PayPal, Bitcoin, and More!

This week, PayPal made headlines as they welcome cryptocurrency on its trading platforms, including Venmo! With the help of Paxos Trust Company, PayPal and cryptos combine. As a result, this opens a new frontier for digital trading that lets crypto owners use their currency in more ways than ever. This might be the green light for crypto traders to finally use cryptos on a day-to-day basis. As of right now, PayPal shall support cryptos including Bitcoin, Bitcoin Cash, Ethereum, and Litecoin. This feature is only accessible in the US. But, PayPal also announced future expansion of this feature in other countries, with more cryptocurrencies, coming in 2021.

Although other fintech companies allow their users to trade with cryptocurrencies, PayPal’s global reach greatly ushers in a brighter future for digital currency. The day after this announcement, Bitcoin’s price spiked to a peak that hasn’t been seen since July 2019. This week, Bitcoin’s price extended beyond $13,000 after only beginning the week around $11,760.

The first two months of the third quarter were the best months for D1 Capital Partners’ public portfolio since inception, that’s according to a copy of the firm’s August update, which ValueWalk has been able to review. Q2 2020 hedge fund letters, conferences and more According to the update, D1’s public portfolio returned 20.1% gross Read More

The first two months of the third quarter were the best months for D1 Capital Partners’ public portfolio since inception, that’s according to a copy of the firm’s August update, which ValueWalk has been able to review. Q2 2020 hedge fund letters, conferences and more According to the update, D1’s public portfolio returned 20.1% gross Read More

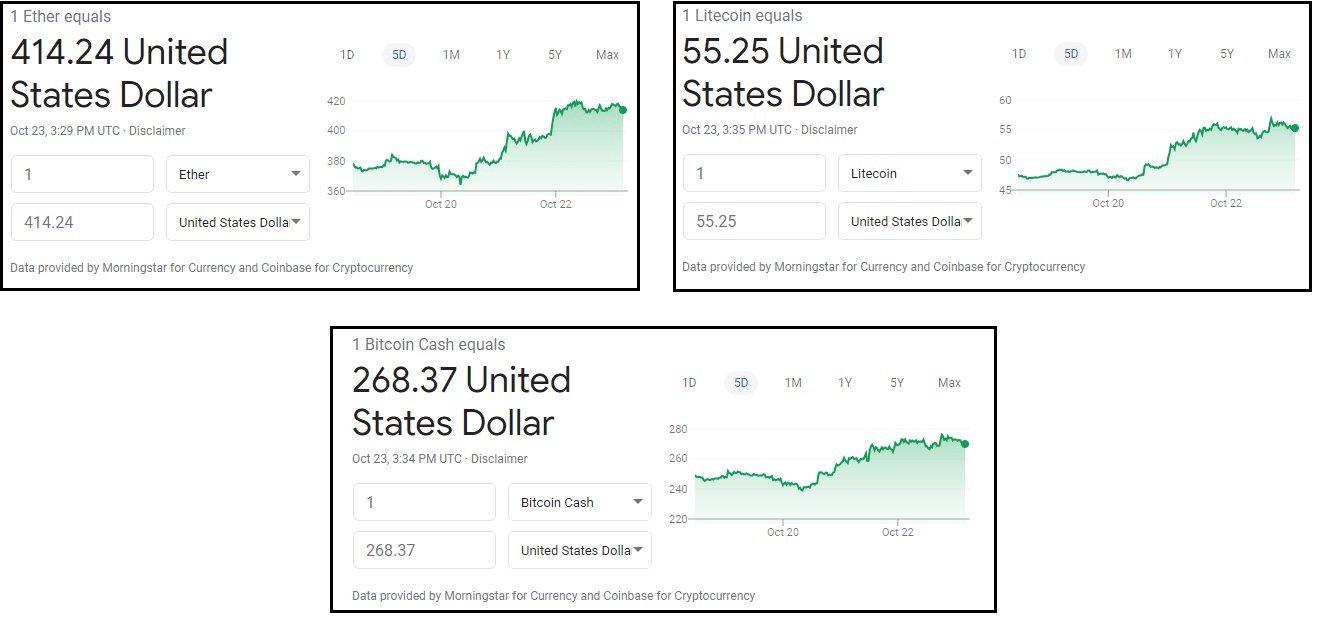

Furthermore, Ethereum, LiteCoin, and Bitcoin Cash were all up as a result of this news.

Enigma Securities’ Head of Trading, Jordan Ettedgui, noted:

“As the crypto market matures over time, institutional clients’ demand for risk management and liquidity alternatives away from spot products continues to grow at an accelerated pace.”

Because Paypal and cryptos are together at last, Bitcoin, Ethereum, Litecoin, and more cryptos have the space to further take root and grow. This new frontier can potentially help stabilize cryptocurrencies and make them less volatile. In case you didn’t know, what affects Bitcoin price is basically supply and demand. Now that Bitcoin has the potential for use in more common commerce, Bitcoin’s price may continue to rise from demand. But, eventually, it may stabilize as it becomes a more regular currency.

What Is Paxos?

One of the first questions you may be asking is what is Paxos?

Paxos Trust Company began in 2012 with the focus to “re-build the infrastructure of finance.” Basically, this pioneer seeks to bring more power to the individual consumer to offer equal access and establish a more fluid economic system.

Paxos’ first incredible achievement was launching iBit exchange in Singapore. Later, in 2015, the NY State Department of Financial Services gave them a limited-purpose trust charter to set up Paxos as the first company both approved and regulated for offering cryptocurrency products. Thanks to this massive achievement, Paxos today is a recognized name of the blockchain industry as a trustworthy source for investors and major institutions. In Paxos’ official statement from their blog, they said:

“Blockchain technology has forever changed financial markets and the way we conceive of monetary assets, but is still in its early days. As companies like PayPal enter the space, they need a performant and trustworthy partner. We are proud to power this historic development in financial technology as we move society toward a brighter and open financial future.”

Additionally, Paxos offers its own gold-backed token as of November 2019: PAXG. Although this is not currently offered with the new PayPal and cryptos expansion, there is room for it to join the ranks. The benefit for PAXG is that it is easy to liquidate or exchange for gold since it is a digital token that represents gold ownership. LBMA-accredited London Good Delivery gold backs every token, making it much less volatile than other cryptocurrencies.

Why Do Businesses Typically Not Accept Cryptocurrency?

Bitcoin is the first cryptocurrency to ever succeed and become an established alternative currency. Established in 2009, its blockchain technology paved the way for other cryptocurrencies to be born as well. However, before PayPal and cryptos were even on the menu, it has been slow for businesses and financial institutions to widely accept cryptocurrency. Why?

First of all, although Bitcoin and other cryptos are at least a decade old, their volatility posed a significant threat to businesses and consumers alike. As it begins to turn into a more familiar form of monetary exchange, its volatility will most likely calm and trade at a regular rate.

Another reason why businesses often refuse cryptos is because of slow transaction rates, and the rates are more expensive than credit or debit cards. Consequently, few businesses bothered to try cryptos. This formed a cycle that inhibited cryptocurrency’s accessibility as a universal currency. Now that PayPal and cryptos unite, using Bitcoin for more regular purchases is a possible future. On top of that, exchange rates may further develop into faster, but still secure, rates like that of regular fiat currency.

Lastly, cryptocurrency is simply not as well understood by the general public than fiat currency or physical assets like gold and silver. Because cryptos are not government-issued, they seem to be elusive concepts for the general consumer. While people usually make more card payments than cash, it is still understood that you are spending physical money. But, as people see cryptocurrencies take off with PayPal, more consumers may learn and start using them more often. However, you can already buy gold with Bitcoin on Bullion Exchanges’ website.

How to Buy Crypto with Paypal

PayPal now steps in to combat the major issues of exchange time and fees with the help of Paxos. Together, this new system also tackles regulating volatility and exchange time and fees through the incorporation of traditional currencies. What this means is, PayPal will have control of private keys in your cryptocurrency wallet, not you. An even finer print to make note of is that you can only hold cryptocurrencies in your PayPal account. Therefore, you cannot transfer your crypto to another wallet on or off PayPal.

Additionally, PayPal takes on the volatility risk so businesses can receive cryptocurrency payment from their consumers. However, most importantly, PayPal is the first company that NYS Department of Financial Services granted the conditional cryptocurrency license. So, PayPal begins its authorized process with Ethereum, Bitcoin, Bitcoin Cash, and Litecoin.

When it comes to buying and selling with PayPal and cryptos, the purchase/sale amount affects fees directly. Between $1.00 and $24.99 USD, the fee is only $0.50 USD. Percentages of the fees for using PayPal and cryptos vary as the amount increases. (Source: PayPal)

- $25.00 to $100.00 USD = 2.30% of the purchase/sale amount

- $100.01 to $200.00 USD = 2.00% of the purchase/sale amount

- $200.01 to $1000.00 USD = 1.80% of the purchase/sale amount

- $1000.01 USD and above = 1.50% of the purchase/sale amount