Get Forbes’ top crypto and blockchain stories delivered to your inbox every week for the latest news on bitcoin, other major cryptocurrencies and enterprise blockchain adoption.

Brian Armstrong made waves with a blog post steering Coinbase away from any form of social activism.

BLOCKCHAIN LUMINARIES SHARE TIPS

Leaders at some of the world’s most influential financial institutions from the U.S. to China and Europe sat down for a virtual panel discussion with Forbes to share tips and tricks of the trade. DTCC managing director Jennifer Peve shared details of the weeks-long program the company uses when onboarding new clients to its blockchain platform, and executives at ING Group and the China Construction Bank also shared their insights.

For additional insights from top decision-makers at Ripple, Axoni, Hyperledger and more, watch the whole event here, and nominations for next year’s Blockchain 50 list are open here.

NO OFFICE POLITICS

Coinbase broke ranks from its Silicon Valley peers and angered some employees when founder and CEO Brian Armstrong overtly stated in a blog post last Sunday that his company is not a place for social activism and nonprofit work. He wrote that Coinbase should be “laser focused” on its mission, and bluntly asserted that its mission is not to address all forms of global inequality.

Armstrong faced swift backlash, and Twitter

CRYPTO MARKETS

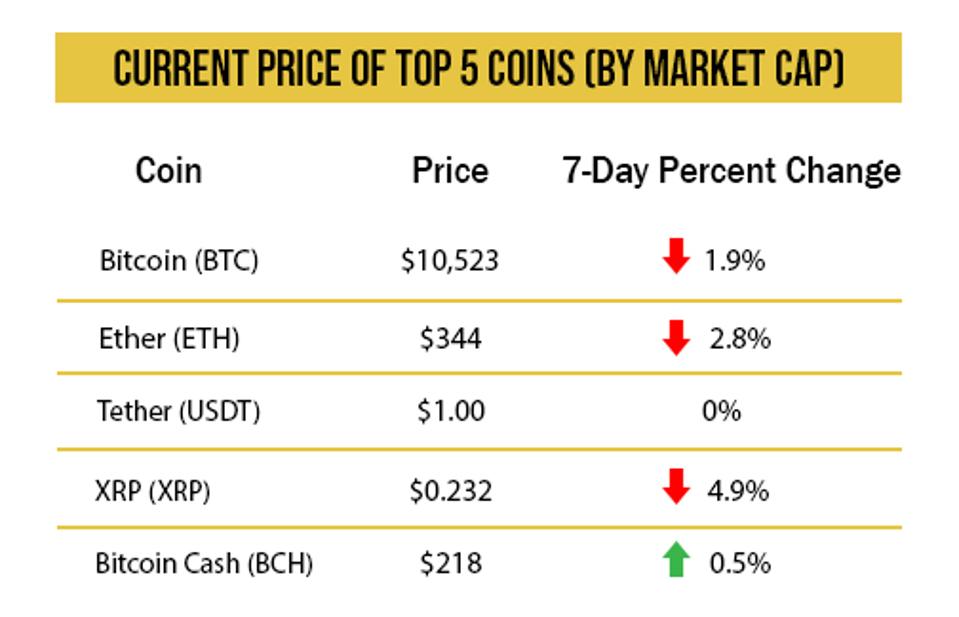

Bitcoin had a calm week before a slump Thursday and Friday morning following the BitMEX charges and then the late-night news of President Donald Trump’s Covid-19 diagnosis that rattled global markets. The selling pressure started before that, with data showing some whales who bought bitcoin in 2018 or 2019 when the price ranged from $4,000 to $6,000 have started to cash in their profits.

The stock-to-flow model created by an anonymous Twitter user that predicts a $288,000 bitcoin price by 2024 is also coming under increasing criticism from industry experts, with one calling it “absolutely useless.”

Source: Messari. Prices as of 4:00 p.m. on October 2, 2020.

CRYPTO EXCHANGE CHARGED

Four executives at Seychelles-based exchange BitMEX were indicted by the Department of Justice Thursday and charged with violating the Bank Secrecy Act and conspiracy to violate the act by willfully failing to monitor money laundering. The two charges each carry a maximum sentence of up to five years in prison. BitMEX has been banned from serving American customers since 2015 due to U.S. regulatory requirements, but was allegedly operating a derivatives exchange illegally.

Money laundering risks have also entered the DeFi branch of the crypto world—hackers stole $200 million from Singapore-based exchange KuCoin, whisking it away to DeFi exchanges like Uniswap.

30 UNDER 30 STARTUP WITH NOVEL USE OF BLOCKCHAIN TO HELP FARMERS

A team of Forbes 30 Under 30 list members behind a brand-new startup called Demeter are hoping to issue digital assets backed by actual harvests of crops like corn, milk and meat. They think their idea will help independent micro-farms that exist on only a few acres of land access capital and compete with industrial farms. Co-creator Stefan Seltz-Axmacher says the token will allow retail investors to literally “put their money where their little mouth is.”

XRP DECENTRALIZATION?

The XRP Ledger Foundation launched on September 24 as an independent organization responsible for accelerating and diversifying the development and adoption of the XRP Ledger.

ELSEWHERE

Ripple to Offset Carbon Emissions for XRP Ledger [Decrypt]

Bitcoin price sets record for most days above $10,000 [Cointelegraph]

Vulture Investor Feasts on Crypto Whales Seeking Quick Exits [Bloomberg]