@thedannylesDanny Les

Strategic Advisor to Startups, Corporates & Investors • Mentor • Entrepreneur • London • Opinions my own •

Nothing in this document constitutes financial advice.

You want to act a degenerate? You do it on your own accord.

Introduction

Unless you’ve been living under a rock these past few weeks you would have definitely heard of Uniswap. It’s visibility in the space has been prominent and only 24hrs ago crypto social media channels exploded with euphoria off the back of the introduction of its $UNI token with a public airdrop to individuals who had used the platform pre September 1st.

But what is Uniswap exactly? And if you’re not able to easily answer that question, you would also be forgiven for not knowing how to use it.

Uniswap is the decentralised swap protocol that has recently taken the crypto market by storm. Fuelled by the new wave of interest in ‘DeFi’ crypto projects, just recently Uniswap outdid Coinbase in exchange volume. To put that into perspective and use analogies tied to my passion for all things Marvel, Coinbase is like the ‘Hydra’ of crypto. Centralised, incredibly well funded and run by a cabal of questionable types in suits hell bent on appeasing their evil investors.

Who opposes Hydra? The Avengers of course! A scrappy, decentralised exchange protocol running on Ethereum and err, unicorns.

Using Uniswap instead of Coinbase, Binance, or any of the other centralised exchanges has significant advantages. Before we get to those, let me give you a brief Uniswap breakdown, so you get the picture.

Following that, I’ll tell you exactly how to use Uniswap so you can ride the degen bandwagon with me and invest in a load of projects you likely have little to no understanding of.

Let’s do this, bitches…

? Uniswap Explained In 1 Minute ?

Decentralised exchanges have been a thing in crypto for a while now.

There was Ether Delta, then IDEX, Kyber, and a few others. Since 2017, none of these ‘DEXes’ (short for Decentralised Exchange) really took off — until Uniswap came along.

Uniswap isn’t a cryptocurrency exchange in the ordinary sense. It’s basically a framework enabling people like you and me to swap tokens directly from our own personal wallets. No intermediaries, no custody, no KYC and no trust required. Follow me down the rabbit hole…

The way Uniswap makes the magic happen is by providing smart contracts allowing you to do three things:

1. Swap tokens

2. Earn fees by adding liquidity

3. Remove liquidity from pools

I’ll go over these three functions in greater depth in a sec, but in a nutshell, Uniswap is a peer to peer marketplace for token trading much like the Pirate Bay is for sharing the latest Brazzers rips.

Advantages of Using Uniswap

Uniswap has a few pretty sexy advantages over traditional crypto exchanges.

● Anonymous — You don’t have to KYC (Know Your Customer verification) to use Uniswap. Instead, trading is done directly from your wallet, so your public wallet address is the only identifier involved.

● Security — Since Uniswap is non-custodial, meaning the protocol doesn’t hold funds, it’s as secure as the Ethereum blockchain itself. Uniswap’s smart contracts have been audited by several teams, including those who verified the MakerDAO contracts.

● New Tokens — Anyone can create an ERC20 token and pair it with ETH to generate liquidity for the new pool. For those that don’t speak Flemish, this means Uniswap gives you instant trading access to new tokens faster than anywhere else.

● Low Fees — All it costs to use Uniswap is a small 0.3% fee per trade. Centralised exchanges tend to charge 0.5% or more per spot trade.

● Trustless — Unlike at centralised exchanges, you hold your private keys when you trade using Uniswap. You’re the custodian of your tokens and trade them directly with the liquidity pools.

Disadvantages of Using Uniswap

Even though Uniswap sends tokens to your wallet via unicorns on the Asgardian Bifrost, there are, unfortunately, a few downsides.

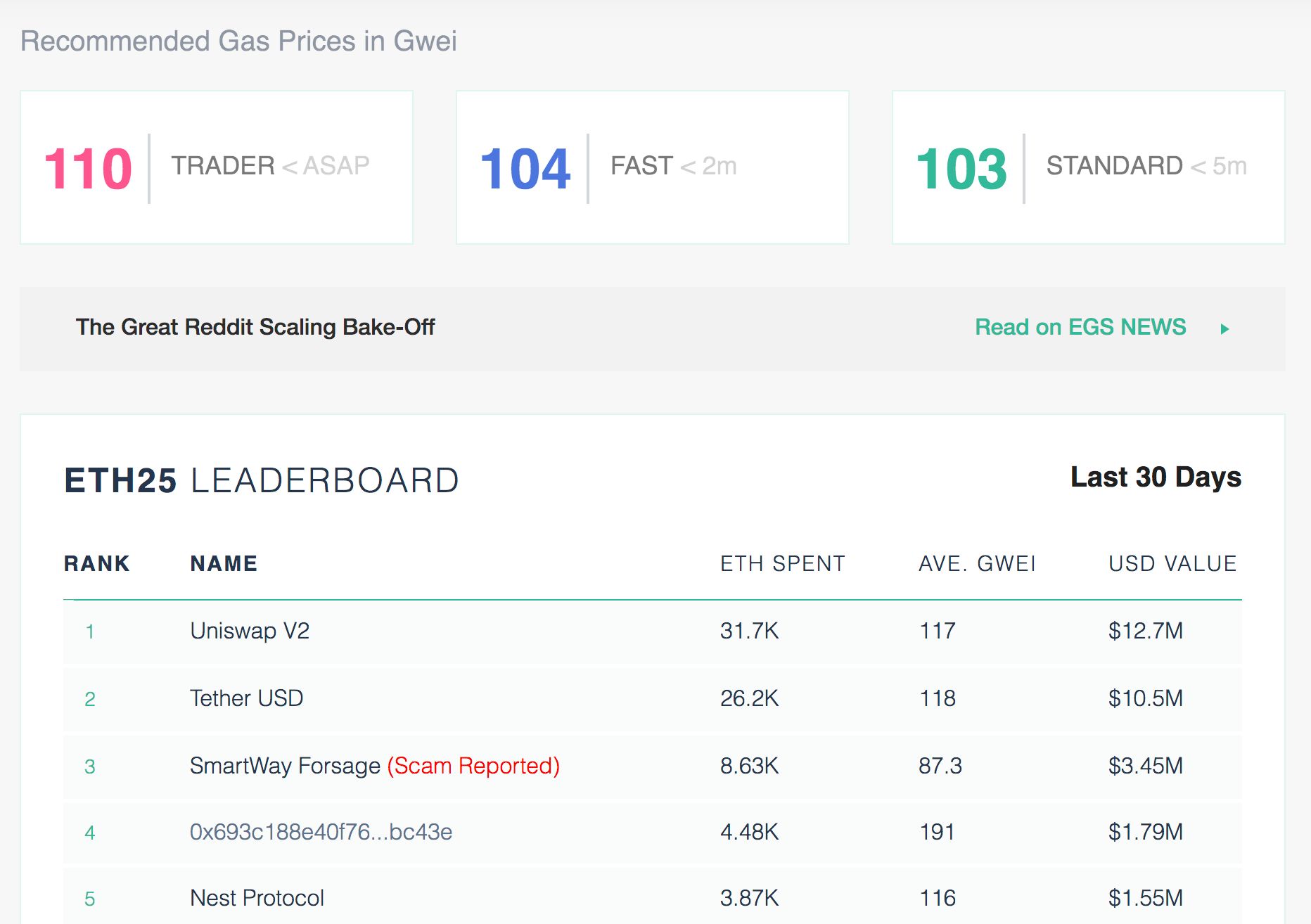

● Gas Fees — Since Uniswap runs on Ethereum, interactions with Uniswap smart contracts all require gas fees paid in ETH. As was seen in August 2020, too many Uniswappers equaled Ethereum network congestion which in turn translated into high gas fees. Ethereum 2.0 should alleviate this issue, though (Another time, another guide).

● Failed Txs — If you don’t set your gas limit fees correctly, your transaction might fail. When it fails, you still pay for the attempt, meaning you lose gas fees but don’t get the trade you wanted.

● Scam Tokens — The advantage of anyone being able to create liquidity for tokens has a downside. Scammers create fake tokens to sucker people into providing liquidity for them. There are easy ways to spot these, which I’ll explain later.

How To Use Uniswap — Guide To Token Swap

When you trade tokens using Uniswap, you’re just swapping them. Users add token liquidity to pools before you come along and deposit your tokens. In return for your deposit of token A to the pool, you receive token B in your wallet.

Anybody can use Uniswap, and even more interestingly, since Uniswap is a protocol, anyone can create an application on top of it. Despite that, Uniswap’s original app is still the most popular.

Alright fuckers, let’s get swapping.

Get a MetaMask Wallet

Before we get into Uniswap, the first thing you should do is create a MetaMask crypto wallet. MetaMask lets you connect to blockchain applications like Uniswap from your browser — it’s pretty handy.

You can connect to Uniswap with other wallets like Trust Wallet or Coinbase wallet, but MetaMask is the most stable and trusted wallet to go with here in my opinion. At the end of the day, it’s best not to complicate things — most Uniswappers use MetaMask.

MetaMask installs as a browser extension. After installing, create your account, write down your seed phrase (don’t ever lose or share this), and you’re good to go.

Buy Some ETH

When researching other Uniswap guides I noticed most forget to tell you that you will need ETH in your wallet before you do anything.

Uniswap only deals in Ethereum-based digital assets, otherwise known as ERC20 tokens. To swap these, you have to pay a gas fee to the Ethereum blockchain — gas fees are paid in ETH.

Even if you already have ERC20 tokens and want to trade these for ETH or other ERC20s, you’ll still need Ethereum to cover the gas so be warned. If you don’t have ETH in your MetaMask wallet, your trades won’t go anywhere. There is no way around this.

How much Ethereum should you buy? Well, it depends on how much swapping you plan to do and how congested the network is.

The best way to calculate all of this is to visit the gas station — ETH Gas Station

You should always plan on a roundtrip, which means gas for the swap, plus gas to move your new tokens back to Uniswap if you’re trading, or another wallet (such as a hardware wallet)

Head over to Uniswap

Jump over to Uniswap.org. Once there, you’ll see two options:

1. Launch App

2. Read the Docs

Since this is your first time, it wouldn’t hurt to read the docs first. There’s a lot of big language stuff about automated liquidity protocols etc. If you care, these docs are a great read.

If you just want to swap some shitcoins, keep moving.

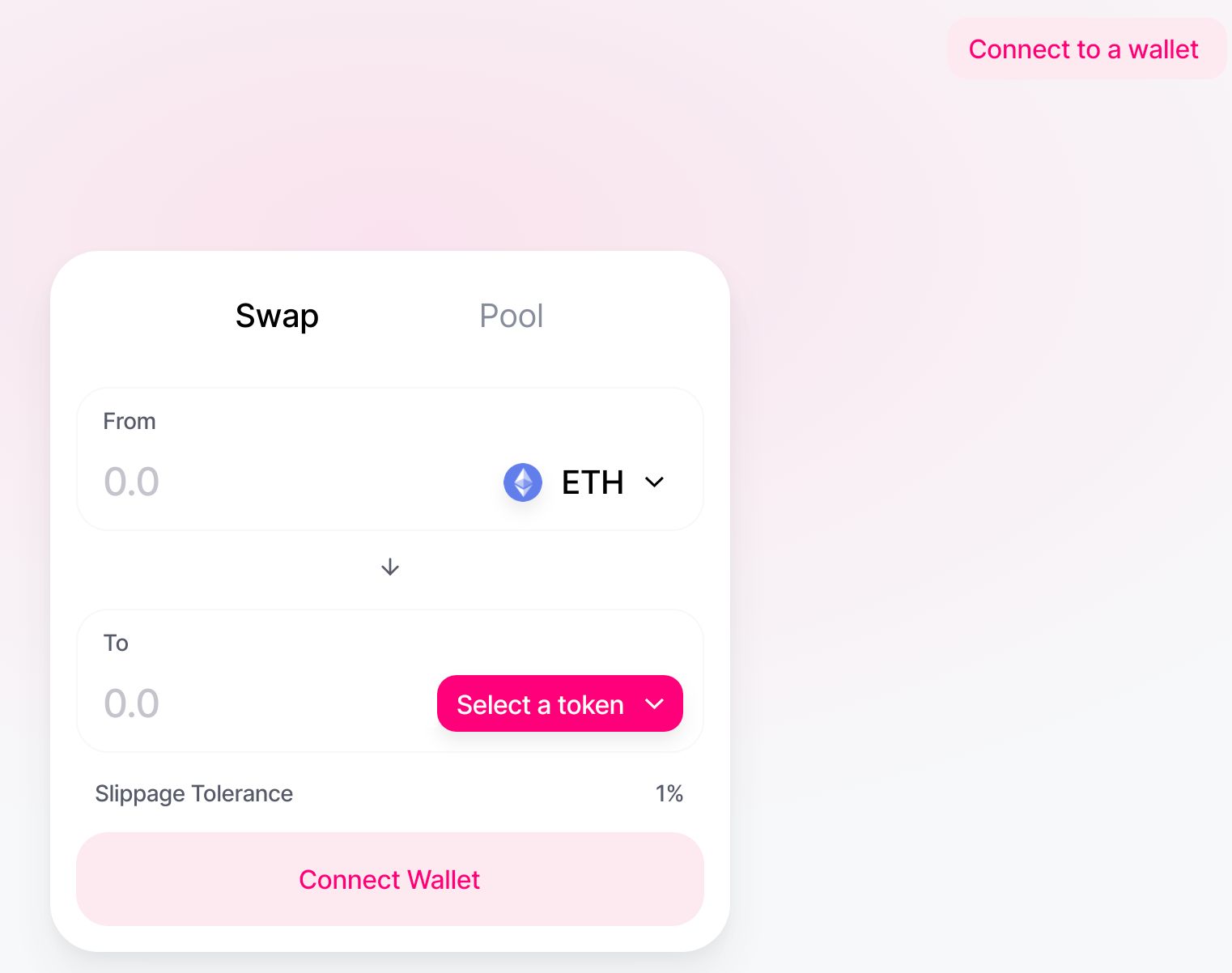

Launch Uniswap App

It’s go time. Click Launch App. This is the screen you find:

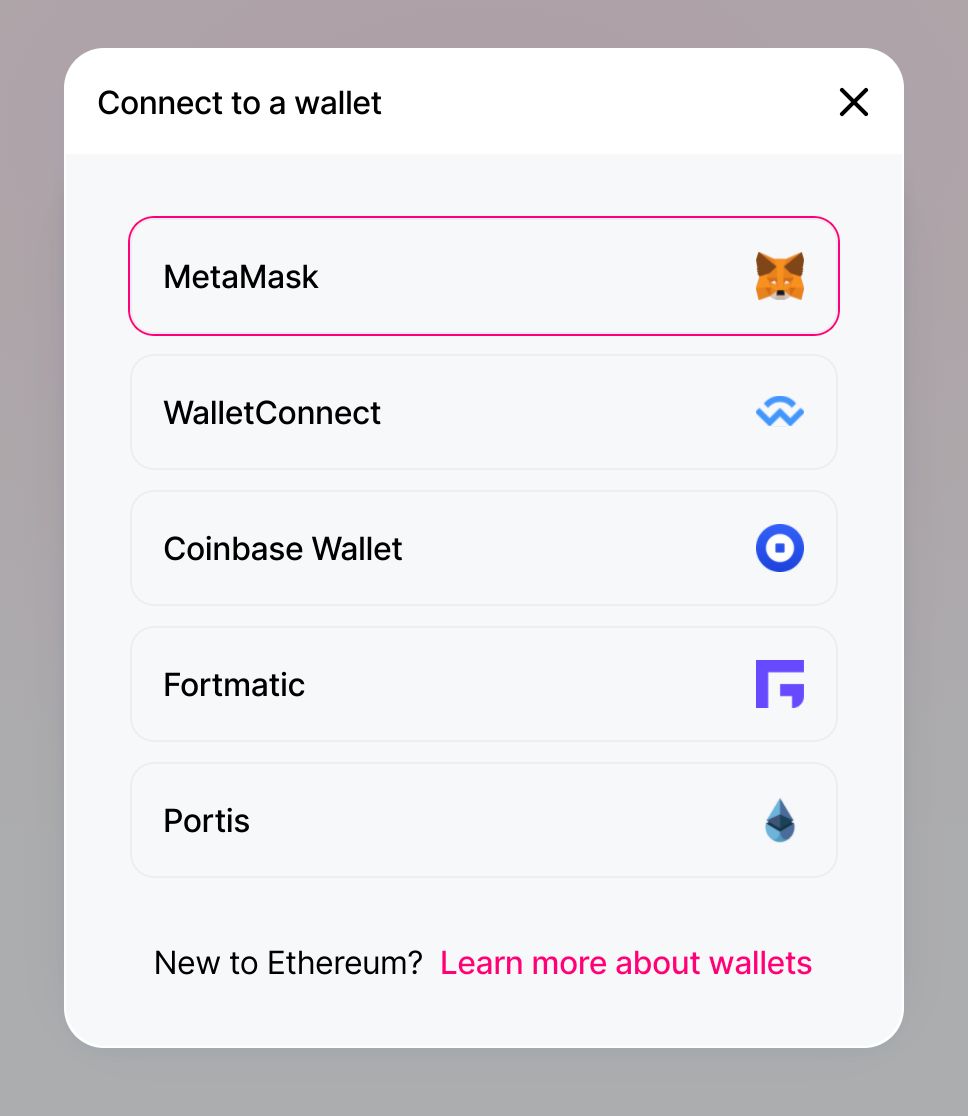

Assuming you’re logged out of MetaMask, you’ll see the option to connect to a wallet in the upper right-hand corner. Go ahead, click it. Now you get the connect to a wallet screen.

Click MetaMask, which will pop up your MetaMask extension and prompt you to log in. Enter your credentials. Once done, you’re taken back to the swap screen. Now It’s time to swap.

Select a Token

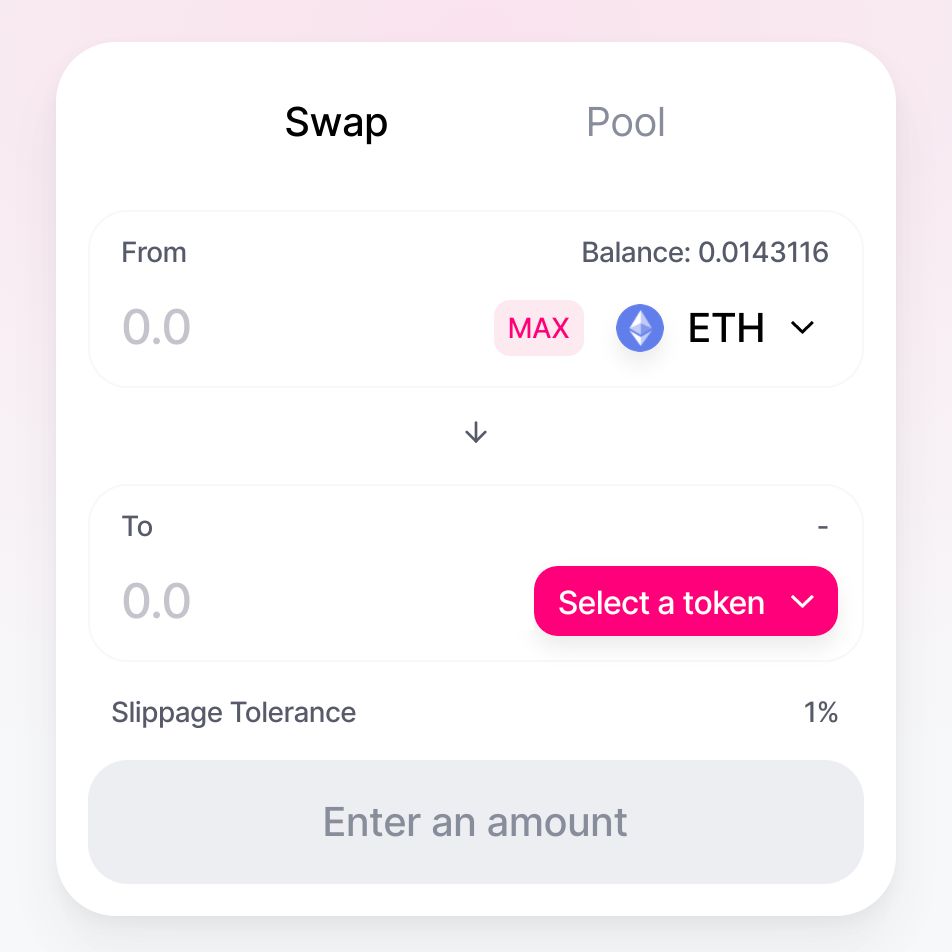

If this is your first time using Uniswap, you’re probably trading ETH for an ERC20 token. By default, Uniswap has ETH in the from field and allows you to select the token of your choice in the to field.

This means you’re sending ETH from your wallet to the liquidity pool for the token selected.

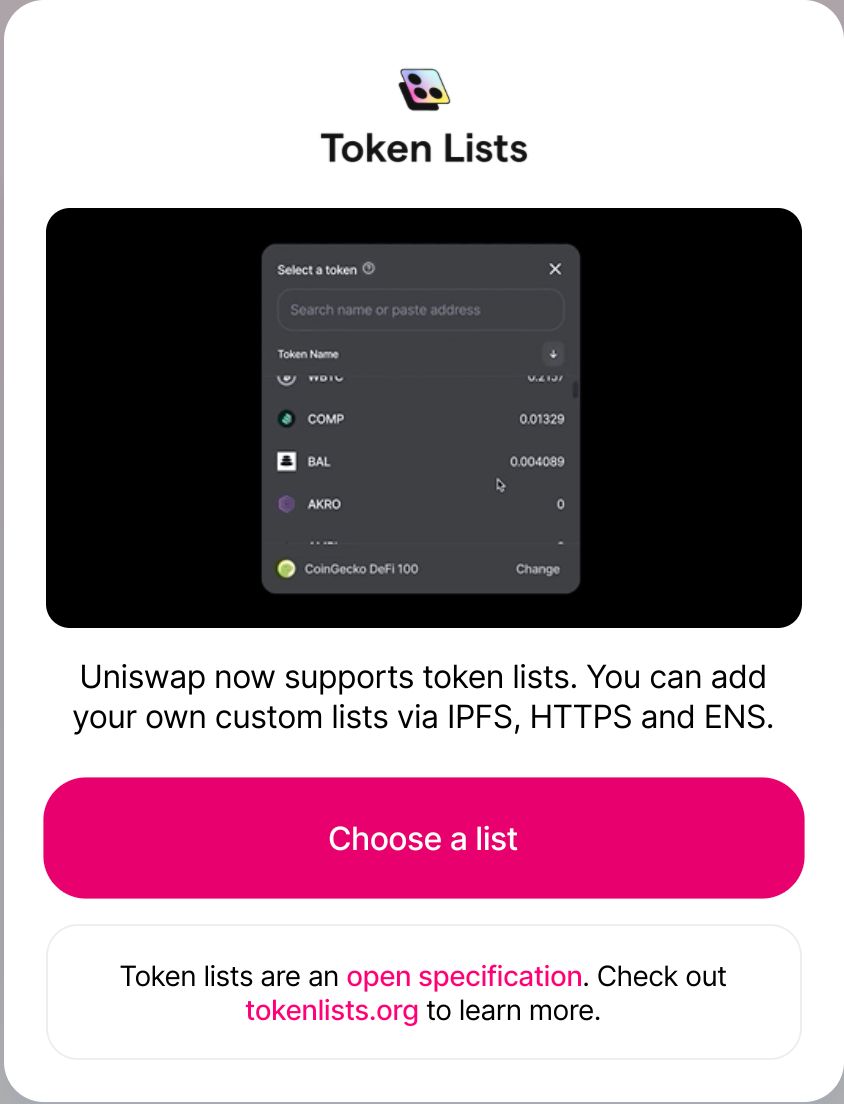

Clicking select a token brings up a token lists screen. These are pre-packaged lists of tokens according to categories, making it easy for you to browse tokens along the lines of your interests.

Choose a list, then browse and select the token you want.

Pro tip: If you know ahead of time which token you want to buy, use CoinGecko to get the token contract address, then paste it at the end of → https://uniswap.info/token/. This method takes you directly to the token and lets you trade or add liquidity.

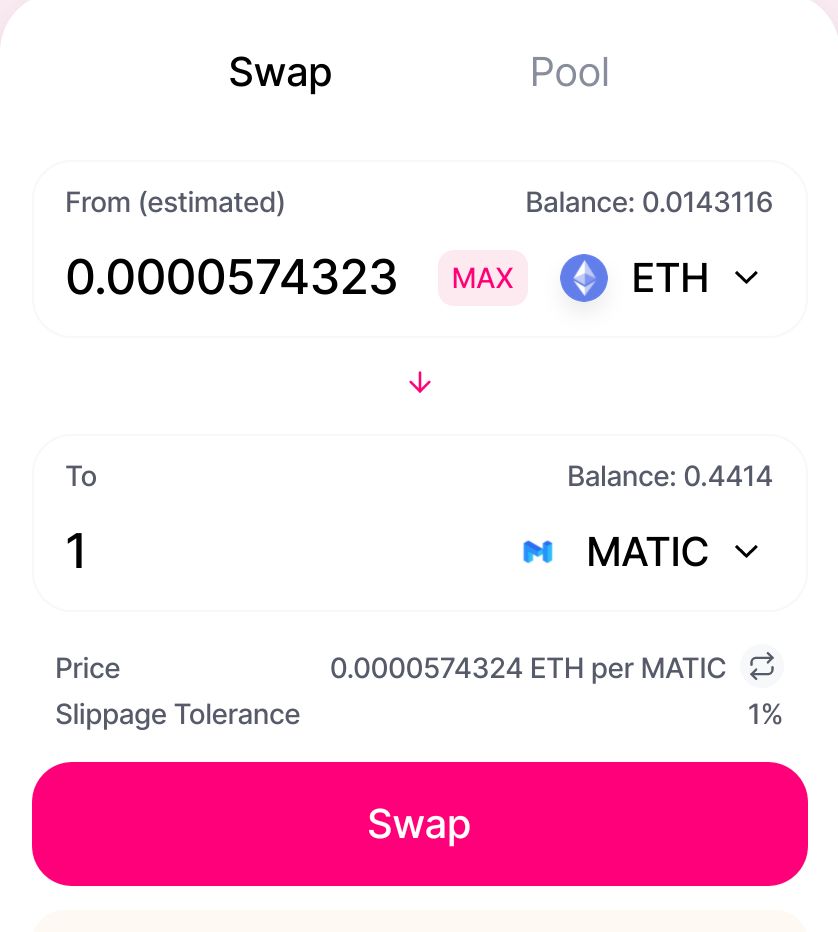

Enter Amounts

Now, enter the amount of ETH you’re swapping in the from line.

The to line will populate with the equivalent amount for the token you’re buying.

Something to be aware of here is the line below the to field about slippage tolerance. Basically, slippage refers to your buy size relative to the amount of liquidity in that pool. If you have a large order relative to the pool size, slippage will increase (and your exchange rate declines).

In practice, slippage happens when you enter your order, click swap, but get an error because the price changed between when you entered the order and clicked swap.

Less slippage = higher chance of the token’s price shifting = greater odds your transaction won’t happen. This is especially true for hot new tokens with tons of trading action happening. To mitigate this issue, you can increase slippage tolerance.

Remember though, the trade-off is more slippage tolerance means fewer tokens.

Hit Swap

Once everything is set up correctly, and you’re ready to go, hit swap.

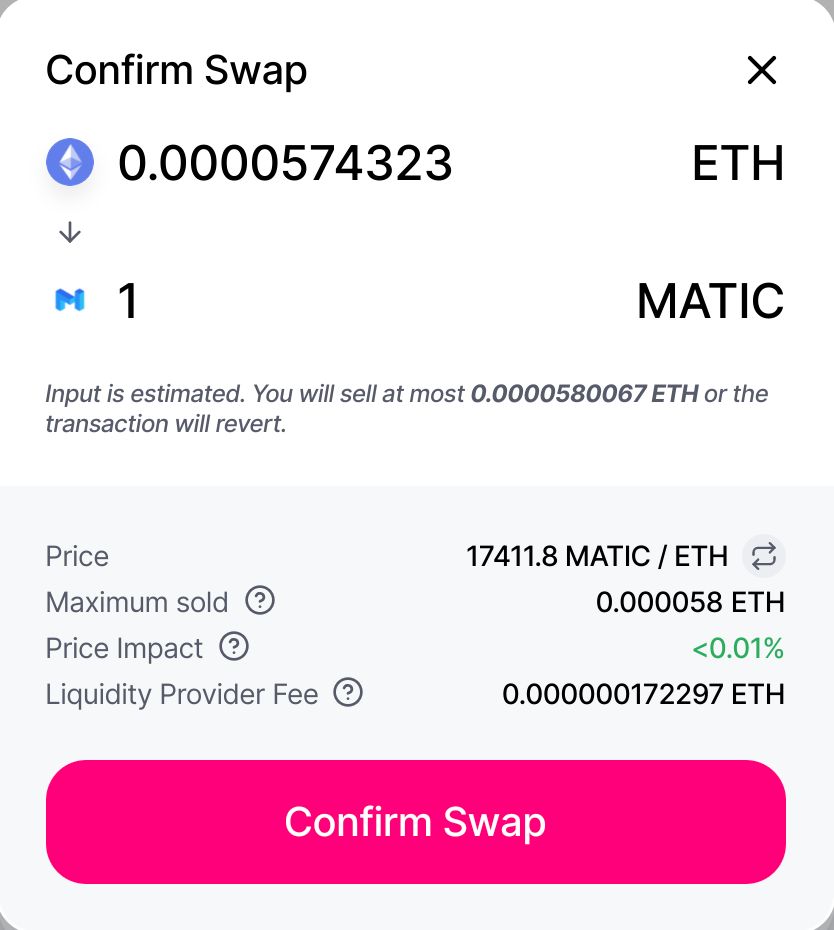

The next screen confirms the details of the transaction. If all looks good and as it should, Confirm swap.

After you confirm the swap, MetaMask will pop up, asking you to confirm or reject the transaction.

Well go on then, confirm the transaction!

Receive Tokens

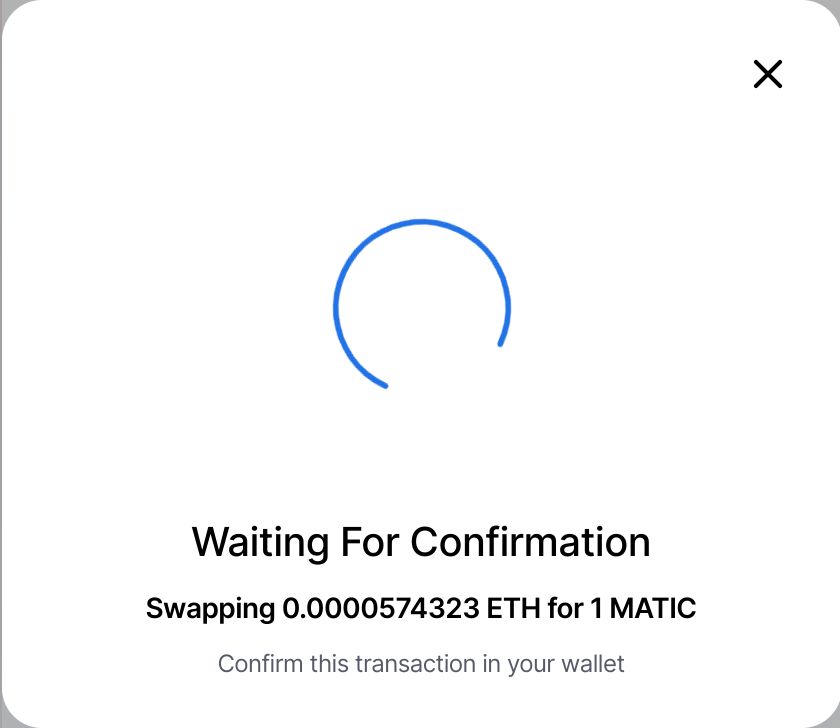

Once you confirm the transaction in your MetaMask wallet, you have to wait a few moments for the tx to hit the blockchain. You can watch this process in action by clicking the Etherscan link given by Uniswap.

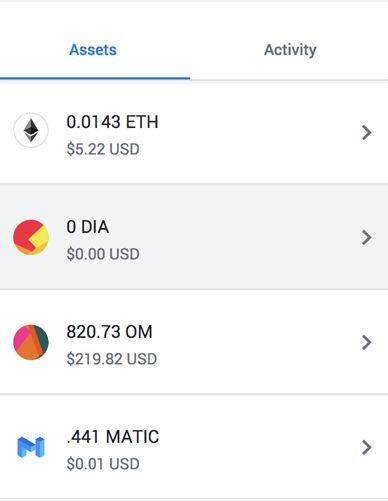

The more congested Ethereum is, the longer these confirmations will take. After a short wait, you’ll see your tokens in your MetaMask wallet by clicking assets.

You can now keep these tokens in your MetaMask wallet, sell them when (if) they moon, or simply throw them in a cold storage wallet and forget about ’em till 2030 (Good luck with that shit). The choice is yours!

Uniswap Tips, Tricks, & Shortcuts

Uniswap is a very straightforward exchange protocol, but, to the uninitiated, there are few tips and tricks to make your experience drama-free.

How To Avoid Scam Tokens

Avoiding scam tokens is your top priority. Uniswap lets anyone create liquidity for any ERC20 token — even tokens that are ‘Sexton’ (cockney: ‘Sexton Blake = Fake).

For example, a hyped token $CUCK (Not real) is hitting the market any day now. People can’t wait. Suddenly, $CUCK shows up on Uniswap. Wait, the $CUCK team hasn’t confirmed anything, you wonder whether you’ve caught it early.

People start throwing ETH at it. There’s $100K sent to the pool before you know it when suddenly the real $CUCK team updates their Telegram saying they haven’t released the token or pictures of their gf’s getting railed yet.

Avoiding scams like this is simple — always verify token contracts using CoinGecko and Etherscan.

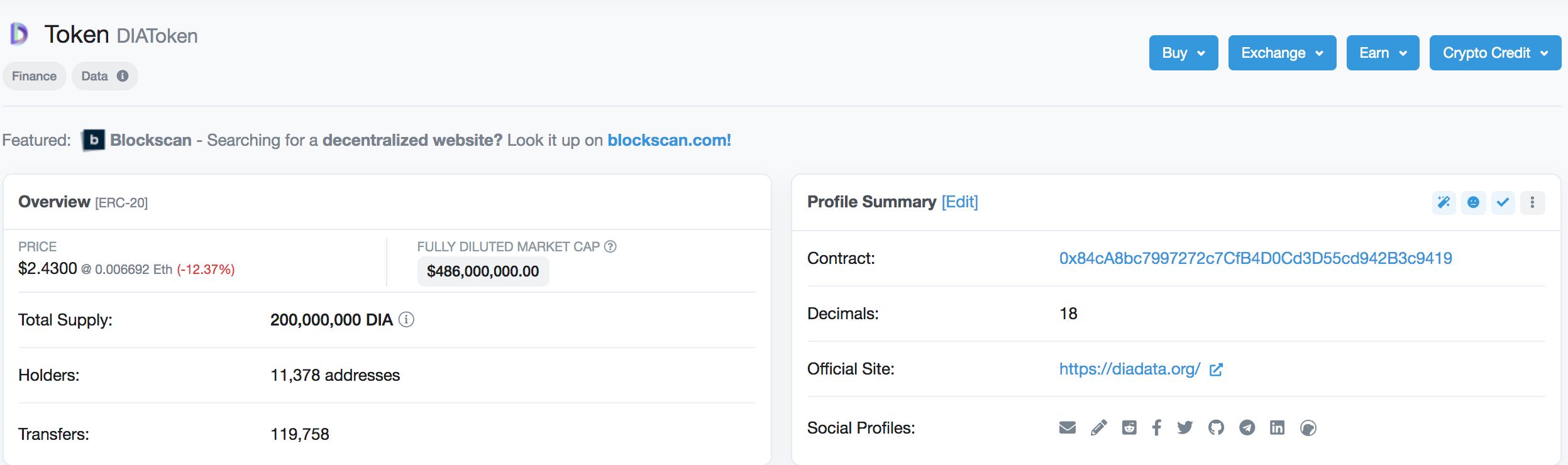

On Etherscan, there’s a convenient field called holders. This is the number of wallets holding the token. This field should have many holders — if you see a token with a suspiciously low number of holders, it’s likely ‘Sexton’.

Always triple check the contract address so that it lines up on Uniswap, CoinGecko, and Etherscan before swapping.

Avoiding Failed Transactions

Nothing pisses me off more than a failed transaction.

You don’t get the tokens you wanted, and ETH gets deducted from your wallet to cover gas.

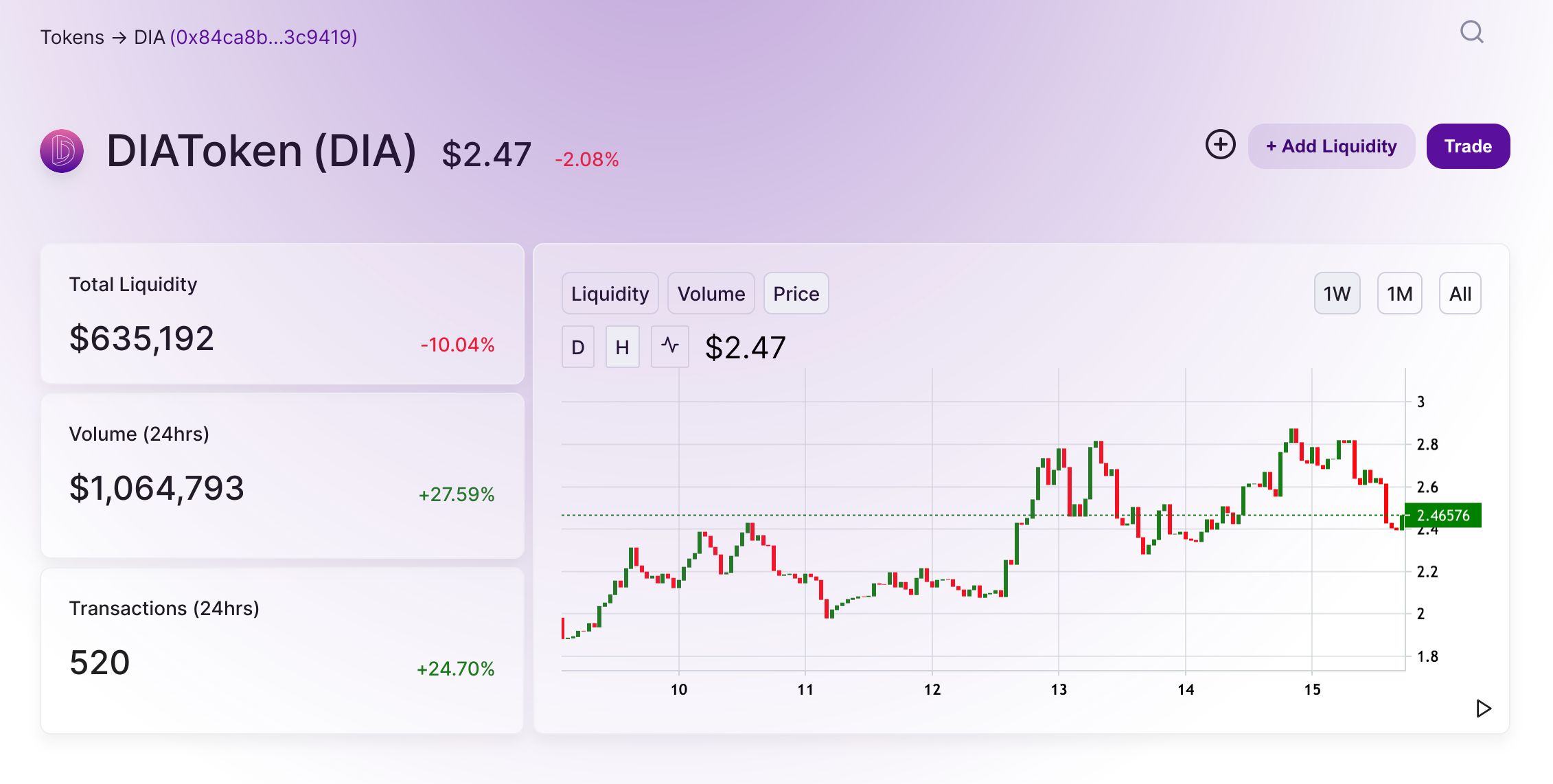

The best thing to do is to avoid failed Uniswap transactions in the first place. To do this, make terrific friends with the Uniswap analytics page.

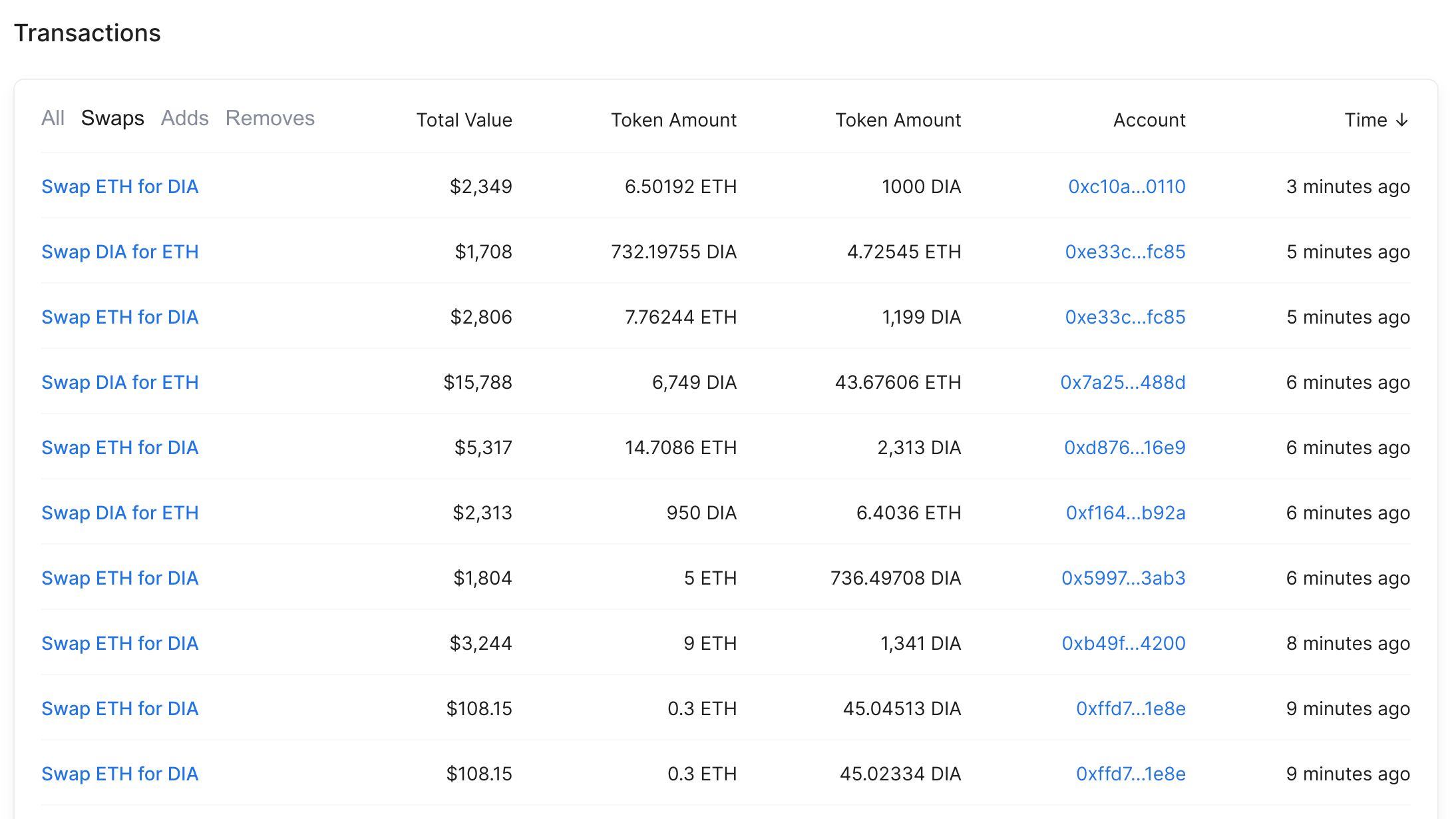

Search for the pair you want to trade — let’s use DIA-ETH for this example.

Now, scroll down to transactions, then click swaps. On the left column, you’ll see swap ETH for DIA and swap DIA for ETH. Click the one that applies to your swap.

This will take you to the blockchain record for that swap, allowing you to see the transaction details. Scroll down to the transaction fee field, then click to see more just below it.

See all that data? You view a few transactions like this to see what gas price (GWEI) was used in recent successful transactions. Use this info to set your swap for success ahead of time.

Conclusion — Uniswap. I like it. A lot.

Much like my wife, Uniswap is far from perfect, but you’ve got to give it a bit of leeway.

This is the cusp of decentralised exchange technology, and it’s so well adopted that even Binance is feeling the heat. That’s why they’re listing digital assets more quickly these days, lest Uniswap take all the exchange volume away. Even more amusing is that since the $UNI token airdrop I mentioned at the start, Binance, Coinbase et al were quick to make $UNI trading available to their users in order to not lose face.

Getting Uniswap straight off the bat will, of course, make your experience a happy one. If something goes wrong, fear not. Instead, consult this guide again because it feels good to know that the time spent married to my bong and writing this guide, helped you use Uniswap for the first time successfully.

Fin.

You can follow me on Twitter: @TheDannyLes

Useful links:

Uniswap — https://uniswap.org/

Metamask — https://metamask.io/

ETH Gas Station — https://ethgasstation.info/

Coingecko — https://www.coingecko.com/en

Etherscan — https://etherscan.io/