- Decentralized exchange protocol Uniswap has launched its governance token UNI which is airdropped to all users.

- The Ethereum network congestion and thus the fees have skyrocketed after the launch of UNI.

Another giant on Ethereum ‘s DeFi sector has introduced a governance model to engage its users. The Uniswap protocol launched UNI, unleashing a frenzy of users rushing to claim their reward. According to Uniswap’s announcement, 60% of the UNI genesis supply is allocated to Uniswap community members, a quarter of which (15% of total supply) has already been distributed to past users. The team behind the platform stated:

Uniswap governance framework is limited to contributing to both protocol development and usage as well as development of the broader Uniswap ecosystem.

In doing so, UNI officially enshrines Uniswap as publicly-owned and self-sustainable infrastructure while continuing to carefully protect its indestructible and autonomous qualities.

In total, 1 billion UNI have been minted at genesis and will become accessible over the course of 4 years. The protocol will make the following supply allocation: 60% will go to members of the Uniswap community, 21.51% to team members and future employees with 4 year vesting, 17.80% to investors with 4 year vesting and 0.69% to protocol advisors with 4 year vesting, as shown in the image below. After 4 years, an annual inflation rate of 2% will begin to encourage participation in Uniswap.

Source: https://uniswap.org/blog/uni/

However, the revolutionary thing about the Uniswap model, as mentioned, is that it will give a percentage of the total UNI supply to all users who have ever used their smart contract, until September 1; even to users who had failed transactions. These users can claim their 400 UNI reward immediately if they were once liquidity providers, users, and SOCKS redeemers/holders.

In total, according to Uniswap’s estimates, there are about 251,000 users. 1000 UNI are claimable by each address that has either redeemed SOCKS tokens for physical socks or owned at least one SOCKS token at the snapshot date. The Uniswap team further stated:

With 15 % of tokens already available to be claimed by historical users and liquidity providers, the governance treasury will retain 43% [430,000,000 UNI] of UNI supply to distribute on an ongoing basis through contributor grants, community initiatives, liquidity mining , and other programs.

For users who want to do yield farming, Uniswap announced the launch of 4 liquidity pools available from September 18 this year at 12:00 am UTC until November 17. 83,000 UNI will be allocated to these groups which will operate with the following pairs: ETH/USDT, ETH/USDC, ETH/DAI, ETH/WBTC.

High fees return to the Ethereum network

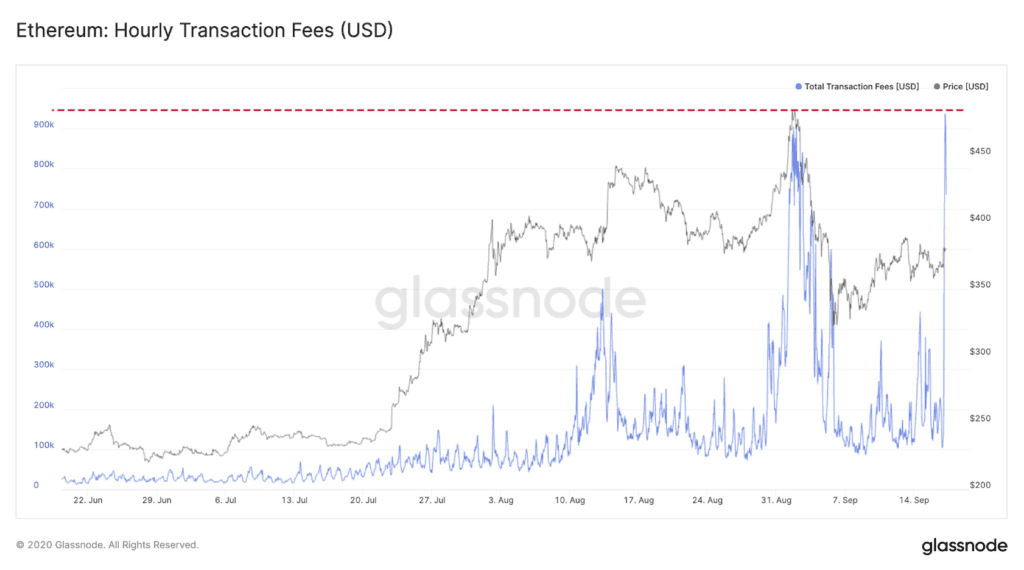

The activity of users in the protocol, with the aim of claiming their tokens, had a direct impact on the increase of transaction fees in the Ethereum network. Data from the Glassnode firm indicate that after the launch of UNI, $1 million in fees were spent in just one hour setting a new historical record, as shown below.

Source: https://twitter.com/glassnode/status/1306520090326822913

At the time of publication, Eth Gas Station recorded that the standard fee for sending a transaction on the Ethereum network is 267 Gwei, the “fast fee” is 405 Gwei and the trader’s fee is 450 Gwei. The Uniswap V2 protocol is the number one ETH spender with 31.7 thousand ETH ($12.7 million) spent in the last 30 days and an average spend of 117 Gwei per transaction.

Regarding the current status of the Ethereum network, former Monero lead maintainer Riccardo Spagni commented:

ETH gas fees at ridiculous levels again. Just sending a simple ETH transaction costs $3.20 unless you want to wait for an hour, and you can forget about doing anything that involves a smart contract.