The Ripple XRP price has rallied in the last week with BTC after the U.S. dollar bounce started to fade but there is still a chance of a USD breakout and that could drive further lows in XRP.

The U.S. Federal Reserve central bank announced yesterday that they plan to keep rates low as far out as 2023 if the economy requires stabilization. The reality there, as with most central banks, is that as debts have grown, an uptick in rates would squeeze government spending requirements higher. This will see policy makers holding rates as low as they can, indefinitely.

The threat still exists for a further crisis in the financial markets and this has been sped up by the Coronavirus response. Many commentators have said that the virus will quicken the adoption of digital currencies. We have seen this become a real talking point in U.S. politics where lawmakers showed concern over China’s move into a digital Yaun, while some tried to push a digital wallet into the first stimulus bill as a means of delivering financial support.

At present, developers quietly seek to improve their processes and technologies, which leaves the crypto market at a standstill in price discovery, where Bitcoin still drives the market as it follows the ups and downs of the U.S. dollar. This may change with further adoption of digital currency but for now, it can still force losses if the U.S. economy recovers without a larger stimulus.

Ripple XRP Technical Outlook

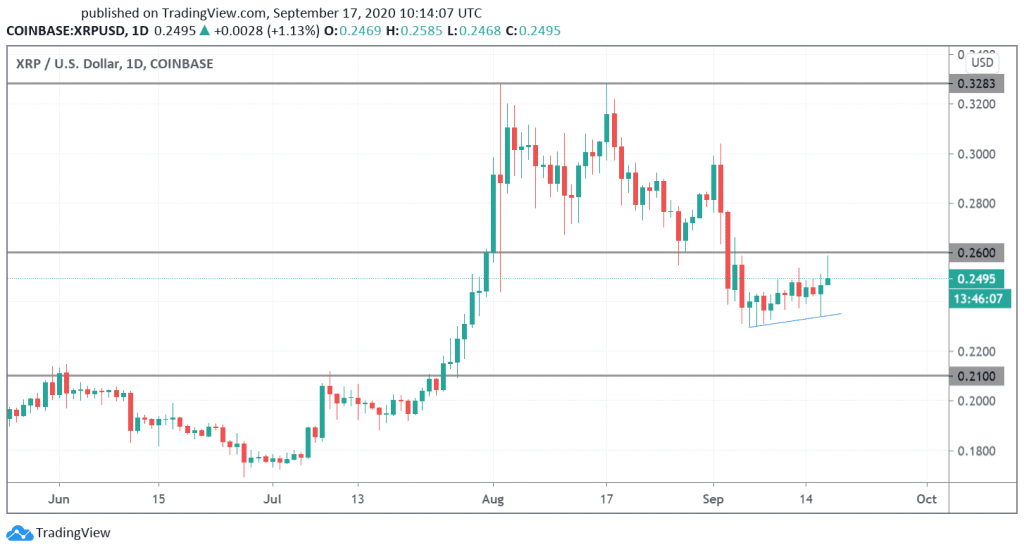

The price of Ripple XRP has risen after the push higher in BTC this week, but the price move in both coins lacks strength. The drop to $0.2500 puts XRP at risk of further lows if it can’t get above the recent resistance and a drop to $0.2100 would be possible. The Investing Cube team is available to assist all levels of traders with a Forex Trading Course or one-to-one coaching.

Don’t miss a beat! Follow us on Telegram and Twitter.

Ripple Price Daily Chart

More content

.png)