The price of Ethereum reached $490, about 11% under our bullish target of $550. Can Ethereum still reach the $550 mark?

Ethereum Price Forecast – Ethereum reaches $490 then follows Bitcoin’s dump!

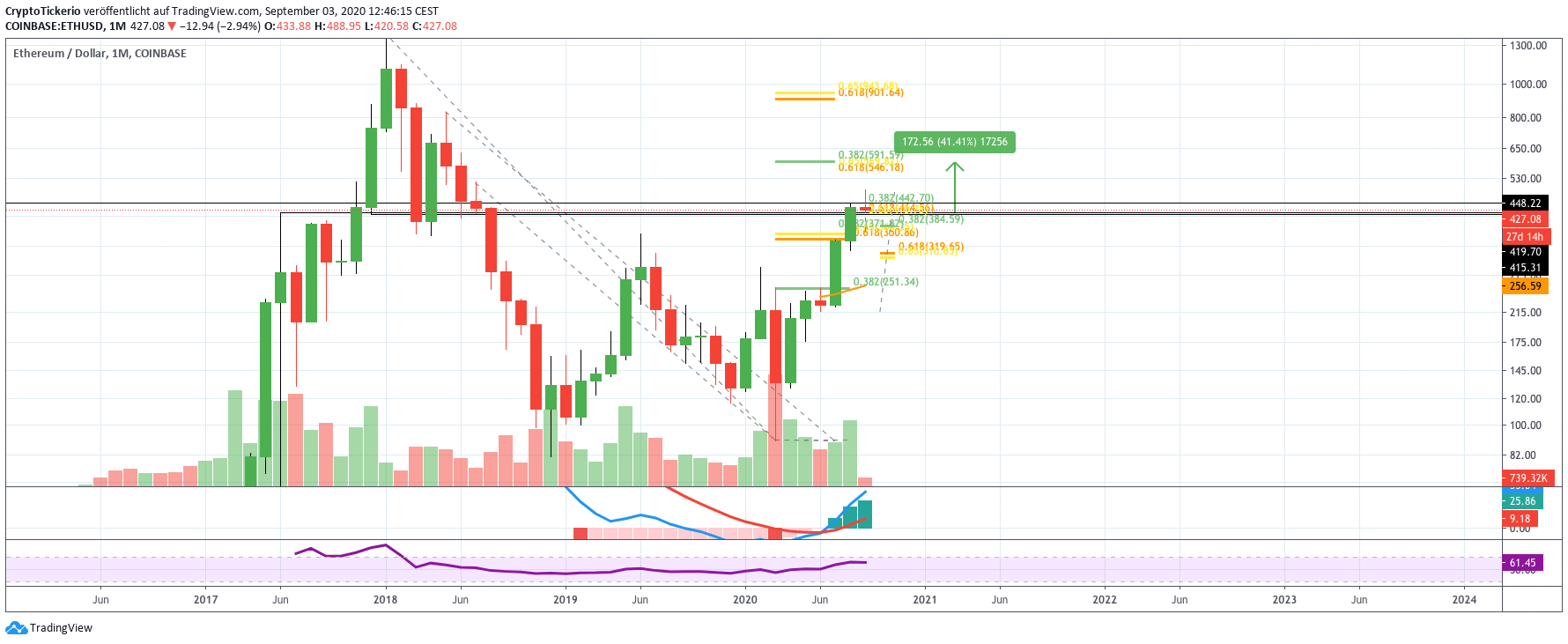

The Ethereum price was able to break the horizontal resistance between $415 and $448 and rose all the way to $490. Meanwhile, a bearish divergence was forming in the RSI and the histogram, which was followed by a strong correction. Currently at $428, Ethereum finds itself in the middle of the horizontal resistance, which now serves it as support. The Ethereum price was able to bounce at the golden ratio around $414 and ended the correction to retake its upwards trend. But should this support break as well, Ethereum should find important Fibonacci support levels between $360 and $380, and in extreme cases around $315 an important golden ratio support.

As long as one of these levels hold, the Ethereum price could again be on its way to the $550 mark!

Ethereum Price Predication – only a small correction?

In the weekly charts the EMAs are on their way to form a golden crossover. This would indeed be extremely bullish for the Ethereum price!

At the moment it seems like ETH has only entered a small correction, before it soon continues its bull trend!

The $550 bullish target is only 41% away from ETH’s current price.

Ethereum Price Forecast – The monthly chart is still bullish!

The current September monthly candle is looking very bearish. However, we are still in the beginning of the month. Ethereum has a lot of days of price action left until the final monthly candle is formed, which could drastically change its shape come end of the month! the MACD is still signaling an upwards trend, while the histogram is still developing in bullish manner and the MACD lines remain crossed bullishly.

The RSI isn’t showing any sell signals, as there is still ample room for the RSI to go up before we reach overbought regions.

Ethereum Price Forecast – Only 6% under our price target!

Ethereum kept rising strongly after our price prediction, and is now about 6% below the 0.382 Fib level at = ±0.043 BTC. The „±“ symbol is used to indicate a variation of 1-10%!

Although a bearish divergence is currently forming in the RSI, the ETH/BTC trend is still very bullish for the medium-term. Should the Ethereum price correct now, it would find important Fibonacci support at ±0.031307 BTC! Meanwhile the resistances at ±0.043 BTC and ±0.059 BTC are the next bullish price targets

Best Regards and successful trading

Konstantin

Follow CryptoTicker on Twitter and Telegram for daily crypto news and price analyses!

In order to support and motivate the CryptoTicker team, especially in times of Corona, to continue to deliver good content, we would like to ask you to donate a small amount. Independent journalism can only survive if we stick together as a society. Thank you

Nexo – Your Crypto Banking Account

Instant Crypto Credit Lines™ from only 5.9% APR. Earn up to 8% interest per year on your Stablecoins, USD, EUR & GBP. $100 million custodial insurance.

Ad

This post may contain promotional links that help us fund the site. When you click on the links, we receive a commission – but the prices do not change for you!

Disclaimer: The authors of this website may have invested in crypto currencies themselves. They are not financial advisors and only express their opinions. Anyone considering investing in crypto currencies should be well informed about these high-risk assets.

Trading with financial products, especially with CFDs involves a high level of risk and is therefore not suitable for security-conscious investors. CFDs are complex instruments and carry a high risk of losing money quickly through leverage. Be aware that most private Investors lose money, if they decide to trade CFDs. Any type of trading and speculation in financial products that can produce an unusually high return is also associated with increased risk to lose money. Note that past gains are no guarantee of positive results in the future.

You might also like

More from Ethereum

Ethereum Price Analysis: ETH Price Must Stay above $400 mark!

The Ethereum price has once again touched the $400 mark. It seems that the ETH/USD price is again on the path of …

The Crypto Market Is Bleeding! When Does The Bloodbath End?

As the saying goes: „the time to buy is when there’s blood in the streets.“ – Baron Rothschild, an 18th …

Ethereum Price Analysis: ETH Plummets Below $400

The entire cryptocurrency market is showing mixed signals as major cryptocurrencies like Bitcoin and Ethereum are testing major levels. At …