Binance Coin’s price on the charts has been on a steady uptrend for a few months now. The past 24-hours further strengthened this narrative as the price saw a 2.5 percent hike. With the coin’s price action being limited to an ascending channel formation a downward breakout for the coin cannot be ruled out.

At press time, Binance Coin was trading at $30.4 with a market cap of $4.3 billion and a 24-hour trading volume of $482 million. Over the course of the past week, the coin did face a period of consolidation despite Bitcoin going past the $12K price point.

Binance Coin 1-day chart

Source: BNB/USD, TradingView

Binance Coin’s daily chart shows that the coin’s price action has been limited between the $17-$30 price range since July. The ascending channel formation in most cases pushes the coin into a downtrend once the breakout is established. At press time Binance Coin was being traded at a price point very close to its immediate resistance at $33. While the coin has attempted to breach this resistance on a few occasions in the past, a breach has not occurred yet.

In the coming week if the coin were to remain within this formation then a move towards its immediate support at $25 is quite likely. In case of a downward breakout for the coin, there are two key points of support at $25 and $21 that can help stabilize the coin.

Source: BNB/USD, TradingView

As per Binance Coin’s technical indicators, a slight bearishness can be seen for the overall price action of the coin in the long run. The MACD indicator has now undergone a bearish crossover with the signal line going past the MACD line indicating a minor price correction in the coming few days. The RSI shows a slight divergence and has now moved close to the overbought zone.

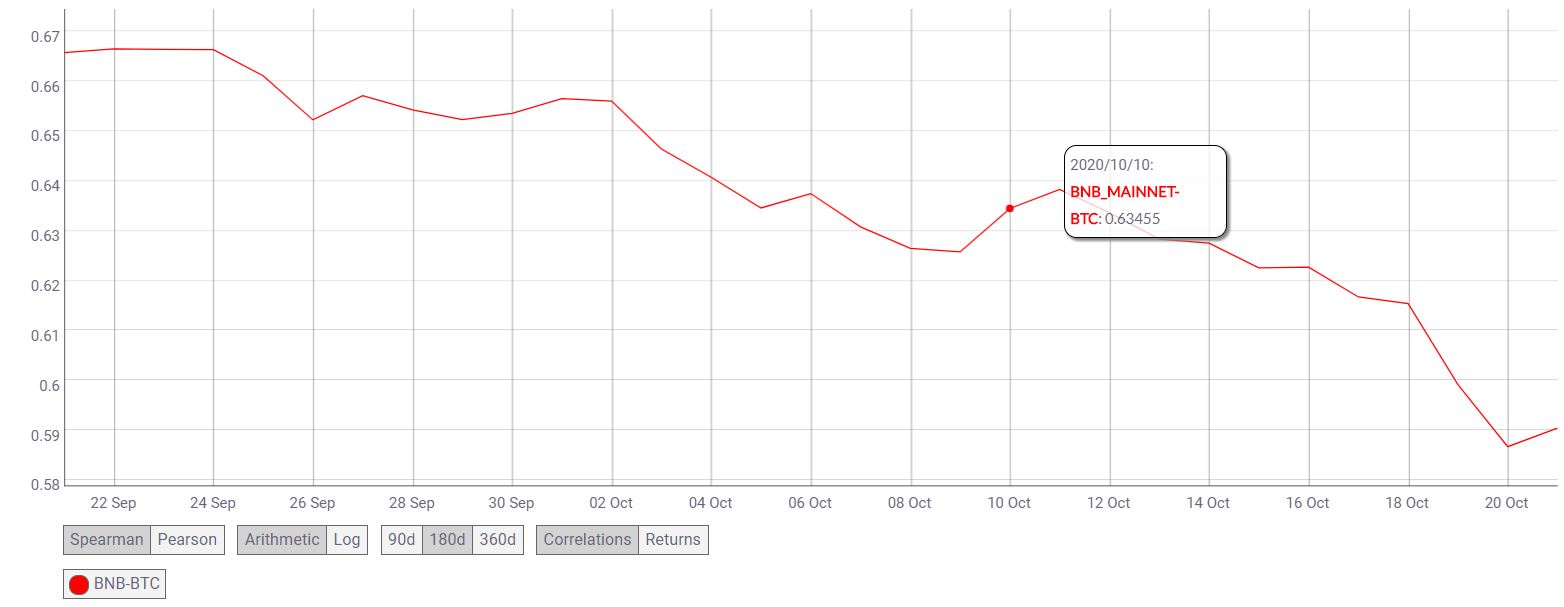

Source: CoinMetrics

While most altcoins tend to move in sync with Bitcoin’s price action, Binance Coin has chosen to stand out. In the past month, BNB demonstrated that price movements independent of that of Bitcoin is possible. The same was reflected in the correlation between BTC and BNB which fell from 0.66 to 0.59.

Conclusion

Binance Coin has been stuck in an ascending channel formation for around 3 months and in the coming week, a minor correction is likely. This can take the price to its immediate support around the $25 price point regardless of whether the price remains within the formation or chooses to break out of it.