Prepared by John R Savage, analyst at BAD BEAT Investing

We recommend that our members keep 2-3% of their portfolio in gold and silver, with another 1-2% of their portfolio in cryptocurrency. We tend to recommend the so-called ‘big three’ in the space, that being Bitcoin, Litecoin, and Ethereum. Sometimes, we are asked about market instruments that track these investment vehicles. One name we were asked about was the Grayscale Ethereum Trust (OTCQX:ETHE). We want to briefly touch on this investment vehicle.

The Grayscale Ethereum Trust only invests in Ethereum, and it does so in a passive manner. This can help investors with a stock trading account get some exposure and to be somewhat invested in Ethereum. In short, it enables investors to gain exposure to Ethereum in the form of an investment security while avoiding the challenges of buying, storing, and safekeeping ETH directly on the crypto exchanges.

The investment vehicle has just under $900 million in assets under management. The annual fee here is quite high at 2.5%, so that is something to keep in mind. Now, here is the kicker. When you buy one share of ETHE, your shares are backed up by 0.09312814 of a single unit of actual ethereum. So, what does this mean? Well, the current price of ethereum at the time of this writing is $375.

So, what does this mean here? Well, let us run some numbers. Going from the above, the true value of what you are buying may surprise you. If we take the ethereum (the ether value) per share, that is 0.09312814*$370.

Why does this matter? Well, that would imply that a true fair value price is about $34.45, give or take a few cents for variability in pricing. Ok great. But to buy a share of ETHE will run you $51.20 right now. As such, you are paying a premium of 48% to the actual value of the asset.

We believe it is better to get a trading account at a major crypto exchange and buy the asset directly and store it in your own digital wallet. Even after transaction fees, you will at no point come anywhere close the premium you pay for buying the shares of ETHE.

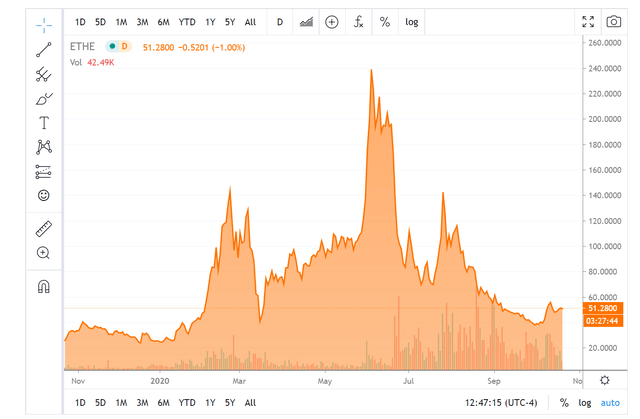

So, what are you paying for? You are paying for convenience. The correlation in directional trading is ethereum, and ETHE, however, is not strong. Take a look at the one-year charts:

Source: Cointelegraph

Just to grab another source:

Source: Google (note the pricing in our calculations was based on $370)

Then, there is the ETHE chart:

Source: Seeking Alpha

Take home

Make no mistake, the correlation in price action is moderate at best. We do not believe paying for convenience is worth it here. Sure, you can make money when the assets move, that is certain. But we would prefer investors take the extra step of getting their own crypto wallet. It is very easy and convenient. We are bullish on ethereum, but bearish on ETHE as an instrument.

If you like the material, click ‘follow’ and if you want to trade with a professional team, check out BAD BEAT Investing

Like how we handled ETHE? Come trade with the pros and start winning

If you enjoyed reading this column and our thought process you should immediately join our community of traders at BAD BEAT Investing.

We are available all day during market hours to answer questions, and help you learn and grow. Learn how how to catch rapid-return trades.

- -12 rapid-return trade ideas each week

- Monthly deep value plays

- Access to a dedicated team, available all day during market hours.

- Target entries, profit taking, and stops rooted in technical and fundamental analysis

- CLICK HERE TO START YOUR RISK-FREE TRIAL

Disclosure: I am/we are long ETC-USD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.