Bitcoin (BTC-USD) has quietly staged an impressive rally this year. We’re watching on an ongoing breakout as the price of Bitcoin has climbed above the important $12,000 level which represented an important technical resistance level. At the current price of $12,729, Bitcoin is now approaching the highest daily closing price since early 2018, and up by more than 75% year to date.

(Source: finviz.com)

We believe the market dynamics are extremely bullish supporting continued momentum in the broader cryptocurrency space. In many ways, the volatile trading environment for Bitcoin in recent years has been positive bringing greater scrutiny to the emerging asset class and helping to consolidate long-term support. Indications are that institutional investors are taking Bitcoin and cryptocurrencies seriously driving inflows into the segment.

Our bullish case for Bitcoin draws a lot of similarities to the themes supporting higher prices in gold (GLD) and precious metals. Simply, as an alternative to traditional fiat currencies, Bitcoin benefits as a store of value against the unprecedented wave of aggressive quantitative easing and dovish monetary policies by global Central Banks which have flooded the market with liquidity. The low interest-rate environment coupled with significant ongoing macro uncertainties supports the demand for an asset with constrained supplies.

Bitcoin as the first and largest cryptocurrency can be seen as the “gold” of asset class where a rising tide can lift all other “altcoins”. We expect Ethereum (ETH-USD), Ripple (XRP-USD), Litecoin (LTC-USD), and Tether (USDT-USD) among others to all benefit from the similar dynamics.

There have been several positive headlines supporting sentiment towards the segment, including reports that PayPal Holdings Inc. (PYPL) will accept cryptocurrencies as payments starting in 2021. As one of the largest payment service providers, PayPal opening the door for cryptocurrencies supports more mainstream adoption.

Separately, indications that the SEC continues to look into approving a “Bitcoin ETF” like the pending Winklevoss Bitcoin Trust ETF (COIN) or VanEck SolidX Bitcoin Trust ETF (XBTC) further add legitimacy to the crypto space. More importantly, the adoption of underlying blockchain technologies and distributed ledger concepts across various sectors support positive sentiment. Overall, the long-term outlook is improving and we believe cryptocurrencies are here to stay and prices can climb higher.

How to Trade Bitcoin with Stocks

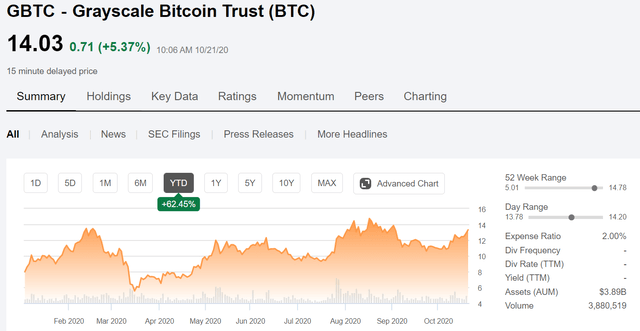

While the SEC is still debating the approval of Bitcoin and cryptocurrency exchange-trade-funds, existing alternatives in the market include a series of funds sponsored by Grayscale Investments LLC. The Grayscale Bitcoin Trust (GBTC) and Grayscale Ethereum Trust (OTCQX:ETHE) are two of the largest examples with a structure more closely related to a closed-end fund and trade over-the-counter.

(Source: Seeking Alpha)

While GBTC and ETHE invest directly in Bitcoin and Ethereum, the share prices currently trade at a large premium to the underlying net asset value of their holding. Essentially, investors are paying more for each share of GBTC and ETHE than the implied value of underlying fund holdings.

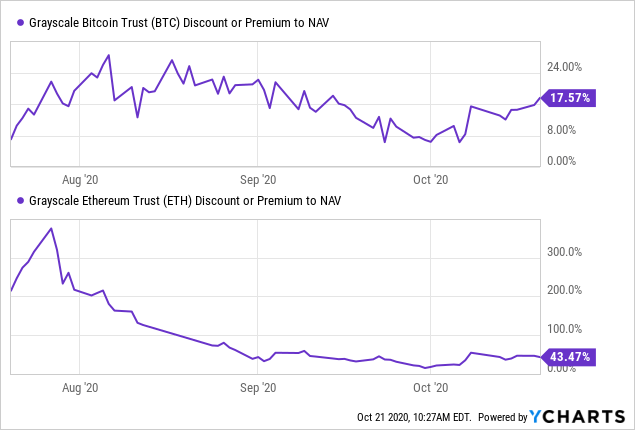

Data by YCharts

Data by YChartsOn its own, a premium to NAV is not necessarily a deal-breaker as the share price can still climb higher as Bitcoin and Ethereum prices rise. Our concern is that if an announcement is made over the coming months that an ETF will be approved by the SEC, we would expect the premium to collapse towards parity or even trade at a discount-driven by a rotation in the market towards the most liquid vehicle. Depending on the pricing environment and cost basis, investors could face an incremental capital loss due to this dynamic. For this reason, we recommend avoiding both GBTC and ETHE as a long-term holding but think they can be an option for short-term trading.

There are also several stocks that represent direct or indirect exposure to higher cryptocurrency prices and sentiment towards the asset class. Here are our three favorites.

1. Riot Blockchain Inc. (RIOT)

(Source: finviz.com)

With a market cap of approximately $200 million, Riot Blockchain Inc. is one of the largest pure-plays on cryptocurrencies. The company owns thousands of dedicated specialized Bitcoin mining machines and continues to expand its hardware fleet. Essentially, the core business is the purchase of the mining equipment that can generate a consistent flow of bitcoins while covering costs like energy consumption. The company can benefit from higher prices of Bitcoin which can drive revenues higher through operating leverage. Separately, the company also owns several blockchain companies including ‘Tesspay’ and ‘Verady’ which seek to deploy solutions across the financial services industry.

Riot generated $1.9 million in revenues in the last quarter although earnings are negative given the significant ongoing growth investments. While the stock remains speculative, we believe it can climb higher as the price of bitcoin gains momentum.

2. Marathon Patent Group Inc. (MARA)

With a market cap of around $80 million, Marathon Patent Group Inc. is smaller than Riot Blockchain but bills itself as “one of the first Nasdaq-listed Cryptocurrency mining companies”. The company operates a cryptocurrency mining facility in Quebec, Canada.

(Source: finviz.com)

The company recently acquired smaller players “Fastblock Mining” for a deal worth $22 million. According to Marathon, once the transaction closes its capacity of 16,960 application-specific-integrated-circuit “ASIC” miners could produce approximately 16 bitcoins per day representing a gross monthly revenue stream of $4 million per month. The company also estimates its mining cost to drop from $7,400 per Bitcoin down to $3,600 going forward. Keep in mind that at the time of the press release from August, Bitcoin prices were about 10% lower than the current level so the economics have likely improved in the period since. From the press release:

If all 16,960 ASIC Miners were deployed today, they would produce 1,639/Ph, which at today’s Bitcoin price and the network’s current Hashrate Difficulty, would produce approximately 16 Bitcoin per day and generate monthly revenue of $4,000,000 per month. With a monthly power cost of $1,127,000, this could result in monthly Gross Profits of more than $2,800,000 per month. The foregoing calculation is based on current Bitcoin prices, and a higher or lower Bitcoin price, would result in higher or lower Gross Profit potential, corresponding directly to the differential in Bitcoin price.

The point here is that Marathon Patent Group and Riot Blockchain Technologies represent real businesses with significant growth potential. The companies as pioneers in the industry are well-positioned to take advantage of the fast-moving market dynamics and benefit from a bullish environment in the crypto space.

Our take is that beyond headline revenue or quarterly earnings, these stocks will likely continue to trade based on sentiment. Given their relatively small size and early stage of development, these are high-risk securities with still speculative fundamentals. That being said, in the context of a diversified portfolio a small position may be appropriate for investors to capture the upside momentum and gain exposure to the trends. We recommend averaging into an allocation over days and weeks to achieve a lower cost basis.

3. Overstock.com Inc.

Finally, we highlight Overstock.com Inc. which has been a massive winner this year supported more by strong growth from its core e-commerce business which gained traction during the pandemic. We have been bullish on this stock going back to the start of the year highlighting its strategic focus with investments in the blockchain space. Notably, Overstock launched and distributed its first digital preferred stock (OTCPK:OSTKO) in May as a dividend for shareholders.

(Source: finviz.com)

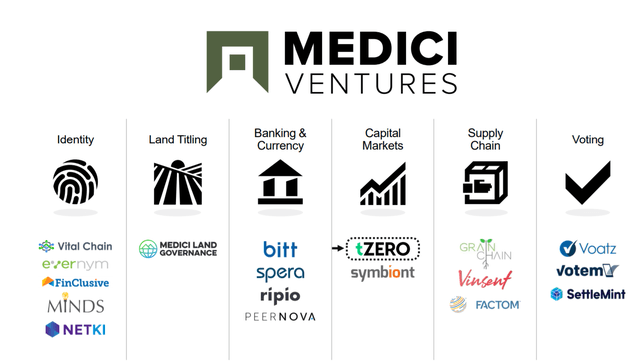

The company owns the subsidiary ‘Medici Ventures’ which includes a portfolio of several blockchain technology companies developing solutions for various industries. While most of the companies here have limited revenues and are still in the early stages of development, the group through Overstock can be considered a sort of venture capital play on the broader blockchain space.

(Source: Company IR)

As it relates to Bitcoin, the bullish momentum with higher pricing in cryptocurrencies supports improved prospects that these companies can be commercialized. Importantly, Overstock reported revenue growth of 109% y/y in the last quarter driven by its online retail business. The improving firm-wide financial position with a positive net income in the quarter supports the viability of continued investments into Medici. We expect shares of OSTK to benefit from the current momentum in cryptocurrencies.

Final Thoughts

We expect the rally in Bitcoin to continue supporting the broader asset class of cryptocurrencies and companies with indirect exposure to higher prices. Ongoing uncertainty related to the strength of the global macro recovery along the renewed concerns by a spike in coronavirus cases should keep markets on edge. Bitcoin should benefit as a store of value and alternative to the traditional financial system.

To the downside, it will be important for Bitcoin to consolidate the recent gains above $12,000. A move under $10,000 would be more concerning and force a reassessment of our bullish view. Steps by the government to increase regulation in the space or limit the adoption of digital currencies remain a risk that could pressure sentiment in the asset class.

The next target for Bitcoin is high from the summer of 2019 when it traded above $13,500 which would open the door to reclaim the all-time high at $19,783 from January 2017.

Add some conviction to your trading! We sort through +4,000 ETFs/CEFs along with +16,000 U.S. stocks/ADRs to find the best trade ideas. Click here for a two-week free trial and explore our content at the Conviction Dossier.

Disclosure: I am/we are long MARA, GLD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.