POLAND – 2020/06/15: In this photo illustration an Ethereum logo seen displayed on a smartphone. … [+]

SOPA Images/LightRocket via Getty Images

Since last Friday, Ethereum has increased by over 20% further padding its 2020 gains. Ethereum has been one of the brightest stars in the current bull market for digital assets, gaining 261% in 2020 compared to 65% for bitcoin.

https://www.coinbase.com/price/ethereum

The principal driver for $ETH’s growth has been the enormous boom in decentralized finance (DeFi) given the majority of the DeFi networks are built atop the Ethereum platform. For example, the alphabet soup of hot tokens — $YFI, $YAM, and $SUSHI (to name a few), have experienced meteoric price increases, 107,761%, 446%, and 1,358%, respectively.

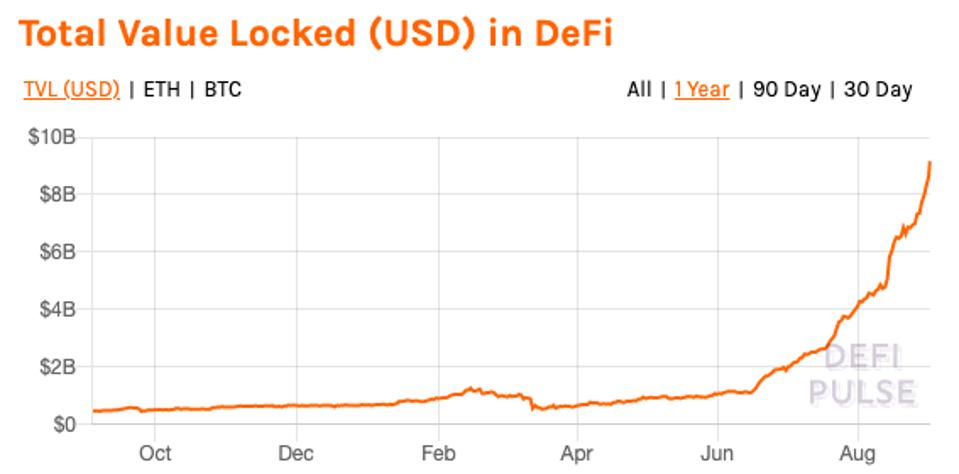

Most importantly, the DeFi boom has accrued value to Ethereum via greater developer interest, i.e. building the the next “unicorn” DeFi token on Ethereum rather than competitors. This dynamic can be visualized by the Total value locked-up (TVL) on DeFi, which has dramatically increased from less than $1 billion to over $9 billion in 2020.

https://defipulse.com/

Josh Olszewicz, Market Analyst at Brave New Coin, notes that the aforementioned dynamic is identical to the initial coin offering (ICO) boom in terms of organic demand driving $ETH price. For example, in 2017 if you wanted to launch an ICO, you needed to buy $ETH to do so, similarly with DeFi token launches today. Thus, until the speculative frenzy for DeFi cools, $ETH price could conceivable rise back to 2017 levels.

Additionally, former Quant Trader, Qiao Wang, notes since DeFi tokens are largely illiquid and traded on decentralized exchanges (DEXs) with $ETH as a trading pair — when speculators take profits, they sell DeFi token $X and buy $ETH, thus boosting price.

The question for bitcoin is whether DeFi can find a legitimate use case for synthetic $BTC ($WBTC), i.e. bitcoin “wrapped” in a way to be compatible on the Ethereum blockchain?

https://twitter.com/QWQiao/status/1300410024632766469

If so, then bitcoin could begin to benefit from the same feedback loop as Ethereum, thus an additional boost to price beyond its current store of value utilization.

It is too early to state, but TVL trends of $WBTC in 2020 suggest that this process is already underway, thus a potential boon for bitcoin price could be in the making as long as the “music continues to play” for DeFi.

Glassnode.com

Disclosure: Author owns bitcoin and ethereum.