, “the Ethereum price has been rising due to its own reasons” independent of BTC’s price movements, Philip Gradwell said.

For example, “over the last few months it has seen increased use in Decentralised Finance (DeFi), which has allowed Ethereum holders to participate in new projects and earn a return on their assets.”

Suggested articles

Big Data, News, Sentiment Analytics & NLPGo to article >>

“This is different from the use case of Bitcoin, which investors increasingly use as digital gold, forgoing a return but expecting the value of the asset to rise.”

In other words, Gradwell sees Bitcoin’s growth seems to be fueled by the increasing popularity of the narrative that BTC is either a hedge against inflation or an asset to buy and hold for profit later on. By contrast, the Ethereum rise is happening in large part because of the growth of the decentralized finance ecosystem and the network’s usage alongside it.

The upcoming launch of Eth2 could also be contributing to Ethereum’s price rise

Indeed, Will McCormick, communications lead at cryptocurrency exchange OKCoin, told Finance Magnates that “the increase in investment in DeFi protocols which are ERC-20 tokens which run on the Ethereum blockchain” is a major contributing factor to ETH’s rise.

“Since June this year, the amount of money locked up in DeFi protocols has risen from $1B to over $14B now,” he said.

Analysts also agree that part of Ethereum’s rise can be attributed to the upcoming launch of Ethereum 2.0 (Eth2), a network upgrade that (among other things) would address some of the network’s scalability issues.

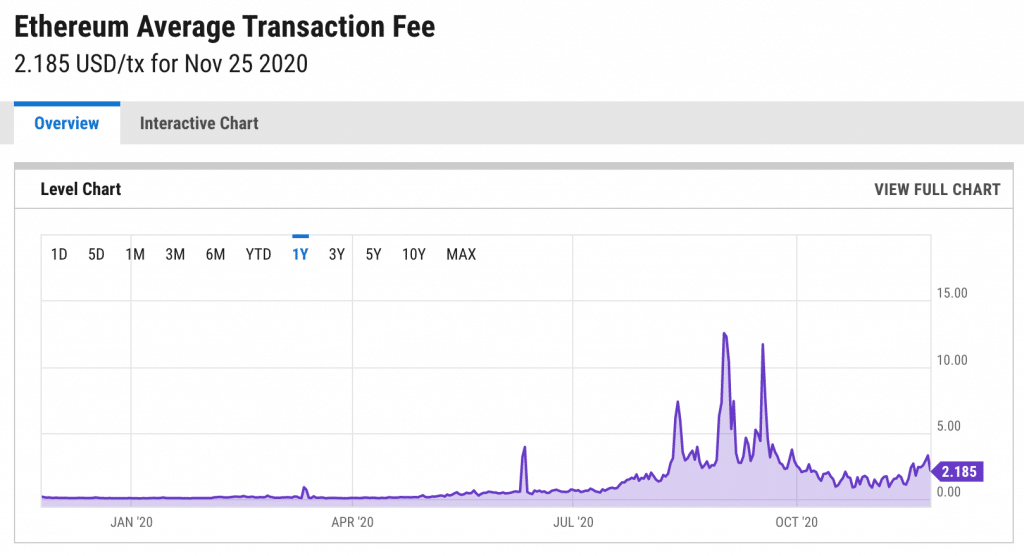

Indeed, several times this year, transaction fees on the Ethereum network spiked because of high levels of traffic on the network. The more users and protocols that the network attracts, the more transactions that are sent through the network. The more traffic there is on the network, the more congested it becomes; as it becomes more congested, fees go up, and transaction times slow down.

However, Ethereum 2.0 aims to address this problem–and, as a result, it seems that more and more people are betting on ETH.

Indeed, “ETH has been steadily rising since September in anticipation of the upcoming Ethereum 2.0 Serenity upgrade,” OkCoin’s Will McCormick told Finance Magnates. “Eth2’s beacon chain genesis has now been confirmed for December 1st following the transfer of 524,288 ETH tokens from 16,384 validators into the Eth2 deposit contract

He also pointed out that this will “enable users to stake or ‘lock up’ a minimum of 32 ETH to run a node in order to secure the new Proof of Stake network.” Users who stake ETH in this way are incentivized with token rewards; therefore, as more stakers are encouraged to join the network, the price of ETH could continue to grow in a more sustainable way after Eth2 is launched.

BTC could still benefit from QE and other economic effects of the coronavirus over the long term

As for Bitcoin, there’s still a chance that the asset could hit $20K before the end of the year, even in spite of the recent price drops.

Earlier this week, Ed Nwokedi, chief executive at RedSwan CRE, told Finance Magnates that investors may still be looking for places to put their cash after the big move to the dollar in March: “there is a lot of dry cash sitting around in bank accounts generating zero yields,” he said.

Ongoing QE efforts may also be contributing to the hunt for alternative assets: “if this money is not moved into a more stable environment, inflation will eat away at the purchasing power of the assets,” he said.

Additionally, “because the US and other major countries are spending a lot of capital to support their economies through the pandemic, national debt is piling up,” he said.

Nwokedi also pointed to Stephen Roach, the former head of the Asian office of Morgan Stanley investment bank, who “expects a record drop in the US dollar by the end of 2021.”

“ Roach recently published an article in which he predicted a 35-40% collapse in the US national currency. He also predicts that this year the federal budget deficit will reach 16% of GDP. As a result of this skepticism, the value of $1 is perceived to be falling and investors are looking for hard assets to park their cash.”

Therefore, even if BTC does see a drop in the short term, the rally could continue over the long term.

What are your thoughts on BTC and ETH’s next moves? Let us know in the comments below.