On November 3, 2020, the cryptocurrency community noticed that one of the largest addresses holding 69,369 bitcoins from the Silk Road were transferred. Following the onchain movement, the U.S. government revealed it had seized the coins from a person they dubbed “Individual X.” The following is an in-depth look at what we know about the Silk Road bitcoin address that was seized by U.S. law enforcement.

This week on election day in the U.S., American law enforcement officials seized 69,369 bitcoins worth over $1 billion today. The bitcoin address is a well known address and news.Bitcoin.com reported on the address on September 11, 2020. The reason why our newsdesk looked into the address is because hackers have been trying to sell an alleged encrypted wallet dat file during the last two years.

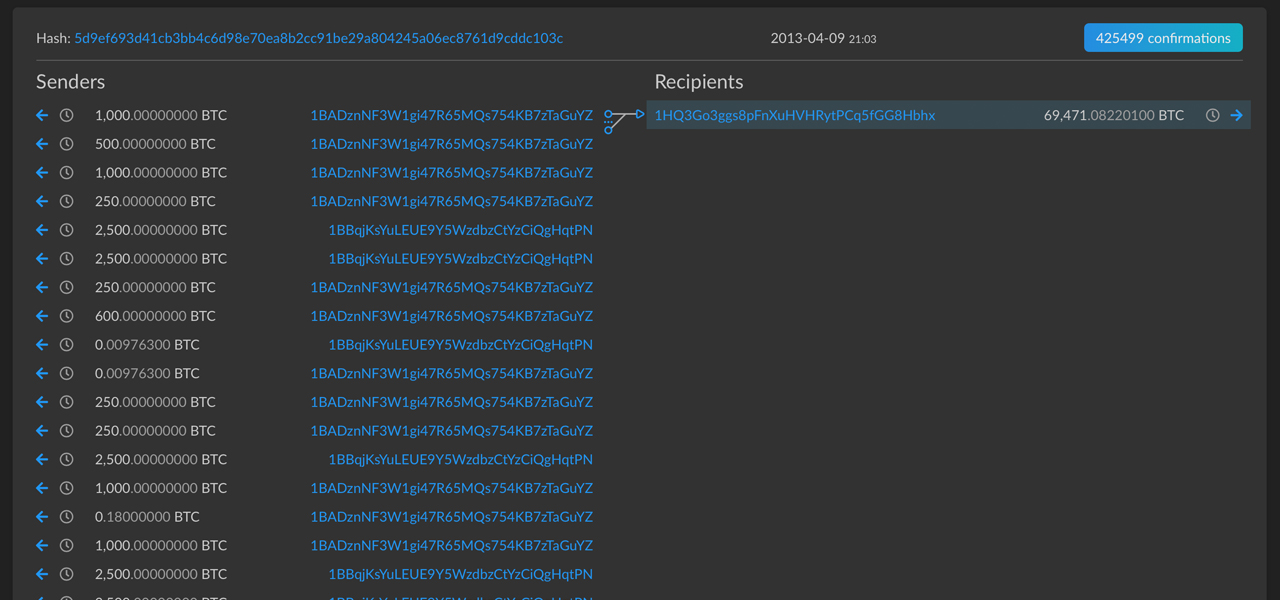

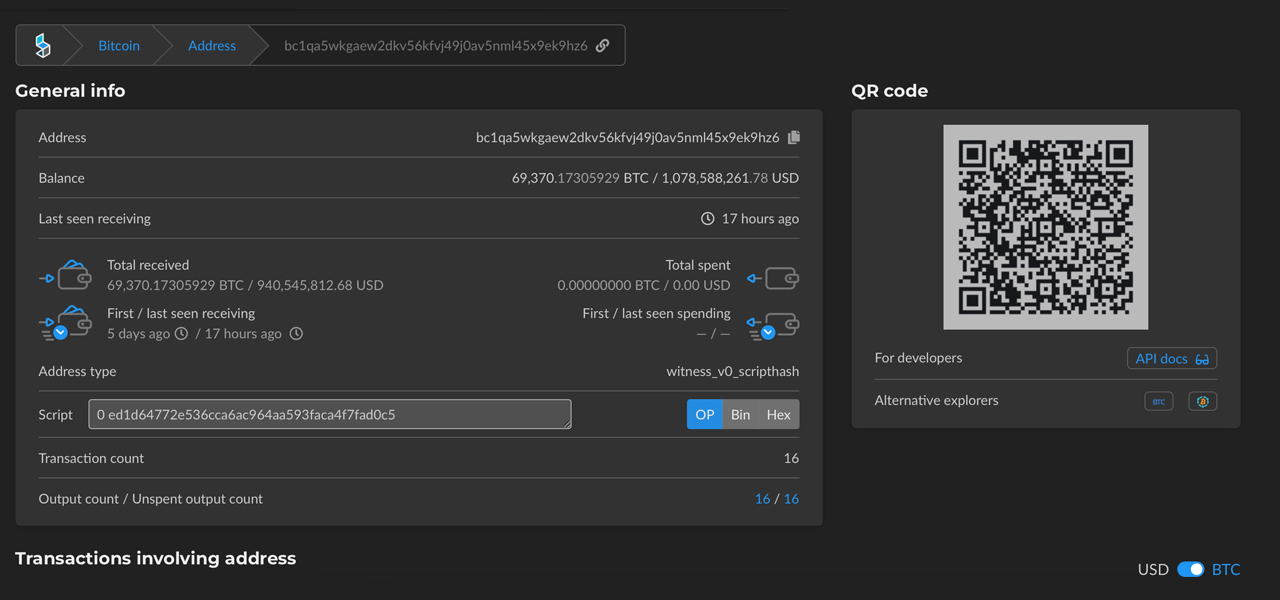

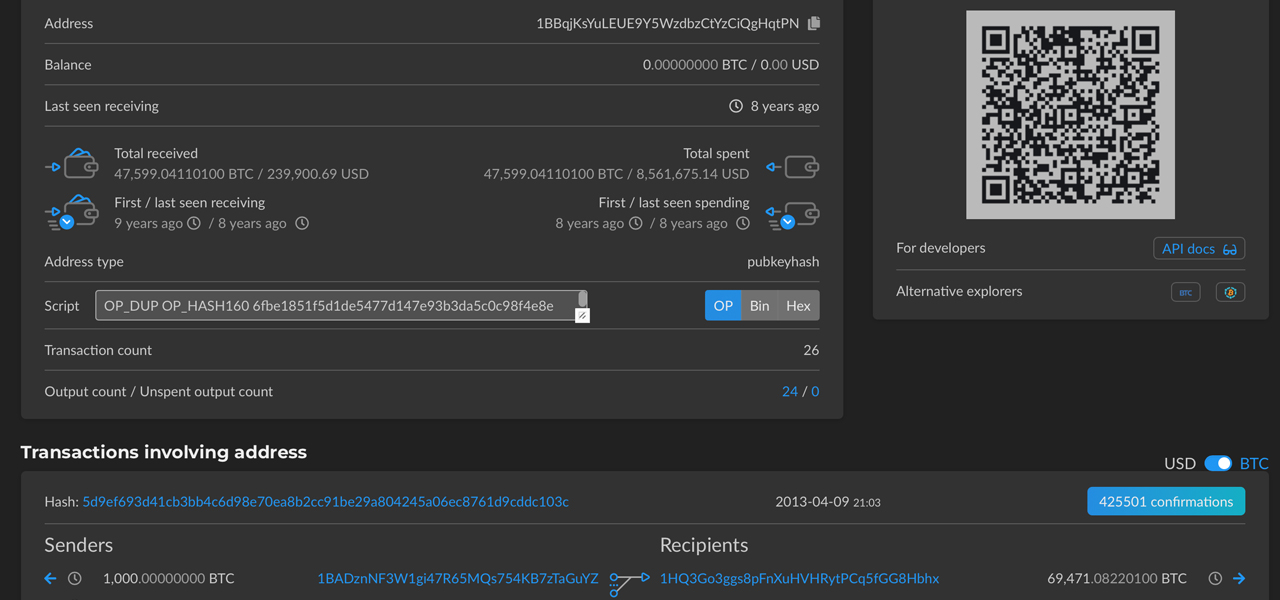

The bitcoin address called “1HQ3Go3ggs8pFnXuHVHRytPCq5fGG8Hbhx” or “1HQ3” for short, stemmed from the Silk Road according to blockchain analysis. According to onchain data, 1HQ3 got 69,471 BTC sent to the address on April 9, 2013. The funds came from the Silk Road (SR) marketplace and many of the funds stemmed from the SR bitcoin address “1BBq.”

Individual X managed to hack nearly $1 billion from the old Silk Road Bitcoin accounts.

Then the govt found Individual X and took the Bitcoin back, the DOJ announced today.

Who is Individual X? pic.twitter.com/N0Rra8EqOR

— Nathaniel Popper (@nathanielpopper) November 5, 2020

Between April 2013 and up until the day the address was seized, only one large transfer was sent. 101 BTC (over $1.5M) was sent to the now-defunct Btc-e exchange and after that, the wallet only contained 69,369 BTC.

Reports show that federal law enforcement seized the funds on November 3 and are seeking forfeiture with the courts. They describe obtaining the BTC from a “hacker” and prosecutors call the person “Individual X.” The person the government calls Individual X is still a mystery to this day and people are uncertain about this person’s true identity.

However, the court filing explains that the Internal Revenue Service (IRS) was involved with the procedure. Law enforcement officials also hired third party blockchain analysis investigators to analyze bitcoin transactions executed by Silk Road.

“From this review, they observed 54 transactions that were sent from bitcoin addresses controlled by Silk Road, two bitcoin addresses totaling 70,411.46 BTC (valued at approximately $354,000 at the time of transfer),” the court filing details.

“According to an investigation conducted by the Criminal Investigation Division of the Internal Revenue Service and the U.S. Attorney’s Office for the Northern District of California, Individual X was the individual who moved the cryptocurrency from Silk Road,” the attorney for United States David L. Anderson wrote.

Anderson further added:

On November 3, 2020, Individual X signed a Consent and Agreement to Forfeiture with the U.S. Attorney’s Office, Northern District of California. In that agreement, Individual X, consented to the forfeiture of the Defendant Property to the United States government. On November 3, 2020, the United States took custody of the Defendant Property from 1HQ3.

The filing also notes that after the 101 BTC was sent to BTC-e in 2015, two years later the alleged Russian operator, Alexander Vinnik, was indicted for running an unlicensed money transmitting business and for money laundering.

I was just thinking ? $975million in bitcoin that was unauthorized and illegally hacked and stolen by “individual x” who then signed an agreement of forfeiture to the @USAttorneys and turned those funds over to the @usgov ….

??? #stimuluspackage ??? @TFoegelle @AustinSchuck— Rene’e & Shadow ?❤️✌️ (@shadownrenee) November 6, 2020

A number of bitcoiners assume this is how the prior owner of address 1HQ3 was caught, but there’s also the last two years of hackers attempting to crack the wallet. After the wallet saw the first transfer in 2013 with 69,471 BTC sent, a great number of cryptic messages have been sent to the address as well.

For instance, crypto advocates can leverage tools like note4ever.com, which encodes any message into a list of bitcoin addresses, so someone can broadcast it to an address of their preference. If someone was to inspect the transactions involved with address 1HQ3, then they would see a number of colorful messages.

Even after the federal agents seized the 69,369 bitcoin, messages with addresses like “1BitcoinForPresident42o7777DKkJij” and 1FreeRossF*ckCops77777777777W87XM can be seen on any blockchain explorer. A great number of messages were sent to 1HQ3 over the years and some people have definitely tried to communicate with the owner.

This leads to the massive amount of advertisements over the last two years that have claimed to sell an encrypted dat file belonging to the 1HQ3 bitcoin address. For example, Alon Gal, the Chief Technology Officer of cybercrime firm Hudson Rock tweeted about the address recently. Google also has approximately 16,700 links tethered to the address as well making it very popular.

Prior to the feds seizing the coins from the so-called Individual X, the wallet dat file was seen on marketplace websites like Satoshidisk.com, and All Private Keys. When news.Bitcoin.com reported on the attempted sales, one site was selling the file for 0.08929505 BTC or $1,050, which was the exchange rate at that time.

The 1HQ3 address may be a mystery today, but more clues are currently unraveling and may be published in the future. So far, this case has revealed where $1 billion worth of the old Silk Road bitcoins went, but 444,000 BTC is considered still missing from the marketplace’s coffers. Using today’s exchange rate, the missing 444k SR BTC is worth more than $6.8 billion today.

It will also be quite interesting to see whether or not the U.S. government decides to auction the 69k bitcoin stash, as they have done many times in the past.

What do you think about the bitcoin stash controlled by Individual X? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Blockchair, Elliptic, Twitter,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.