Getty Images

Bitcoin has been on fire in 2020, having rallied almost 60% year-to-date to completely dwarf the 7% return on the S&P 500. According to Raoul Pal, a former Goldman Sachs

GS,

hedge-fund manager, the world’s biggest cryptocurrency is just getting warmed up.

Warmed up as in reaching $1,000,000 within five years.

That’s quite an explosion from $11,393, where bitcoin

BTCUSD,

currently sits, but Pal, in an interview with Stansberry Research, says the lofty seven-figure target is realistic.

“Just from what I know from all of the institutions and all of the people I speak to, there is an enormous wall of money coming into this,” said Pal, who currently serves as CEO of Global Macro Investor. “The pipes aren’t there to allow people to do it yet, and that’s coming, but it’s on everybody’s radar screen and there’s a lot of smart people working on it.”

He explained that recovery from the pandemic will take longer than many expect, and the global economy is moving toward the “insolvency phase,” which he believes will boost bitcoin.

“We’ve got more problems to come in Europe, the U.S., and elsewhere,” Pal said. “And businesses don’t have enough cash flow, they’re closing in droves… The only answer is more from the central banks, so that’s why I started to buy more and more bitcoin.”

How much more?

Pal said more than half his portfolio is invested in bitcoin, up from his previous positioning of an equal share alongside cash, gold and stocks.

“My trading positions are relatively small because I don’t think there’s as much opportunity as the room is in bitcoin,” Pal said. “So really, mainly a bit of cash, some gold

GOLD,

and bitcoin. And I’m even toying with the idea of selling my gold to buy more bitcoin.”

Watch the full interview:

Pal isn’t the only bitcoin bull calling for big things to come.

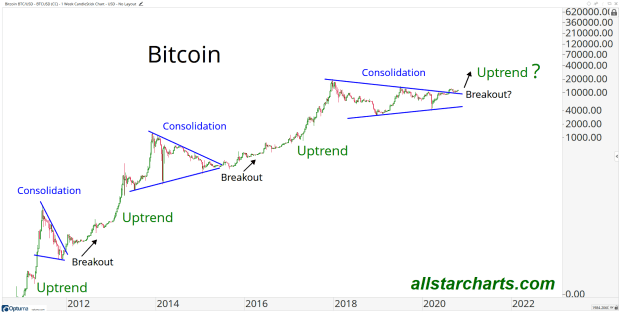

J.C. Parets of the All Star Charts blog took a technical look at trading action lately and determined that, if history repeats itself, bitcoin is about to deliver in a big way for the crypto crew.

Check out his chart:

“If this were one of those tests you took in grade school where they ask you what’s next in this pattern, you would say Breakout and then Uptrend, right?” Parets wrote in a blog post. “It hasn’t done much since breaking out above 10,000. But if we’re above that, this is a long for sure, I think.”

Like Pal, Parets said he believes bitcoin can be a “game-changer.”

At last check, bitcoin was mostly flat Thursday, while the Dow Jones Industrial Average

DJIA,

Nasdaq Composite

COMP,

and S&P 500

SPX,

were all lower.