The altcoin market is bleeding as the bullish rally continues for Bitcoin. Bitcoin has increased its market dominance to 60%, and this level is the record for the last 2 months. Altcoin investors have started a boom in return to Bitcoin by selling their assets. This caused the altcoins to crash while increasing Bitcoin market dominance.

The last few weeks have been very lucrative and promising on the Bitcoin front. The leader managed to beat the price of the coin above 12 thousand dollars and is currently trading at 12 thousand 250 dollars. Analysts predicted that the rally could continue to new records, with Bitcoin successfully exceeding $ 12,000. While everything is going well for the leading coin for now, altcoins do not show a bright appearance.

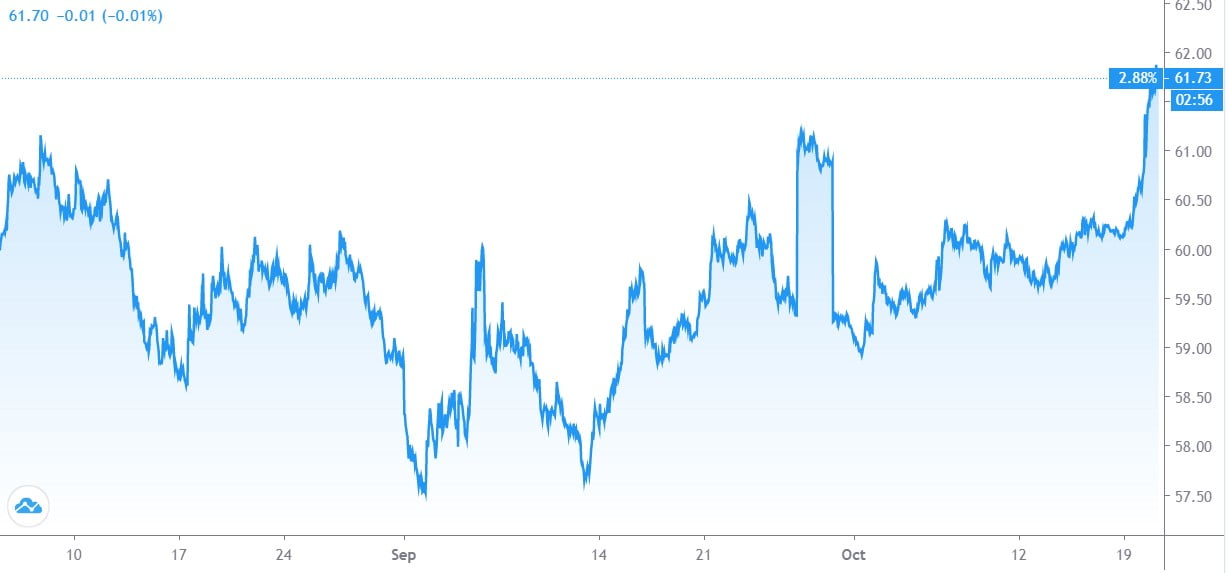

The rise of Altcoin also gained momentum with DeFi popularity, forcing Bitcoin market dominance in August to drop below 60% for the first time in 2020. But September 2020 has been a bit troublesome for the entire cryptocurrency world; altcoins also followed Bitcoin and profits from previous months began to melt. But for the past 1 week, although Bitcoin has shown a stable performance, this time altcoins cannot follow it. This bullish rally continues to be valid only for Bitcoin.

Altcoins are having a nightmare

Bitcoin market dominance has risen to 60.3% today after declining to 55%, and altcoins have declined to 39.7%. Even Ethereum (ETH), which is the leading altcoin in this negative picture, could not survive; Although ETH remained intact, it did not show a significant increase. While ETH market dominance has seen 15% in the last 2 months, it has now declined to around 11%. All charts were painted red in the top 10 among the crypto coins ranked by market value in Coingecko.

Looking at the first fifty, the most losers of the last 7 days;

Crypto.com Coin – 28.1%

OCD – 11.6%

NEM – 15.8%

Zcash – 12.9%

Theta Network – 17.4%

Uniswap – 10.7%

Synthetix Network Token – 21.1%

UMA – 12.5%

Celcius Network – 16%

Compound – 15%

Aave – 33.1%

Bitcoin takes over the wheel

Market experts say that Bitcoin is less and less affected by external developments; They claim to protect itself, showing that it has quickly evaded developments such as the BitMEX lawsuit and the turmoil in the OKEx exchange. Bitcoin loosened its affiliation with other markets a little more; As Bitcoin exceeded $ 12,000, stocks fell and gold fell slightly. Most analysts think this bullish trend could be the start of a new bull run for the leading coin.

Many market commentators and crypto analysts highlighted the critical resistance of $ 12,000, and comments that a new record could be set by exceeding this level prompted investors to abandon altcoins. According to analyst Tony Spilotro, many altcoin investors may have reorganized their portfolios and chose to invest their money in Bitcoin, which could see perhaps $ 20,000 again in the face of Bitcoin’s uptrend.

Spilotro said that Bitcoin’s last two-week candles have closed above the middle of the Bollinger bands. In this chart, Spilotro suggests that the Bitcoin price could increase by an average of 38% and BTC market dominance could rise above 80%. According to the analyst, such a rise can completely neutralize altcoins, just like in 2017.