Bitcoin Traders were treated with a roller-coaster ride last week. Reacting strongly to the news of United States President Donald Trump contracting COVID-19 and the BitMEX founders and executives being accused of failing to stop money laundering, bitcoin took a huge plunge and once fell below the $10,500 support within minutes.

Although being considered as a safe-haven asset, bitcoin for the past few weeks has reacted strongly to macro mood. When the news of President Trump leaving the hospital, stock markets and gold all responded positively. Bitcoin and altcoins futures were up and the losses on Friday were reversed.

Bitcoin and the global economy face many challenges in the last quarter of 2020. The 2020 presidential election, spiking COVID-19 cases across the world, and geopolitical conflicts may boost the volatility of bitcoin, and which direction bitcoin may go remains unclear.

But now, one technical indicator suggests that a huge volatility spike is on the way. The bitcoin Bollinger Band width has dropped below 0.95 for the first time since 2016. Additionally, Raoul Pal, the CEO of Global Macro Investor and Real Vision Group, shared his view that bitcoin volatility may spike: “Bitcoin 30-day historic volatility has been falling fast and is in the 20’s. In the past it has hit 20% vol 7 times. 6 times prices exploded higher immediately and vol hit 80% in a few months. 1 time (Nov 2018) prices fell sharply. Either way, a big move is coming soon.”

If you want to take shelter during the volatile season, here are two options worthy of trying.

Option 1: A Wallet Designed for Traders and HODLers

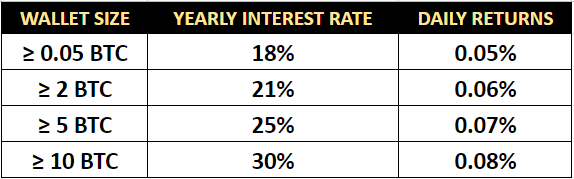

You might want to continue to hodl your BTC and wait for the market to give a clear signal. However, as we don’t know how long it will be, meanwhile you could consider storing your BTC into an interest-bearing wallet, where your deposit could gain up to a 30% annualized interest rate.

Option 2: Managing Trading with Less Risks

You could benefit from the downside by shorting bitcoin. Using leverage, traders can open a position X times more than their actual capital. Bexplus, a leading cryptocurrency leverage trading platform, even offers a 100x leverage. Even at times of great volatility, you can generate profits with the help of Bexplus. And its Stop Loss & Take Profit options could help you lower the risks and lock in profits.

Bexplus – Recommended Leverage Trading Platform

- No KYC requirement, registration with Email verification within a few minutes

- Demo account with 10 BTC for traders to get familiar with leverage trading

- 100% bonus for every deposit and 10% off of transaction fee

- Intuitive and full-featured App on Apple App Store and Google Play

- Affiliate program with up to 50% commission reward

- 24/7 customer support