Many people who have increasingly despaired at the adverse effects of changing climate have probably mused: Why can’t we go completely green? Why are fossil fuels so hard to quit? The answers, as usual, are legion: Renewable energy is too expensive, too unreliable, too undeveloped and fossil fuels lack a suitable substitute. All of these reasons contain a modicum of truth. But our biggest challenge remains lack of political will because lowering our reliance on fossil fuels requires dedicated investments that provide uncertain, long-term benefits.

Indeed, scientists have continued making remarkable progress in ironing out one of the biggest kinks of clean energy: The intermittent and unpredictable nature of renewable energy.

Now, researchers have come up with yet another solution to make renewable energy more dependable: Renewable Energy trading platforms that leverage AI and blockchain technology.

Dutch scientists have successfully developed Distro, a solar and battery storage-based microgrid trading platform underpinned by blockchain distributed ledger technology and AI.

Distro is both good for the goose and the gander: The platform has demonstrated double-digit reductions in energy costs for customers as well as comparable revenue improvement for renewable energy producers.

High-frequency energy trading

The Distro Platform, developed by S&P Global Platts and Blocklab Rotterdam to support energy trading at very high frequencies, uses blockchain smart contracts to ensure all transactions are validated and immutable.

Distro is a high-frequency microgrid energy trading platform that leverages AI and blockchain by optimizing supply and ensuring it meets consumer demand in a highly granular manner. This is reflected in rapid changes in local energy prices. In other words, Distro incentivizes lower consumption during periods of low energy generation by lowering prices during high generation periods.

Related: The Geopolitical Power Of The Shale Revolution Is Fading

During the trial, Distro enabled an 11% reduction of energy costs for end-users while also boosting revenues by 14% for energy producers as well as increasing battery storage returns on investment by 20%.

Yet another benefit: Distro is able to significantly lower wastage, with 92% of all solar power generated in the dock consumed by local businesses.

In other words, everybody wins with Distro.

AI Powering a Clean Energy Revolution

Distro is not the first platform to demonstrate that cutting-edge technologies such as AI and blockchain can be deployed to significantly improve the reliability of renewable energy sources such as solar and wind.

From utilities employing AI and machine learning to predict power fluctuations and cost optimization to companies using IoT sensors for early fault detection and wildfire powerline/gear monitoring, here are real-life cases of how these bleeding edge technologies continue to power an energy revolution even during the pandemic.

#1. Innowatts: Energy monitoring and management The Covid-19 crisis has triggered an unprecedented decline in power consumption. Not only has overall consumption fallen but there have also been major shifts in power usage patterns, with sharp decreases by businesses and industries while domestic use has increased as more people work from home.

Houston, Texas-based Innowatts, is a startup that has developed an automated toolkit for energy monitoring and management. The company’s eUtility platform ingests data from more than 34 million smart energy meters across 21 million customers, including major U.S. utility companies such as Arizona Public Service Electric, Portland General Electric, Avangrid, Gexa Energy, WGL, and Mega Energy. Innowatts says its machine learning algorithms are able to analyze the data to forecast several critical data points, including short- and long-term loads, variances, weather sensitivity, and more.

Related: The Energy Sectors Most Threatened By A Biden Presidency

Innowatts estimates that without its machine learning models, utilities would have seen inaccuracies of 20% or more on their projections at the peak of the crisis, thus placing enormous strain on their operations and ultimately driving up costs for end-users.

#2. Google: Boosting the value of wind energy

A while back, we reported that proponents of nuclear energy were using the pandemic to highlight its strong points vis-a-vis the short-comings of renewable energy sources. To wit, wind and solar are the least predictable and consistent among the major energy sources, while nuclear and natural gas boast the highest capacity factors.

Well, one tech giant has figured out how to employ AI to iron out those kinks.

Three years ago, Google announced that it had reached 100% renewable energy for its global operations, including its data centers and offices. Today, Google is the largest corporate buyer of renewable power, with commitments totaling 2.6 gigawatts (2,600 megawatts) of wind and solar energy.

In 2017, Google teamed up with IBM to search for a solution to the highly intermittent nature of wind power. Using IBM’s DeepMind AI platform, Google deployed ML algorithms to 700 megawatts of wind power capacity in the central United States–enough to power a medium-sized city.

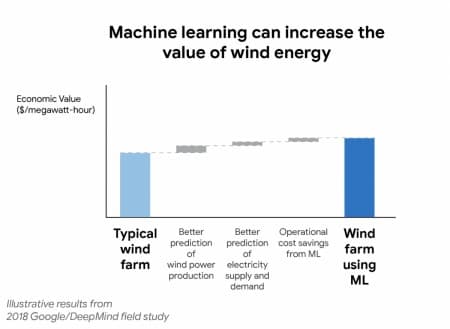

IBM says that by using a neural network trained on widely available weather forecasts and historical turbine data, DeepMind is now able to predict wind power output 36 hours ahead of actual generation. Consequently, this has boosted the value of Google’s wind energy by roughly 20 percent.

A similar model can be used by other wind farm operators to make smarter, faster, and more data-driven optimizations of their power output to better meet customer demand.

IBM’s DeepMind uses trained neural networks to predict wind power output 36 hours ahead of actual generation

Source: DeepMind

#3. Wildfire powerline and gear monitoring

In June, California’s biggest utility, Pacific Gas & Electric, found itself in deep trouble. PG&E pleaded guilty for the tragic 2018 wildfire accident that left 84 people dead and, consequently, was slapped with hefty penalties of $13.5 billion as compensation to people who lost homes and businesses and another $2 billion fine by the California Public Utilities Commission for negligence.

Needless to say, it’s going to be a long climb back to the top for the fallen giant after its stock crashed nearly 80% following the disaster despite the company emerging from bankruptcy in July.

Perhaps the loss of lives and livelihood could have been averted if PG&E had invested in some AI-powered early detection system.

One such system is being worked on by a startup called VIA, based in Somerville, Massachusetts. VIA says it has developed a blockchain-based app that can predict when vulnerable power transmission gear such as transformers might be at risk in a disaster. VIA’s app makes better use of energy data sources, including smart meters or equipment inspections.

Another comparable product comes from Korean firm Alchera which uses AI-based image recognition in combination with thermal and standard cameras to monitor power lines and substations in real-time. The AI system is trained to watch the infrastructure for any abnormal events such as falling trees, smoke, fire, and even intruders.

Other than utilities, oil and gas producers have also been integrating AI into their operations. These include:

- ExxonMobil–Exxon has partnered with IBM to explore the use of AI and quantum computing to accelerate the development of more realistic simulations and developing chemistry calculations for more efficient carbon capture

- BP Plc.–uses AI technology to improve the performance of its lubricants ERP system to achieve 40% faster response times

- Royal Dutch Shell–one of the earliest energy players to adopt the technology, Shell uses AI, machine learning, computer vision, and deep learning as well as autonomous vehicles and robotics in drilling and extraction in a bid to improve safety for its customers and employees. Shell has also deployed AI in predictive maintenance across thousands of critical assets globally

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com: