Decentralized finance (DeFi) could stand in the way of Ethereum 2.0 (ETH 2.0) reaching the number of stakers required to make it safe and decentralized enough, noted ConsenSys Codefi, a unit of Ethereum-focused software company ConsenSys.

In their recent report on DeFi, Codefi estimated that the second version might launch its genesis block this quarter, as was previously discussed. Phase 0, aka the Beacon Chain, is coming first, and the report describes it as “the central control tower keeping track of the 32 shards on Ethereum 2.0.”

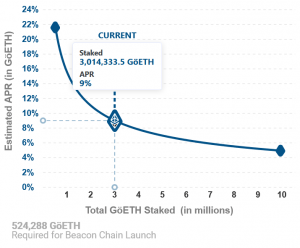

This phase brings with it the long-awaited Proof of Stake consensus mechanism, and will enable users to earn rewards through staking ETH on the network and by acting as an active or passive validator. To earn these rewards, validators will have to lock up their ETH in the deposit contract which is also said to be coming soon. “The precise percentage yield of ETH earned by validators is not a fixed number; rather, it is dependent on the number of validators and the amount of staked ETH,” said the report.

“In Q3, however, some community members expressed concern that DeFi could be the number one threat to getting a significant amount of staking participation in ETH 2.0,” Codefi noted.

They explain this point further, saying that ETH 2.0 needs ethereum holders to lock up their funds in a deposit contract “for a variable return and more disconcertingly, a currently unspecified amount of time.” But then, if these numerous DeFi protocols offer higher returns than ETH 2.0 staking, ETH holders could potentially decide to use their funds elsewhere – and this could result in the network’s second version not reaching the amount of staked ETH necessary to make it “sufficiently secure and decentralized.”

Staking and rewards:

The report said that,

“It is not unreasonable to worry that ETH holders would (at best) wait to see how early staking returns compare to DeFi returns, or (at worst) decide altogether not to “risk” locking up ETH until Phase 1.5 (which is likely at least a year away) in case another similar bull run occurs in the meantime.”

However, providers could eventually start offering liquid tokens that represent the value of their staked ETH, said the report, comparing this to DeFi’s introduction of a derivative token that represents a user’s pooled tokens. Codefi argued that it’s not yet possible to know if and where will holders decide to stake their coins, locking them in a deposit contract, nor is it possible to know what will drive such a choice, but added that “the amount of liquidity an ETH holder can access, the volatility of ETH 1.x vs ETH 2.0, and the evolving user experience of being an ETH holder” are among the factors contributing to this decision.

At pixel time (11:00 UTC), ETH trades at USD 386 and is almost unchanged in a day. The price is down by 7% in a week, trimming its monthly gains to 8%. ETH is still up by 110% in a year.

____

Learn more:

Ethereum Starts Training ETH 2.0 Validators

Vitalik Buterin Not Sure ‘When ETH 2.0’ but Says Clients Can Launch it Alone

New Ethereum 2.0 Calculator: Stake ETH 1 and Earn 279% in 10 Years

Ethereum is a Casino