The Case for a Second COVID-19 Ripple, Not Wave by Greg Presseau Of Perennial Capital

Q2 2020 hedge fund letters, conferences and more

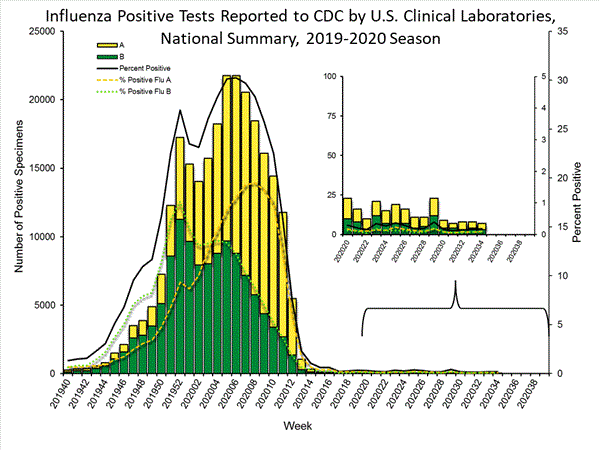

While the COVID-19 vaccine is within reach, we are left wondering if the return of COVID will resemble a normal flu season, starting around mid-Nov and crescendos to the SH Jan/FH Feb. Looking at CDC data we see seasonally the flu follows the below pattern:

This year’s digital assets bull market is nothing like the one seen in 2017, according to Jeff Dorman, the chief investment officer of the Arca Digital Assets Fund. According to a copy of the firm’s August investor update, which ValueWalk has been able to review, Arca is up 250% for the year to the end Read More

Source: CDC

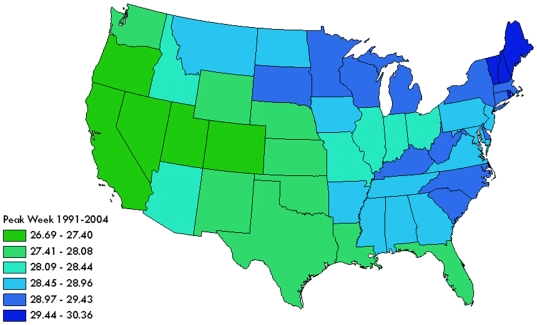

What’s interesting to think about is how the flu is transmitted and how each region will have varying peaks/severity. According to Wenger and Naumova in their paper “Seasonal Synchronization of Influenza in the United States Older Adult Population”, the spread of the flu normally migrates from west to east where the former peaks earlier than the latter as per the map below:

Source: Wenger & Naumova, “Seasonal Synchronization of Influenza in the United States Older Adult Population”

A COVID-19 Ripple

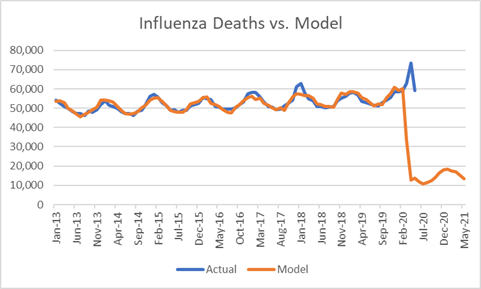

Something interesting that the authors attributed to the spread of the virus between regions is air travel. Air travel is at 11% of trend through May 2020. Using two inputs, NYC average weather per month (a proxy for seasonality) and the % of trend in airline travel we can create a basic multi-regression for flu related deaths (I couldn’t find flu infections but assume deaths are highly correlated with infections). Assuming that air travel remains stagnant, we see a much lower rate of infections/deaths. I.e. a COVID-19 ripple, not a wave:

Source: CP Capital, Bloomberg

We are hopeful that we will get a vaccine just in time before the flu season kicks off and our adherence to mask rules coupled with limited air travel/public transport use will reduce the second wave to a COVID-19 ripple.