What’s hot in crypto this week?

Ethereum “whales.” Whale are users with a lot of money, and now many of them are turning to decentralized finance to make more. These users are undoubtedly driving the decentralized finance movement by depositing millions of dollars into decentralized liquidity pools to earn interest.

Most are using yearn.finance, a set of automated money robots that do the work for them. All they have to do is deposit their money into a “vault,” and wait while these smart contracts move the assets between liquidity pools to generate the highest interest — like a very smart savings account.

But the actual calculation of yield percentages are not transparent, which makes it hard to discern how much yield farmers are actually making. Remember, yield farming is the attempt to get crypto assets to produce the most returns possible, often by moving assets around and trying to spot the highest annual percentage yields. Stated annual percentage yields in this case have been said to exceed 1,000%. But that’s misleading, because they are usually based on expected return, given the rate is sustained for an entire year. But farming for any particular reward often only lasts a few days to weeks, with projects reducing the reward over time.

Where are they placing their money?

There are many different vaults to pick from on year.finance, each with its own base asset and strategy for making returns on investments. The most popular one is the yCRV vault, which we look at here. The yCRV vault leverages yCRV, a token basket of DAI, USDC, USDT, and TUSD, and farms the CRV tokens plus trading fees.

What’s Flipside’s take?

Flipside Crypto took a look at three Ethereum whales’ yVault performance over time, using this yVault ROI Calculator. The data is using a subgraph from thegraph.com built by one of the yearn.finance developers.

1) The largest whale has $40.6 million in the yCRV vault, generating $500,000 in returns in the past three weeks.

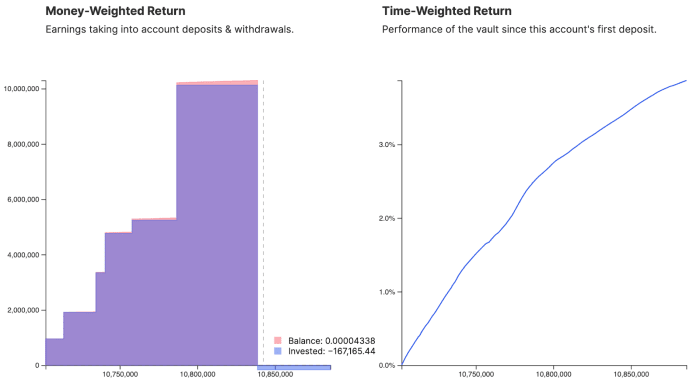

Below is a screenshot of the largest whale’s return on investment. This person invested a total of 38.5 million yCRV tokens in the yCRV vault, which equates to $40.6 million (1 yCRV = $1.06). On the x-axis are the block numbers on the Ethereum blockchain. This person started investing money on block number 10,750,000, which was validated on August 28th. Since then, they have made $497,395 in returns.

2) Up to over $97 million in investment at one point, and made $847,000 in the past three weeks.

This whale had a balance of 92 million yCRV around Sept. 2 (block number 10,780,000) which is worth $97.7 million. They have currently accumulated 799,194.51 yCRV or $847,145.64 in earnings since Aug. 28. This represents a simple return of 2.17%, annualized at 40.46%.

3) Built up to $10 million in deposits, left with $177,000 after three weeks.

This person gradually deposited over $10.9 million before selling on Sept. 12 (block # 10,850,000) and taking home 167,165 yCRV, or $177,194.

What are the risks involved with investing in yVaults?

The risks of yVaults are actually pretty slim, because no capital is at risk. Even if the price of Curve dropped to zero, people would just not accrue any returns, but they wouldn’t lose their money. The only way they could lose their money is if the underlying asset loses value — or in the case of stablecoins, which are backed by reserve assets, loses its peg.

The Flipside Crypto Asset Score Tracker provides institutional and sophisticated retail investors the ability to track over 500 cryptocurrencies’ fundamentals. FCAS Tracker is currently free to a select group of new users as it continues to develop the product. Visit Flipside here to gain access to Flipside Analytics.